TAKEStock: Ezz Steel [ESRS] - Forging Forces

Our take on EZDK’s decision to delist off EGX; all good for ESRS

Ezz Steel [ESRS]

Egypt / Materials

12MPT EGP58

Ezz Steel [ESRS] - Forging Forces

Ezz Steel’s [ESRS] subsidiary Al Ezz Dekheila Steel Co. (EZDK) [IRAX] (a 64.1% stake) is set to voluntarily de-list from the EGX following particular EZDK shareholders’ desire to divest from the company, including the Egyptian government. EZDK has offered to buy out shareholders that are objecting to the de-listing against EGP1,250/share, a 53% premium to the closing price on 10 July 2023 before the announcement. As a result of this voluntary de-listing, EZDK could eventually become a wholly-owned subsidiary of ESRS, making this look like a de facto buyout. To assess the added value ESRS could gain from this corporate event, we used peers’ comparable multiples to value ESRS post this transaction. But before diving into the potential synergies from forging the forces of both ESRS and EZDK, let’s first have a quick look at the steel industry so far in 2023.

From ore to global steel

According to the World Steel Association (WSA), global crude steel production stood at 944mn tonnes (-1.1% y/y) in H1 2023. This is consistent with industry experts’ prediction that world steel production will more or less maintain the same level of production as 2022 (1.9bn tonnes). The marginal production decline that occurred was a result of (a) worldwide inflationary pressures, (b) high interest rates, and (c) supply disruptions from the Russia-Ukraine war. Hence, many countries’ production volumes were greatly affected in H1 2023, such as Japan (-4.7% y/y), the United States (-2.9% y/y), Brazil (-8.9% y/y), Turkey (-16.3% y/y), and the European Union (-10.9% y/y). We can expect global steel production to remain consistent at its current level, driven by China’s efforts to restabilize its economy and Turkey’s efforts to rebuild following the earthquake. Furthermore, global steel prices have been trending downward following high commodity prices witnessed in 2022 as alternate suppliers (such as India and Iran) offset the shortage caused by the Russia-Ukraine war, with prices decreasing c.USD40/tonne q/q in Q1 2023.

From ore to local steel

In Egypt, domestic production has taken a significant hit as a result of the FX illiquidity which rendered many domestic steel producers unable to import needed raw materials. Many Egyptian steel factories had to either cease production for periods of time or operate at reduced capacities as a result, which we had previously reported in PRIMETime on 14 June 2023. However, ESRS’ production was not affected due to its sheer size and access to FX. Thus, domestic steel prices have been trending higher as a result of the FX shortage and inflationary pressures. For instance, ESRS raised local prices of its steel rebar (mainly used in construction) by 37% ytd to EGP32,135/tonne (+82% y/y). Meanwhile, domestic steel consumption was greatly affected by Egypt’s economic woes:

Consumption of rebar decreased 33% y/y to 1.4mn tonnes in Q1 2023 (ESRS local rebar sales fell 32%).

Consumption of hot-rolled coil (HRC) (mainly used in steel pipes, automotive, and engineering industries) decreased 23% y/y to 396,000 tonnes in Q1 2023 (ESRS local HRC sales fell 20%).

Man of steel

ESRS needs no introduction, of course. With a total steel production capacity of 7mn tonnes per year, it stands as the largest steel producer in Africa and the Middle East. In 2022, ESRS’ steel production output reached 5.1mn tonnes (+2% y/y) ranking the 67th largest steel producer in the world by the WSA (vs. 74th in 2021).

ESRS’ Q1 2023 performance

ESRS’ top-line in Q1 2023 reached EGP28bn (+49% y/y, +19% q/q) with a GPM of 29% (+4pp y/y, +10% q/q), driven by:

Higher export revenues of USD285mn (+34% y/y) as a result of greater sales volumes offsetting lower prices.

Higher local revenues of EGP18.8bn (+26% y/y) as a result of higher prices offsetting lower sales volumes.

However, ESRS reported net losses of EGP1.7bn (vs. net profits of EGP759mn in Q1 2022, EGP571mn in Q4 2022), as a result of:

An FX loss of EGP8.9bn (+684% y/y, +336% q/q).

Higher finance costs of EGP1.2bn (+53% y/y, +39% q/q).

Achilles’ heel

Notwithstanding FX gains and losses, ESRS would have reported net profits of EGP7.2bn in Q1 2023. This shows how highly sensitive ESRS is to EGP devaluations, given that:

Most of its COGS are USD denominated:

Iron ore and scrap, the two main raw materials, are imported and paid in USD.

Natural gas costs are priced in USD terms, albeit paid in EGP.

ESRS has several USD-denominated liabilities totaling some USD880mn at the end of Q1 2023, which also makes it susceptible to the impact of interest rate hikes.

