NEW RESEARCH

TAKEStock: Ezz Steel [ESRS] – Forging Forces

Ezz Steel’s [ESRS] subsidiary Al Ezz Dekheila Steel Co. (EZDK) [IRAX] (a 64.1% stake) is set to voluntarily de-list from the EGX following particular EZDK shareholders’ desire to divest from the company, including the Egyptian government. EZDK has offered to buy out shareholders that are objecting to the de-listing against EGP1,250/share, a 53% premium to the closing price on 10 July 2023 before the announcement. As a result of this voluntary de-listing, EZDK could eventually become a wholly-owned subsidiary of ESRS, making this look like a de facto buyout. To assess the added value ESRS could gain from this corporate event, we used peers’ comparable EV/tonne multiples and ESRS’ proportionate pro forma production volumes to value ESRS post this transaction. We estimated ESRS' proportionate pro forma fair value at EGP23.7bn or EGP44/share, suggesting a 12MPT of EGP58/share.

For the full report, please click here.

Today’s Top News & Analysis

MPC raised policy rates by 100bps, surprising the market

Softest Contraction in Egyptian non-oil private sector activity in two years

Fertilizers producers' gas supply back to normal levels

Saudi extends oil cut again, Russia cutting oil exports

Cement quota renewed for another year

Concrete Plus invests USD750mn in a car tires factory

SKPC H1 2023: Strong yearly growth, Q2 bottom-line stands out

ESRS’ EGM agrees to guarantee EZDK’s loan, IRAX’s EGM approves voluntary delisting

MACRO

MPC raised policy rates by 100bps, surprising the market

In its meeting last Thursday, the Central Bank of Egypt’s (CBE) Monetary Policy Committee (MPC) decided to raise deposit rate, lending rate, and the main operations by 100bps to 19.25%, 20.25%, and 19.75%, respectively. (CBE)

Softest Contraction in Egyptian non-oil private sector activity in two years

Egypt's Purchasing Managers’ Index (PMI) for the non-oil private sector still shrank again, but at the softest pace in nearly two years. The index strengthened to 49.2 in July 2023 from 49.1 in June 2023, yet still below the 50.0 threshold that marks growth in activity. (S&P Global)

Fertilizers producers' gas supply back to normal levels

The Egyptian government has reportedly resumed its natural gas supply at normal levels for Egyptian fertilizers producers, after cutting the supply by about 20% for several days during the past two weeks for the heat wave. (Asharq Business)

Saudi extends oil cut again, Russia cutting oil exports

Saudi Arabia will extend its 1mn bpd voluntary oil production cut into September 2023, bringing output to c.9mn bbl. The cut, which began in July 2023, could be extended, deepened, or both. Meanwhile, Russia will voluntarily cut its oil exports by 300,000 bpd in September. (CNBC, Zawya)

Cement quota renewed for another year

The Egyptian Competition Authority (ECA) has reportedly approved to extend the cement quota for another year, as we have expected in our CORECoverage report named "Survival of the Fittest". Details about the new formula are yet to be officially announced. (Amwal Al Ghad)

Concrete Plus invests USD750mn in a car tires factory

Concrete Plus Engineering and Construction Company has obtained a license from theSuez Canal Economic Zone (SCZone) to establish a fully integrated factory for manufacturing car tires with a total investment of USD750mn, in partnership with a Saudi investor. (Alshorouk news)

CORPORATE

SKPC H1 2023: Strong yearly growth, Q2 bottom-line stands out

Sidi Kerir Petrochemicals Co. (Sidpec) [SKPC] reported its unaudited H1 2023 results, recording net profits of EGP1.2bn (+158% y/y) on higher revenues of EGP6.6bn (+69% y/y) with a GPM of 31% (+11pp y/y). Furthermore, Sidpec’s Q2 2023 showed bottom-line growth of 32% q/q to EGP689mn, while revenues decreased to EGP2.9bn (-18% q/q) with a GPM of 34% (+5% q/q). SKPC is currently trading at an LTM P/E of 8.7x, based on Thursday’s closing price. (Company disclosure)

ESRS’ EGM agrees to guarantee EZDK’s loan, IRAX’s EGM approves voluntary delisting

Ezz Steel Co.’s [ESRS] EGM agreed to sign on as guarantor for Al Ezz Dekheila Steel Co.’s (EZDK) [IRAX] loan with a maximum amount of USD250mn. The loan is to finance EZDK’s voluntary delisting. Meanwhile, IRAX’s EGM approved its voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures. (Company disclosure)

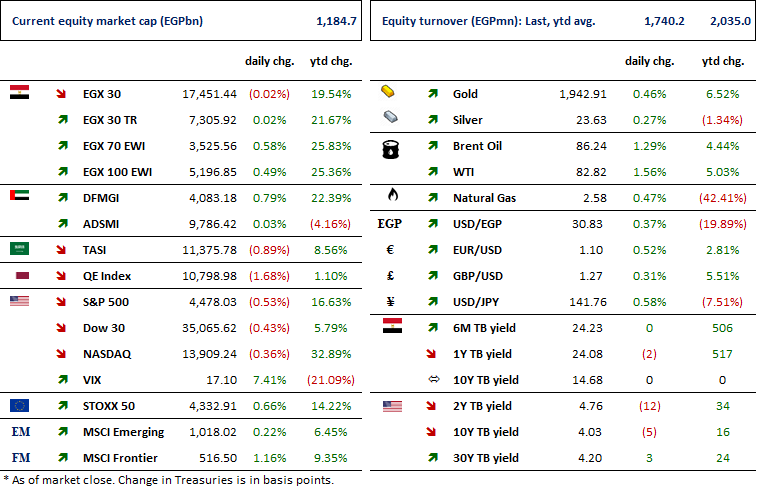

Markets Performance

Key Dates

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

14-Aug-23

ETEL: Financial results Announcement / Q2 2023 financial results' announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

27-Aug-23

SPMD: OGM / Approving financial statements ending 31 Dec. 2022.

28-Aug-23

ZMID: Cash dividend / Deadline for eligibility for a dividend of EGP0.150/Share.

31-Aug-23

ZMID: Cash dividend / Payment date for a dividend of EGP0.05/share (1st installment).

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).