NEW RESEARCH

Crédit Agricole Egypt [CIEB]: A Story Retold

In our CORECoverage update last August, we underlined Crédit Agricole Egypt’s [CIEB] resilience against extremely volatile economic conditions through a conservative strategy and a selective portfolio. That was before the Central Bank of Egypt hiked interest rates by a cumulative 500bps (300bps in October 2022 and 200bps in March 2023), which we had not factored in our forecasts at that time. Back then, we laid our bet on the possibility that to navigate through the tough year, the bank would use the same old strategies it had used in 2016, given the same drivers (a hawkish monetary policy and a local currency devaluation). Indeed, in 2022 CIEB proved our hypothesis correct by maintaining its moderate balance sheet growth which followed suit in Q1 2023. Not only did CIEB succeed in riding the wave of fierce competition, but it also managed to record sturdy profitability margins, similar to those seen in 2016 and 2017. Having updated our valuation model, in view of the currently-high interest rate environment, we raise our 12MPT from EGP8.3/share to EGP16.9/share, but downgrade our rating from Overweight / Medium Risk to Neutral / Medium Risk.

For the full report, please click here.

Today’s Top News & Analysis

Egyptian Drilling Co. to be offered to strategic investors

Private sector minimum wage raised by 11% to EGP3,000

Misr for Central Clearing to launch several services in 2023

AMOC’s BoD approved 2023/24 budget

e-Finance signed a contract with Visa and Banque Misr to launch "Nexta"

Reefy targets EGP4.25bn of microfinancing in 2023

GB Corp launched “Kredit”

MACRO

Egyptian Drilling Co. to be offered to strategic investors

The Egyptian General Petroleum Corporation (EGPC) has reportedly signed a swap agreement with The Sovereign Fund of Egypt (TSFE) to add a 30% stake of its subsidiary, the Egyptian Drilling Co., to the pre-IPO fund. The goal is to offer the stake to strategic investors in Q4 2023. There is also a possibility of offering an additional stake on the EGX. (Al-Borsa)

Private sector minimum wage raised by 11% to EGP3,000

The National Wages Council decided to increase the private sector's minimum wage by 11% from EGP2,700 to EGP3,000, starting July. (Al-Borsa)

Misr for Central Clearing to launch several services in 2023

Misr for Central Clearing, Depository and Registry (MCDR) is planning to launch the first phase of "Egypt Clear" app this year, which will transform some of MCDR's operations to digital. Moreover, MCDR is looking to launch electronic voting and short selling services during 2023. (Al-Mal)

CORPORATE

AMOC’s BoD approved 2023/24 budget

Alexandria Mineral Oils Co.’s [AMOC] BoD approved the company’s 2023/24 budget, projecting a net income of EGP603.5mn on revenues of EGP28bn. The 2022/23 budget had projected for the company to generate a net income of EGP532mn on revenues of EGP18bn. We note that AMOC’s 9M 2022/23 net income of EGP1.39bn has way exceeded its full-year expectations. (Company disclosure)

e-Finance signed a contract with Visa and Banque Misr to launch "Nexta"

eCards, a subsidiary of e-Finance Investment Group [EFIH], signed a contract with Visa and Banque Misr to launch a new mobile banking application under the name "Nexta". The application will offer prepaid Visa cards issued by Banque Misr, where eCards is responsible for the issuance, management, and operation of the cards. (Company disclosure)

Reefy targets EGP4.25bn of microfinancing in 2023

Reefy, CI Capital Holding’s [CICH] microfinance arm, is targeting EGP4.25bn of microfinancing in 2023. This comes on the back of successfully injecting over EGP1bn during Q1 2023. (Al-Borsa)

GB Corp launched “Kredit”

GB Corp [GBCO] announced the launch of a new subsidiary called Kredit that is specialized in financing SMEs, after having approvals from the Financial Regulatory Authority (FRA). (Company disclosure)

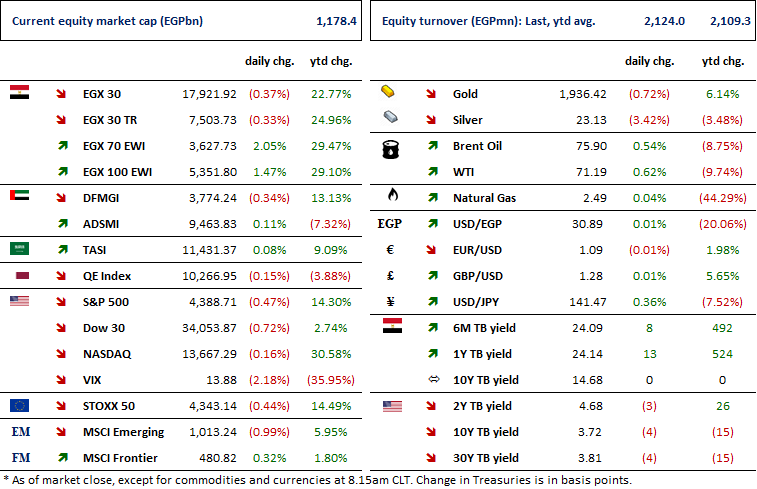

Markets Performance

Key Dates

22-Jun-23

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.

4-Jul-23

ISPH: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

ISPH: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

5-Jul-23

Egypt PMI: June 2023 reading.

6-Jul-23

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

BTFH: Capital increase / Capital increase subscription closing date.

9-Jul-23

EGCH: EGM / Approving the final cost of the nitric acid and ammonium nitrate project.

ETRS: EGM / Approving increasing the issued capital & amending Articles No. 7, 8 & 47 of the company's bylaws.

MPRC: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

10-Jul-23

MPRC: Cash dividend / Ex-dividend date for EGP0.50/Share.

MCRO: EGM / Amending Article No. 3 of the company's bylaws.

12-Jul-23

OCDI: OGM / Discussing netting contracts.

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

31-Jul-23

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).