NEW RESEARCH

TAQA Arabia [TAQA]: Fueling the Future

Trading on TAQA Arabia’s [TAQA] shares started yesterday when almost everyone is asking the same question: What is a fair valuation for the company’s equity? The company’s independent financial advisor (IFA) has assigned a fair value of EGP8.9/share. From our end, we ran our own analysis of TAQA’s key business segments (gas, power, and petroleum) to come up with a valuation range based on regional comparable company analysis and a DCF model. Using the sum-of the-parts (SOTP) valuation method and the corresponding regional peers’ (mostly from the Middle East) median EV/EBITDA multiples we reached a fair value of around EGP7.9bn or EGP5.9/share. The DCF model yielded a slightly lower fair value of EGP7.4bn or EGP5.5/share. Combining both valuations yields an average equity value of EGP7.7bn or EGP5.7/share, suggesting a 12MPT of EGP7.4/share.

For the full report, please click here.

Today’s Top News & Analysis

Anti-dumping fees on steel imports extended for four more years

Egypt to announce privatization progress

New amendments to attract more FDIs

MIGA considers the guarantee of a USD100mn loan for NBE and Banque Misr

CIB secures a USD250mn loan from IFC

CLHO Q1 2023: Net profits decline despite strong revenues

EGX cancels all TAQA trades executed yesterday; TAQA outlines investment strategy

Qalaa Holdings’ EGM postponed to be held within 30 days

MACRO

Anti-dumping fees on steel imports extended for four more years

The Ministry of Trade & Industry decided to extend anti-dumping fees on imports of reinforcing steel (bars, coils, rods) from China, Turkey, and Ukraine for another four years. The anti-dumping fees were first implemented in 2017 at a rate of 25% for reinforcing steel and iron imports and 15% for steel billet imports. (Gate Ahram)

Egypt to announce privatization progress

The Egyptian government is expected to hold a press conference on Tuesday to announce the completion of a number of asset sales. Egypt was targeting USD2bn in sales by June. (Enterprise)

New amendments to attract more FDIs

The House of Representatives gave preliminary approval on amendments to the investment law of 2017 aimed at increasing foreign direct investments (FDIs). The amendments allow some projects to benefit from a one-approval system known as the “Golden License” in the sectors of oil processing, fertilizers, iron and steel, LNG transport, and energy-intensive industries. (Enterprise)

MIGA considers the guarantee of a USD100mn loan for NBE and Banque Misr

The Multilateral Investment Guarantee Agency (MIGA), a member of the World Bank Group, is currently considering the guarantee of a USD100mn loan from the European Bank for Development & Reconstruction (EBRD) to National Bank of Egypt (NBE) and BankMisr. (Al-Borsa)

CORPORATE

CIB secures a USD250mn loan from IFC

In a statement published yesterday, Commercial International Bank - Egypt [COMI] announced securing a long-term loan of USD250mn from the International Finance Corporation (IFC) to support its capital and fund green projects. (Bank disclosure)

CLHO Q1 2023: Net profits decline despite strong revenues

Cleopatra Hospitals Group [CLHO] reported Q1 2023 consolidated net profits of EGP95mn (-1.4% y/y) despite higher revenues of EGP777mn (+22% y/y). The decline in net profits is attributable to a higher minority interest expense and a net finance cost of EGP6mn vs. a net finance income of EGP13mn last year, due to CLHO increasing its debt to support its expansion plans. Meanwhile, gross profit margin decreased slightly to 33.9% (-0.9pp y/y). (Company disclosure)

EGX cancels all TAQA trades executed yesterday; TAQA outlines investment strategy

As scheduled, trading on TAQA Arabia’s [TAQA] shares started yesterday with a massive block trade of almost 31% of the company’s equity worth EGP3.7bn, or EGP8.9/share (e.g. the IFA’s fair value per share). We think the block trade was part of the shareholder restructure scheduled for this week. Throughout the trading day, bids with more than 100mn shares came in ranging from less than EGP0.5/share up to more than EGP500/share, but almost no offers were made. This resulted in very weak trading volumes with the day ending with only 1,362 shares traded at a value of EGP395,317, with TAQA closing at c.EGP300/share. Upon requests from brokerage firms, the EGX canceled all trades, except the block trade, saying that these transactions were executed by mistake. Trading will recommence again today without price limits and with an opening price of EGP0.5/share (TAQA’s par value).

Meanwhile, TAQA’s chairman clarified that the percentage of free float shares will be around 44.5% once all is said and done and will be available for trading by the end of this week. Furthermore, TAQA’s CEO highlighted some of the company’s investments for this year worth a total of EGP1.7bn (vs. EGP1.8bn in 2022), which include:

· Establishing a new company in Saudi Arabia with Natural Gas Distribution Co. [KSA: 9516] (a 50% stake each).

· Building two new refueling stations in Mozambique.

· Establishing a new company in Tanzania to operate a compressed natural gas (CNG) refueling station and a natural gas car conversion center.

· Increasing the total number of CNG stations in Egypt to 80 (currently 64). (EGX, Al-Borsa: 1, 2, CNBC Arabia)

Qalaa Holdings’ EGM postponed to be held within 30 days

Qalaa Holdings’ [CCAP] EGM (which was set to approve continuation of the company despite retained losses exceeding more than half shareholders’ equity) did not convene on 6 July 2023 due to a lack of quorum. Shareholders will be invited to convene in another EGM within 30 days. (Company disclosure)

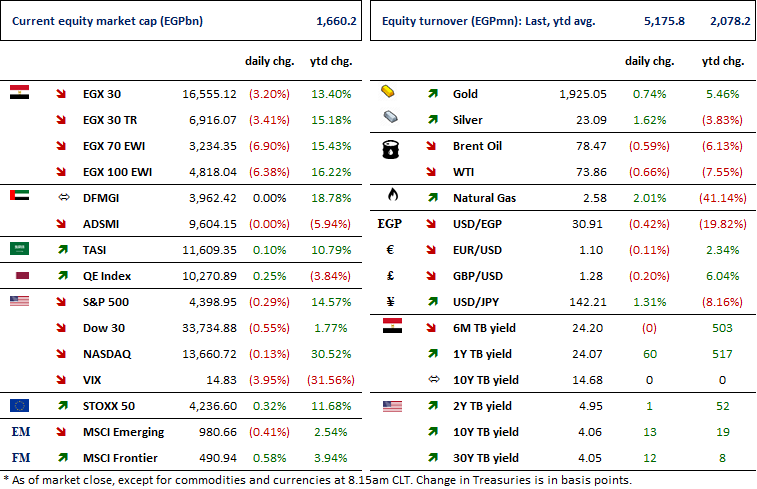

Markets Performance

Key Dates

10-Jul-23

MPRC: Cash dividend / Ex-dividend date for EGP0.50/Share.

MCRO: EGM / Amending Article No. 3 of the company's bylaws.

11-Jul-23

BTFH: Capital increase / Capital increase subscription closing date.

12-Jul-23

OCDI: OGM / Discussing netting contracts.

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

19-Jul-23

PACH: OGM / Board election.

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

31-Jul-23

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).