Today’s Top News & Analysis

Egypt to offer two new bids for oil and gas exploration

Qatar and UAE interested in local energy projects

Egypt submitted a request to join BRICS

QIA is eyeing a 30% of Holding Co. for Hotels

EKHO to trade on treasury shares at the Boursa Kuwait

Trading on TAQA shares to start on Monday; valuation is mixed vs. regional peers

EFG Holding's EGM approves increasing authorized and paid-in capital

EXPA did not receive official statements from House

Edita acquired 100% of Fancy Foods

Ibnsina Pharma signed three medical promotion contracts

MACRO

Egypt to offer two new bids for oil and gas exploration

Egypt will reportedly launch two new bids for oil and gas exploration in at least 16 areas in the southern region and in the Red Sea before the end of 2023. One of the bids will be in 8 regions belonging to the Egyptian General Petroleum Corporation, while the other bid will be in at least 8 regions belonging to the South Valley Egyptian Petroleum Holding Co. (Asharq Business)

Qatar and UAE interested in local energy projects

Qatar and UAE sovereign funds are interested in acquiring local energy projects in the upcoming weeks in a deal worth USD3bn, according to sources. (Al-Borsa)

Egypt submitted a request to join BRICS

The Egyptian government has submitted an official request to join the BRICS alliance. The alliance aims to shift trade to alternative currencies, be it national currencies or a new common currency. (Enterprise)

QIA is eyeing a 30% of Holding Co. for Hotels

Qatar Investment Authority (QIA) is interested in acquiring a stake of around 30% of the Holding Co. for Hotels, The Sovereign Fund of Egypt (TSFE) subsidiary, in a deal that could be worth USD750mn. The Holding Co. for Hotels includes 7 hotels, namely:

· Cairo Marriott Hotel

· Cataract Aswan

· Mena House Hotel

· Winter Palace Luxor

· Cecil Hotel Alexandria

· Movenpick Aswan

· Elephantine Aswan

The initial agreement will be within one month whereas the procedures of the acquisition will start within two months. (Al-Borsa)

CORPORATE

EKHO to trade on treasury shares at the Boursa Kuwait

The Capital Markets Authority in Kuwait approved the right of Egypt Kuwait Holding Co. [EKHO] to trade on treasury shares (maximum 10% of the company’s capital) at Boursa Kuwait, for a period of six months starting from 13 June 2023. (Company disclosure)

Trading on TAQA shares to start on Monday; valuation is mixed vs. regional peers

Trading on shares of TAQA Arabia [TAQA], Qalaa Holding’s [CCAP] subsidiary (a 55.3% stake), will reportedly start next Monday. The Independent Financial Advisor's (IFA) fair value per share was cited by media sources as EGP8.9/share or a total equity valuation of EGP12bn. This implies a P/E ratio of 22x, an 18% premium to regional peers’ median of 19x but an EV/EBITDA multiple of 12x, a 30% discount to regional peers’ median of 17x. The regional peers we used are:

· ADNOC Distribution [ADX: ADNOCDIST]: P/E ratio of 19x and EV/EBITDA of 17x.

· Aldrees Petroleum & Transport Services Co. [SASE: 4200]: P/E ratio of 38x and EV/EBITDA of 24x.

· Oman Oil Marketing Co. [MSM: OOMS]: P/E ratio of 10x and EV/EBITDA of 6x.

· Qatar Fuel Co. (WOQOD) [DSM: QFLS]: P/E ratio of 15.5x and EV/EBITDA of 17x.

· Shell Oman Marketing Co. [MSM: SOMS]: P/E ratio of 18x and EV/EBITDA of 10x.

· The Abu Dhabi National Energy Co. [ADX: TAQA]: P/E ratio of 20x and EV/EBITDA of 20x. (Asharq Business, Prime Research)

EFG Holding's EGM approves increasing authorized and paid-in capital

EFG Holding's [HRHO] EGM approved increasing the authorized capital from EGP6bn to EGP30bn and increasing its paid-in capital from EGP5.8bn to EGP7.3bn through a 25% bonus share distribution to be funded from retained earnings as of 31 December 2022. (Company disclosure)

EXPA did not receive official statements from House

Export Development Bank of Egypt [EXPA] has not yet received any official statements from the House of Representatives regarding cancelling the bank's establishment law. (Bank disclosure)

Edita acquired 100% of Fancy Foods

Edita Food Industries [EFID] fully acquired Fancy Foods, a company specializing in frozen bakery. EFID mentioned last May that the acquisition is worth EGP380mn. (Company disclosure)

Ibnsina Pharma signed three medical promotion contracts

Ibnsina Pharma [ISPH] established a scientific office under which it signed three contracts for medical promotion. This will be a new revenue stream of EGP40mn in 2023 and more in the pipeline, with a 30-35% net profit margin, which should enhance ISPH’s overall net profit margin. In addition, ISPH did not encounter any new capex to add this new activity. (Company disclosure)

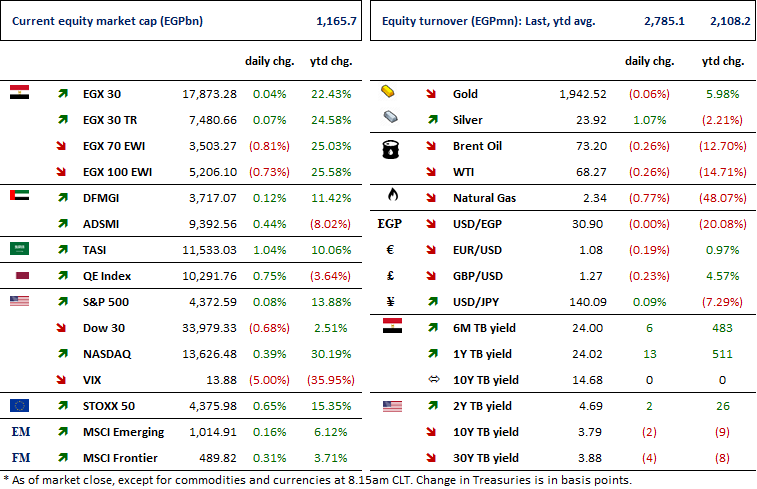

Markets Performance

Key Dates

15-Jun-23

ZMID: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

17-Jun-23

MICH: BoD meeting / Follow up on production, sales and exports.

MICH: EGM / Amending Article No. 6 of the company's bylaws for increasing the authorized capital from EGP400mn to EGP1bn.

18-Jun-23

MOIL: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

MOIL: EGM / Discussing the continuation of the company.

19-Jun-23

SUGR: Cash dividend / Deadline for eligibility for a dividend of EGP2.550/Share.

EXPA: Capital increase / Capital increase subscription starting date.

EXPA: Right Issue / First day of trading the rights issue.

20-Jun-23

SUGR: Cash dividend / Ex-dividend date for EGP2.550/Share.

22-Jun-23

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.

4-Jul-23

ISPH: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

ISPH: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

5-Jul-23

Egypt PMI: June 2023 reading.

6-Jul-23

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

BTFH: Capital increase / Capital increase subscription closing date.

9-Jul-23

EGCH: EGM / Approving the final cost of the nitric acid and ammonium nitrate project.

10-Jul-23

MCRO: EGM / Amending Article No. 3 of the company's bylaws.