The de facto buyout

Certain EZDK shareholders, specifically the Egyptian government (a 31% combined stake in EZDK) given its FX liquidity needs, expressed their desire to divest from the company. EZDK’s BoD accordingly approved buying out shareholders seeking to exit, which would result in a violation of the EGX listing rules (low free float) and hence the voluntary de-listing decision. Assuming the full acquisition of EZDK shares not owned by ESRS, this transaction will cost EGP8.75bn, which is likely to go through given the hefty price premium vs. the pre-announcement market price that will entice retail and institutional investors alike. As part of the de-listing procedures, EZDK agreed to pay 60% of the Egyptian government’s exit value in USD. This is equivalent to USD147mn, which will mostly be financed by a USD125mn long-term loan from a group of UAE banks. The EGP1,250-a-share puts EZDK’s valuation at EGP24.4bn, which implies an LTM P/E ratio of 8.6x and an LTM EV/EBITDA of 2.2x compared to 5.6x and 1.7x, respectively, based on the closing price on 10 July 2023.

Steel synergy

We believe this corporate event is a win-win situation. On one hand, the Egyptian government will secure needed FX liquidity. On the other hand, ESRS will eventually capture tremendous added value. Firstly, ESRS is effectively taking full control of EZDK through a de facto leveraged buyout at a relatively low interest rate of 10.9% (according to our estimates), which means better capital allocation and a lower cost of capital. Indeed, EZDK’s financial position can comfortably afford the additional USD debt. Furthermore, economies of scale will eventually lead to improved production efficiency while simultaneously allowing for cost savings. Meanwhile, ESRS would eventually increase its effective stakes in EZDK’s subsidiaries, namely:

Al Ezz Flat Steel Co. (full ownership by EZDK).

Al Ezz Rolling Mills Co. (full ownership by EZDK).

Hadid Co. For Industry, Trading & Contracting (Contrasteel) (a 90% stake by EZDK).

Contra Wood for Wooden Products (an 86% effective stake by EZDK).

Egyptian Steel (an 18% investment stake by EZDK).

We note that EZDK and ESRS are effectively within the same group with the same organizational structure and the same operating procedures. Thus, we are only considering the added benefit ESRS could get from owning 100% of EZDK for the purposes of this report. We believe ESRS will enjoy a stronger negotiating power as its proportionate domestic market share rises from an estimated 31% to 43% of total steel consumption in Q1 2023 on a pro forma basis for ESRS and EZDK. We note that Egyptian Steel is an investment of EZDK and is not a subsidiary that EZDK has operational control. Thus, we only considered Egyptian Steel’s added value for the purposes of our valuation. We calculate that Egyptian Steel’s market share contribution to ESRS will increase from 3% to 4%.

Steel surge

EZDK’s crown jewels are the factories that produce HRC, the main USD source for the company. Following the transaction, ESRS will be able to consolidate a greater share of USD export revenues by assuming complete ownership of EZDK’s HRC factories. As a result of a previous corporate reorganization, ESRS only has full ownership of a mini-mill in Al-Sadat City with a production capacity of 1mn tonne/year of rebar. Meanwhile, EZDK now fully owns the other three factories:

A plant in Alexandria with a production capacity of 2.1mn tonnes/year of long steel (rebar and wire rod) and 1.1mn tonnes/year of flat steel (HRC).

A complex in Suez (Al Ezz Flat Steel Co.) with a production capacity of 1.2mn tonnes/year of HRC and 1.1mn tonnes/year of rebar. (We note that ESRS recently added a second melt shop in the complex, increasing its melting capacity and thus optimizing the efficiency of the rolling mill. Production from the melt shop began in May 2023 and it is expected to add 1-1.2mn tonnes/year to ESRS’ production volumes and will benefit ESRS’ FV down the line. We note that production from the second melt shop was not considered in our valuation).

A plant in the Tenth of Ramadan City (Al Ezz Rolling Mills Co.) with a production capacity of 0.5mn tonnes/year of long steel, also converts wire rods into welded steel fabric.

Proportionately speaking and before the transaction, ESRS effectivity controls 3.4mn tonnes/year of long steel production capacities and 2.3mn tonnes/year of HRC production capacities, based on its 64.1% stake in EZDK and its own capacity. After the transaction and the full control of EZDK, ESRS will have added 1.3mn tonnes/year of long steel capacity and 0.8mn tonnes/year of HRC capacity.

Steel fusion

We note that 87% of the loans that are on ESRS’ consolidated balance sheet belong to EZDK and as such 91% of FX losses incurred were associated with EZDK. We can assume that down the line the two entities will eventually merge once ESRS has fully exploited all benefits from keeping their balance sheets separated, including deferred tax assets resulting from prior years’ losses.

Valuation

What now?

To gauge the added benefit for ESRS from fully controlling EZDK, we opted to perform a comparable analysis on peers within the steel industry. All but one of the steel companies included in our analysis were also listed among the WSA top 100 steel-producing companies. In selecting the appropriate multiple for the analysis, we focused on a metric that could adequately capture the complete benefits of integrating EZDK. Therefore, we decided to utilize peers’ total steel production volumes in 2022 and their respective EV/tonne to avoid the use of other financial indicators (e.g. sales, EBITDA, net income, etc.) that might not accurately reflect post-transaction changes.

