Today’s Top News & Analysis

Egypt’s net foreign reserves are still on the rise

Chevron to start drilling in its Red Sea concession in H1 2024

Shell adding 200mn cubic feet per day of natural gas to Egypt by 2024

Trading on TAQA shares starts today

ESRS Q1 2023: FX losses negate top-line growth

MIDAR added to the pre-IPO fund

VODE to increase its stake in Basata Pay

MACRO

Egypt’s net foreign reserves are still on the rise

Egypt’s net international reserves (NIR) increased for the tenth month in a row in June 2023 to USD34.81bn (provisional) from USD34.66bn in May 2023. (CBE)

Chevron to start drilling in its Red Sea concession in H1 2024

Chevron is planning to start drilling in its first exploratory well in its oil and gas Red Sea concession in H1 2024. The exploratory phase, which started in 2020, costs upwards of USD20mn, and drilling is estimated to cost USD50mn. (Asharq Business)

Shell adding 200mn cubic feet per day of natural gas to Egypt by 2024

Shell will commence with the tenth phase of the Nile Delta offshore West Delta Deep Marine concession in the Mediterranean. Shell plans to start drilling in 3 natural gas wells this year and hopes to start production next year. Drilling is expected to cost more than USD200mn and the concession is estimated to add c.200mn cubic feet per day of natural gas to Egypt by 2024. (Asharq Business)

CORPORATE

Trading on TAQA shares starts today

Trading on TAQA Arabia’s [TAQA] shares will start today after the Financial Regulatory Authority gave the green light. The percentage of free float shares will be at least 14% with an opening price of EGP0.5/share (par value). However, since the shares will trade through direct listing, the price of the stock will be dictated by supply and demand. TAQA’s shares will not be subject to the price limits or the temporary suspension mechanism throughout its first day of trading, but normal procedures will be in force for the following trading session. The IFA’s fair value was confirmed to be EGP8.9/share. Our comments regarding this valuation can be found in our 15 June 2023 PRIMETime newsletter. (EGX)

ESRS Q1 2023: FX losses negate top-line growth

Ezz Steel [ESRS] released its Q1 2023 consolidated financial statements, posting net losses of EGP1.7bn (vs. net profits of EGP759mn in Q1 2022, EGP571 in Q4 2022) on higher revenues of EGP28bn (+49% y/y, +19% q/q) with a GPM of 29% (+4pp y/y, +10% q/q). The company’s net losses were caused by recording an FX loss of EGP8.9bn (+684% y/y). The company’s top-line y/y growth is mainly attributed to:

· Higher export revenues of USD285mn (+34% y/y), driven by:

o Higher rebar sales of USD94mn (+236% y/y) as a result of greater sales volumes overshadowing declining prices.

o Higher hot rolled coil (HRC) sales of USD191mn (+4% y/y) as a result of greater sales volumes overshadowing declining prices.

· Higher local revenues of EGP18.8bn (+26% y/y), driven by:

o Higher rebar sales of EGP12.4bn (+22% y/y) as a result of higher prices overshadowing declining sales volumes.

o Higher HRC sales of EGP6.5bn (+36% y/y) as a result of higher prices overshadowing declining sales volumes.

Meanwhile, ESRS’s sequential revenue growth was mainly driven by higher local prices for rebar and HRC. (Company disclosure)

MIDAR added to the pre-IPO fund

MIDAR, a state-owned real estate developer, has reportedly been added to the pre-IPO fund. The Egyptian government hopes to offer 25-30% of the company to strategic investors this year and then offer an additional stake on the EGX next year. (Asharq Business)

VODE to increase its stake in Basata Pay

Vodafone Egypt [VODE], Telecom Egypt’s [ETEL] subsidiary, is waiting for the Central Bank of Egypt's (CBE) approval to increase its stake in Basata Pay to 20%. (Al-Borsa)

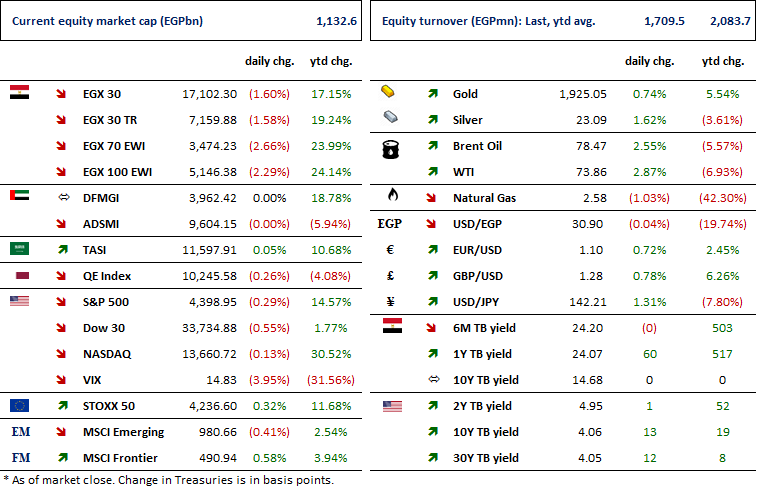

Markets Performance

Key Dates

9-Jul-23

EGCH: EGM / Approving the final cost of the nitric acid and ammonium nitrate project.

ETRS: EGM / Approving increasing the issued capital & amending Articles No. 7, 8 & 47 of the company's bylaws.

MPRC: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

10-Jul-23

MPRC: Cash dividend / Ex-dividend date for EGP0.50/Share.

MCRO: EGM / Amending Article No. 3 of the company's bylaws.

11-Jul-23

BTFH: Capital increase / Capital increase subscription closing date.

12-Jul-23

OCDI: OGM / Discussing netting contracts.

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

19-Jul-23

PACH: OGM / Board election.

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

31-Jul-23

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).