Neutral / Medium Risk

12MPT: EGP16.9 (was EGP8.3)

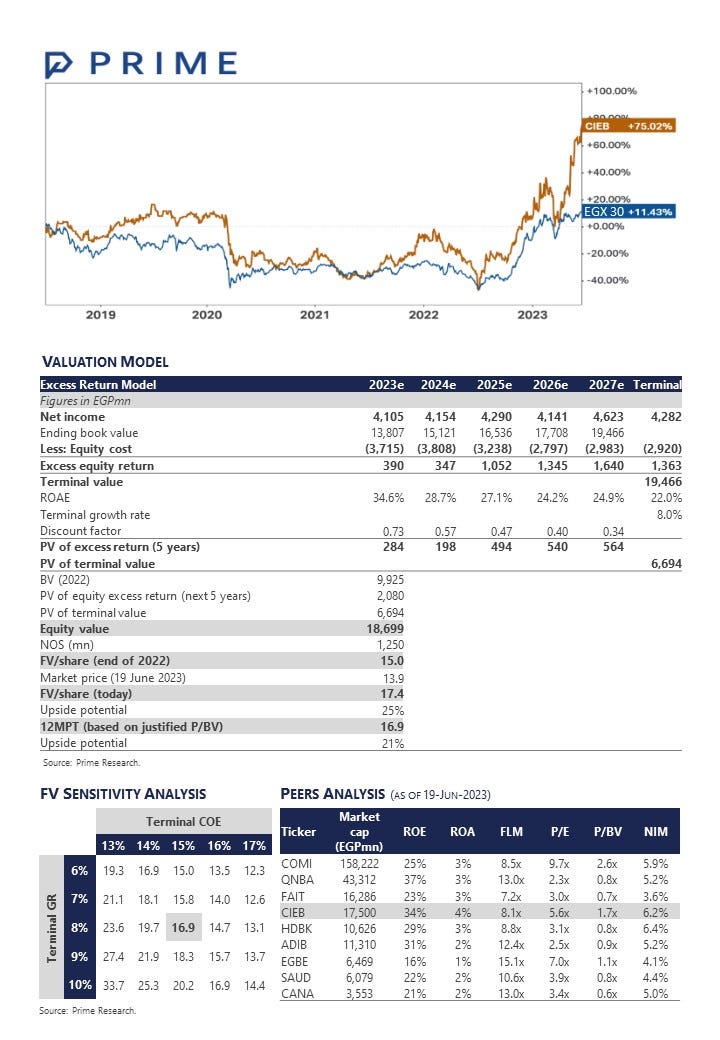

In our CORECoverage update last August, we underlined Crédit Agricole Egypt’s [CIEB] resilience against extremely volatile economic conditions through a conservative strategy and a selective portfolio. That was before the Central Bank of Egypt hiked interest rates by a cumulative 500bps (300bps in October 2022 and 200bps in March 2023), which we had not factored in our forecasts at that time. Back then, we laid our bet on the possibility that to navigate through the tough year, the bank would use the same old strategies it had used in 2016, given the same drivers (a hawkish monetary policy and a local currency devaluation). Indeed, in 2022 CIEB proved our hypothesis correct by maintaining its moderate balance sheet growth which followed suit in Q1 2023. Not only did CIEB succeed in riding the wave of fierce competition, but it also managed to record sturdy profitability margins, similar to those seen in 2016 and 2017. Having updated our valuation model, in view of the currently-high interest rate environment, we raise our 12MPT from EGP8.3/share to EGP16.9/share, but downgrade our rating from Overweight / Medium Risk to Neutral / Medium Risk.