The magnitude

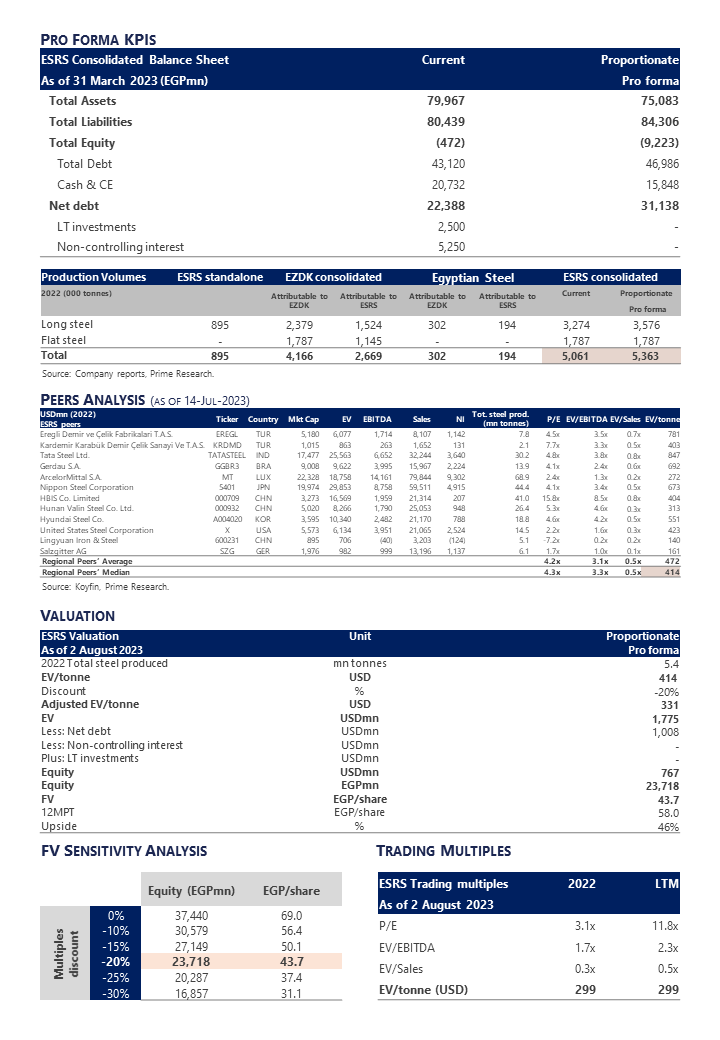

The production volume figure below shows the 2022 production volumes for ESRS, EZDK, and Egyptian Steel. In 2022, ESRS' consolidated steel production reached 5.1mn tonnes, comprising ESRS' standalone volumes and EZDK's consolidated volumes. However, this figure does not accurately represent ESRS' effective stakes. To provide a more accurate representation, we considered:

ESRS' 64.1% effective stake in EZDK gives it proportionate control of 2.7mn tonnes of EZDK’s production volumes.

ESRS' 12% effective stake in Egyptian Steel gives it proportionate control of 194,000 tonnes of Egyptian Steel’s production volumes.

To analyze the impact of the transaction, we added ESRS' effective control of Egyptian Steel's volumes post-transaction to ESRS' consolidated production volumes. This results in our proportionate pro forma 2022 production volumes of 5.4mn tonnes.

The balance

We then revised certain aspects of ESRS’ consolidated balance sheet to reflect the proportionate pro forma position of the company post-transaction, by:

Adjusting debt to account for the loan that EZDK will acquire to finance the Egyptian government’s exit.

Adjusting EZDK’s cash balance lower to reflect the funds used to finance the rest of the acquisition.

As a result of the transaction, ESRS' net debt will rise from a current EGP22bn to a proportionate pro forma of EGP31bn. Furthermore, With ESRS becoming EZDK's sole owner, there will no longer be any major non-controlling interest, which we took into account. With ESRS' long-term investments currently reflecting EZDK’s 18% stake in Egyptian Steel, we excluded its EGP2.5bn book value since we implicitly reflected Egyptian Steel’s value in ESRS' proportionate pro forma tonnage. In a nutshell, both non-controlling interest and long-term investments were adjusted to zero.

A proportionate valuation approach

Our comps analysis yielded a median peers' EV/tonne of USD414. For ESRS, we accounted for Egypt's recent FX issues, which have already had a negative impact on ESRS, by applying a 20% discount to peers’ EV/tonne, reaching an adjusted EV/tonne of USD331. We also conducted a sensitivity analysis given a range of other discount rates. Using proportionate pro forma production volumes for ESRS, we arrived at an EV of USD1.8bn, net of the 20% discount. After deducting net debt, we estimated ESRS' proportionate pro forma fair value at EGP23.7bn or EGP44/share, suggesting a 12MPT of EGP58/share.