TAKEStock: TAQA Arabia [TAQA] - Fueling the Future

Our initial take on TAQA before its first trading day

TAQA Arabia [TAQA]

Egypt / Energy & Utilities

12MPT EGP7.4

TAQA Arabia: The Story

Trading on TAQA Arabia’s [TAQA] shares is set to start today when almost everyone is asking the same question: What is a fair valuation for the company’s equity? The company’s independent financial advisor (IFA) has assigned a fair value of EGP8.9/share. From our end, we ran our own analysis of TAQA’s key business segments to come up with a valuation range based on regional comparable company analysis and a DCF model. But first, let’s go quickly over TAQA’s businesses.

Power pioneers: TAQA is Egypt's prominent energy and utility provider with more than 25 years of operational history up its sleeve. The company caters to the daily energy requirements of more than 1.7mn customers. TAQA specializes in investing, installing, constructing, and operating energy infrastructure, encompassing gas transmission and distribution, conventional and renewable power generation and distribution, and marketing oil products and lubricants. The company also offers water treatment and desalination services to a diverse clientele.

Energized diversification: Since its establishment in 2006, TAQA has successfully incorporated 15 operating companies. With its own track record, each company executed numerous projects in various Middle Eastern and African countries. This diverse portfolio of subsidiaries has enabled TAQA to evolve into an energy powerhouse. Below, we highlight TAQA’s four main businesses:

TAQA Gas: Harnessing Egypt's energy potential

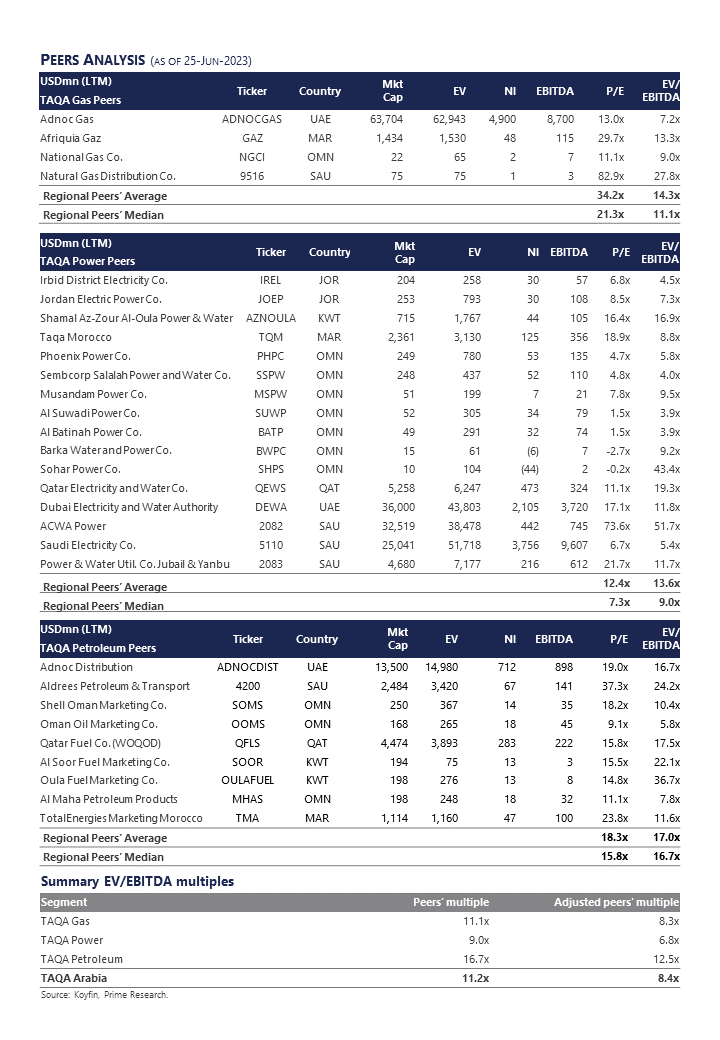

What it does: TAQA Gas’ main operations include engineering, procurement and construction development, transmissions, pipeline installations, natural gas filling stations, natural gas car conversions, water heating, and operating distribution concessions with distribution capacities of more than 11.8 bcm/year.