Skating over obstacles: As we noted before, CIEB always chooses profitability over aggressive market expansion. The bank builds upon its selective portfolio to shield against a volatile environment. For example, the high-yield certificates of deposit (CDs) issued by state-owned banks induced most banks to follow suit to safeguard their funds. However, CIEB did not need to, thanks to its corporate foreign-currency deposits, with total deposits closing the year higher by 25% y/y on the back of the EGP devaluation, albeit lower than a total market growth rate of 33%. Similarly, CIEB’s loan book grew by 13% in 2022 on the revaluation of corporate foreign-currency loans vs. a total market growth rate of 32%. Still, CIEB chooses to drift away from investing in Treasuries despite their attractive yields to avoid a higher effective tax rate. This can be seen clearly in 2022 where total financial investments as a percentage of total assets declined to 17%. Meanwhile, GLDR also declined to 57% in 2022 as the bank resorted to investing in interbank assets, especially after open market operations (OMO) auctions started to offer relatively high yields. Also, in Q1 2023, this approach was evident with a 20% devaluation in the EGP, pushing CIEB’s deposits to grow 12% ytd. Additionally, with a positive asset repricing gap, the bank was still able to make the best use of a high interest rate environment. Accordingly, net interest income (NII) reached a quarterly record high of EGP1.5bn, pushing NIM up as high as 8.4%. As for asset quality, NPLs were maintained at 2.8%, which explains the provisions reversal of EGP3mn in Q1 2023 in view of a coverage ratio of 153%.

Been there, done that: A closer look at how CIEB fared back in 2016 and 2022, we can deduce that the bank’s strategy has not changed in view of similar circumstances. Below, we note a few of the similarities that could drive the rest of this year, keeping 2017 in mind:

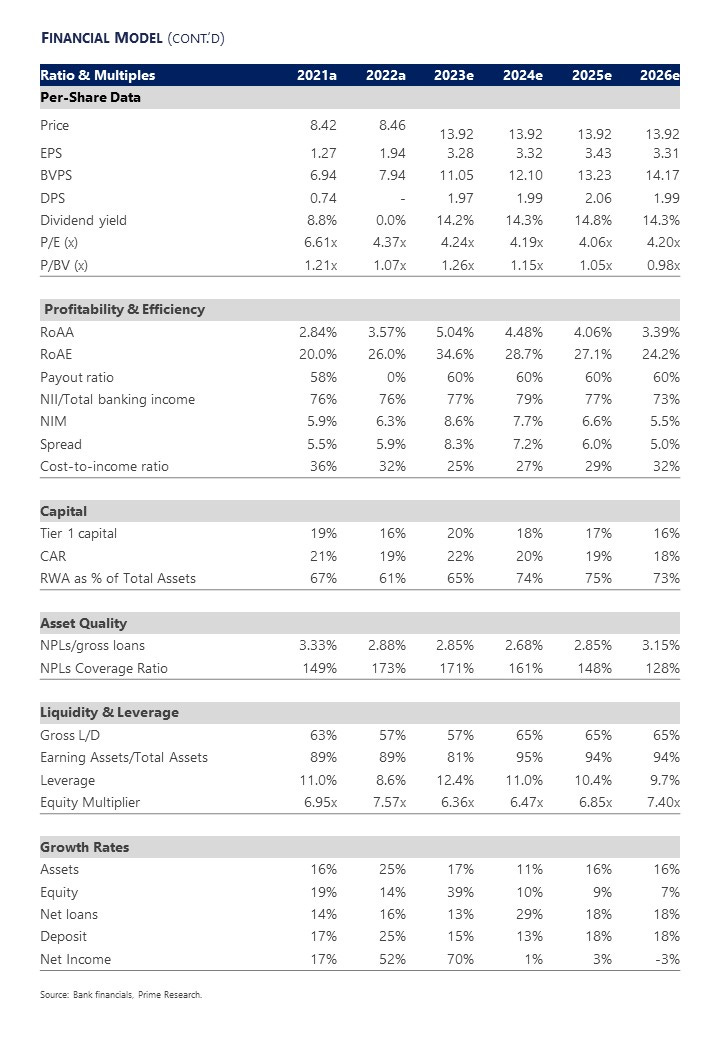

Subdued balance sheet growth: We expect IEA to exhibit a tamer y/y growth of 6% to EGP71bn in 2023 as the high interest rates put a lid on loan growth. Also, we do not expect further devaluation in EGP throughout 2023 which would also limit CIEB’s balance sheet growth. Similarly, we expect deposits to grow by c.15% in 2023 to EGP69.6bn, mainly on the back of the EGP devaluation in Q1 2023.

Strong earnings growth, driven by NII: We expect net income to grow 70% y/y to EGP4.1bn in 2023, given the expected 56% y/y growth in NII to EGP5.9bn in light of the cumulative effect of the interest rate hikes. We noticed a similar pattern in 2016 and 2017 when net income grew by 32% and 43%, respectively.

Accelerating ROAE: ROAE increased from 30% in 2015 to 36% in 2016, only to peak at 41% in 2017 as the cumulative effect of interest rate hikes materialized. Similarly, ROAE increased from 20% in 2021 to 26% in 2022, and we expect another expansion in ROAE to 34% in 2023, even after taking into account that CIEB did not distribute any dividends for 2022.

Solid credit quality: We expect credit quality to remain intact throughout 2023, where the cost of risk (CoR) to remain around -60bps (same as 2022) with an NPL ratio of 2.9% and a coverage ratio of 171%.

Generous dividends: We expect the dividend payout to resume in 2023 back to its historical average payout ratio of 60%.

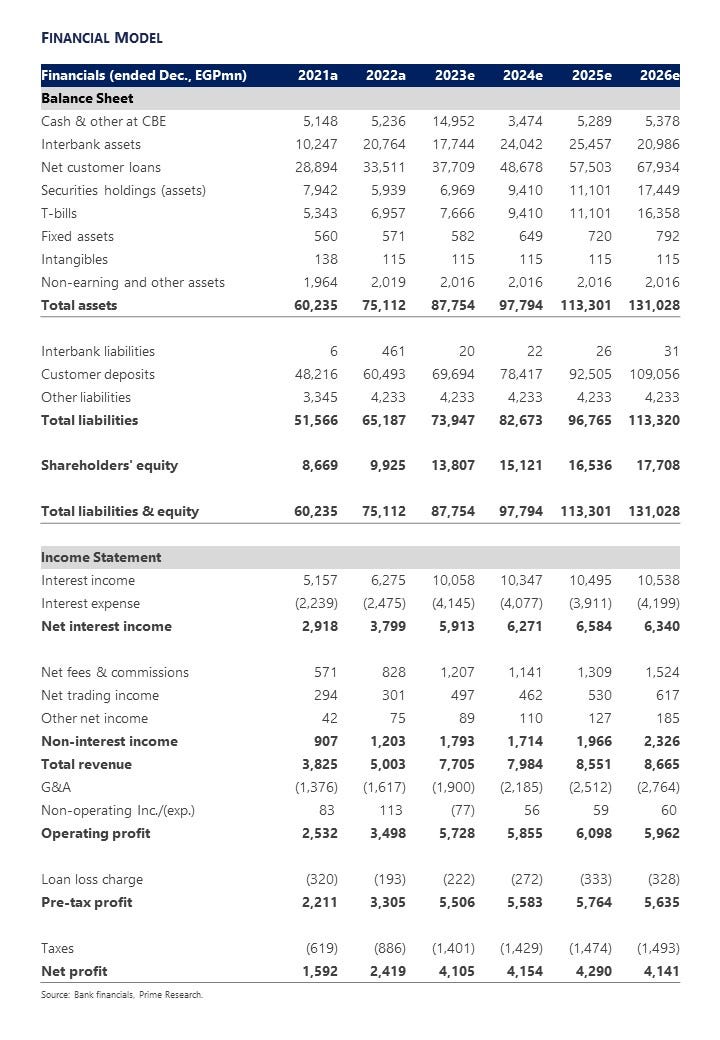

12MPT raised by 103% to EGP16.9/share, yet downgraded to Neutral / Medium Risk: Our residual income-based fair value came out as EGP17.3/share, assuming a long-term ROE of 22% and a terminal COE of 15%. However, we set our 12MPT at EGP16.9/share based on a justified P/BV of 2x applied to Q1 2023 equity. This offers an upside potential of 21%, which is still lower than CIEB’s COE. Hence, we downgrade our rating from Overweight to Neutral with the same Medium Risk. Our new 12MPT implies a 2023e P/BV of 1.5x. Key catalysts: Further EGP devaluation amplifying CIEB’s loan book. A higher-than-anticipated earnings growth. Key risks: Intensifying competition. Deterioration in asset quality resulting in a higher-than-expected CoR.