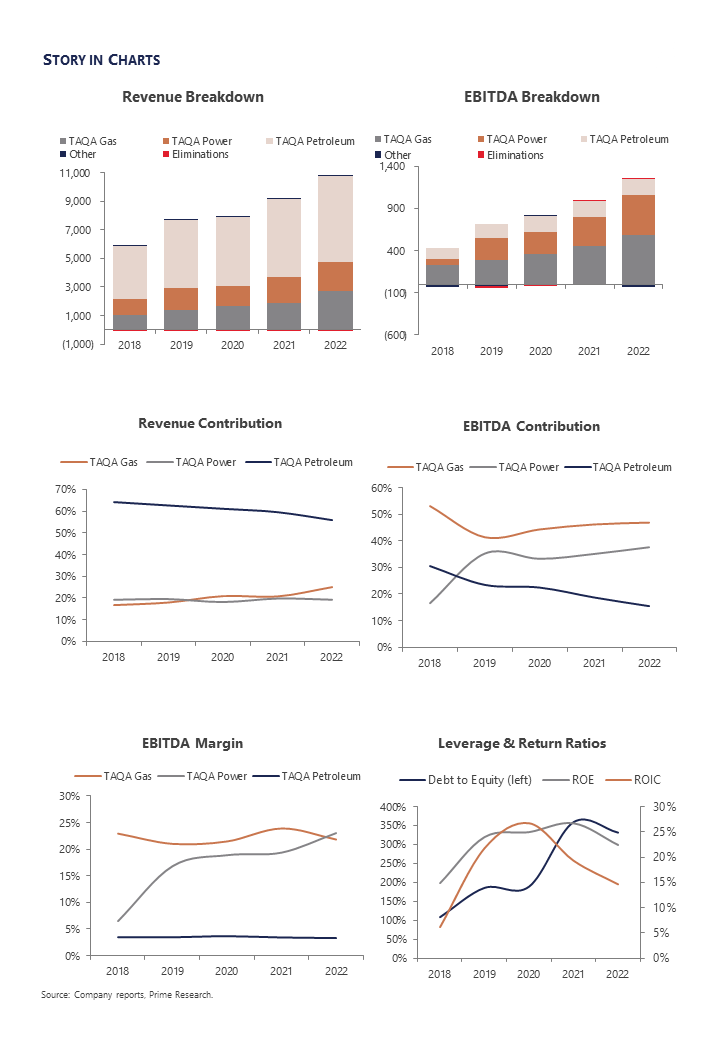

How it measures up: Even though TAQA Gas is the second lowest contributor to group revenues (25% in 2022), it is the highest contributor to group EBITDA (47% in 2022).

TAQA Power: The power surge

What it does: TAQA Power’s primary operations include development, construction, operation, maintenance, billing and collection, and energy efficiency of conventional and renewable power generation and distribution projects in a variety of different industries. The company’s track record includes the development of more than 150MW traditional power generation projects, 1300MVA power distribution projects, and 105MW solar PV generation projects. Other operations include electric vehicle charging services and offering specialized solar solutions with flexible financing options to provide a more sustainable and efficient source of energy.

How it measures up: TAQA Power is the second highest contributor to group EBITDA (38% in 2022) even though it only contributed 19% to group revenues in 2022.

TAQA Water: The blue horizon

What it does: TAQA Water’s main operations include investing, designing, constructing, automating, installing, operating, and maintaining smart water solution systems. Services include filtration, desalination, chemical treatment, and wastewater treatment. Currently, the company is developing the first green water desalination plant in Egypt; it will serve more than 5,000 people in the Red Sea Governorate and reduce carbon emissions by 5.5 tons/day.

How it measures up: TAQA Water’s figures are included in the others segment in TAQA’s financials (EGP1.3mn in revenues in 2022).

TAQA Petroleum: Liquid gold

What it does: TAQA Petroleum’s main operations include the distribution of refined fuel products and Castrol lubricants through its network of service stations. Currently, the company owns and operates an 18ML fuel storage terminal and is constructing another one. Currently, TAQA Petroleum has 64 filling stations and 80 Castrol service centers around Egypt.

How it measures up: TAQA Petroleum is the largest contributor to group revenues (56% in 2022) but is the lowest in terms of EBITDA contribution (16% in 2022) and EBITDA margin (3% in 2022).

Valuation

Relative Valuation

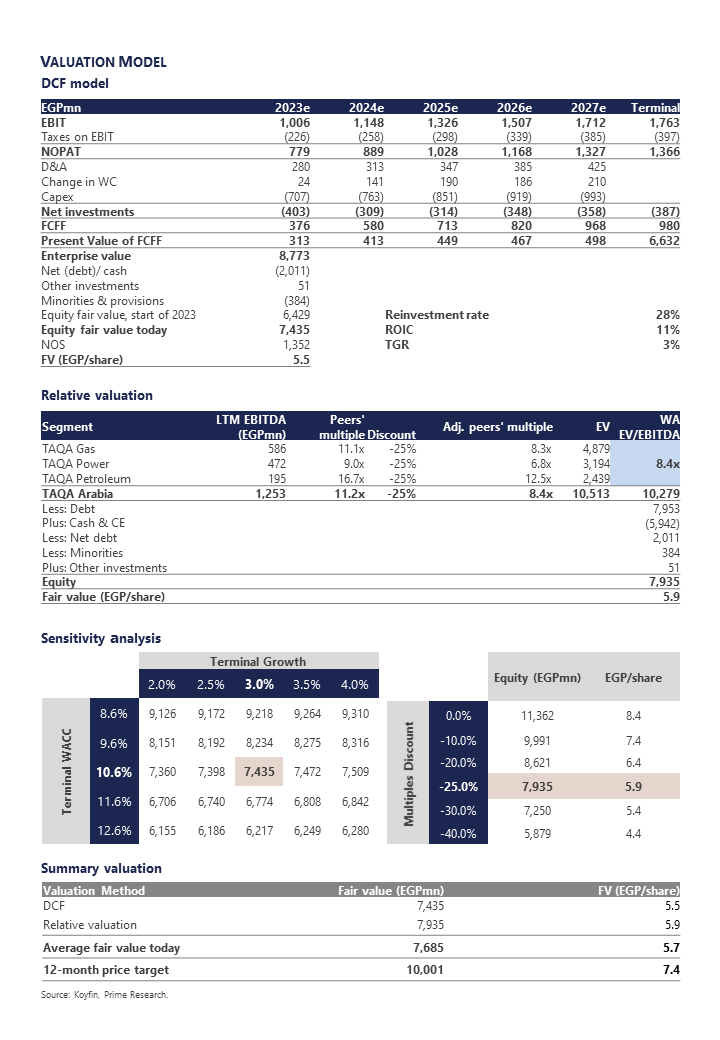

Disassembling the valuation puzzle: To assign a value to TAQA’s equity, we used a sum-of-the-parts (SOTP) method, valuing each business separately using regional peers’ multiples. We believe an SOTP method is appropriate in view of TAQA’s diverse and distinct businesses, attaching a value to each business. To do so, we considered TAQA’s three main segments (namely gas, power, and petroleum) and then applied a regional peers’ median EV/EBITDA multiple (mostly from the Middle East) to reach an enterprise value for each business. The figures below highlight the regional peers’ median EV/EBITDA multiples used for each business.

Putting the pieces together: When adding all enterprise values of TAQA’s businesses, we opted to account for the relative country risk (economic, FX, etc.) between the regional peers (mostly in the GCC) and TAQA (mainly in Egypt). Thus, we applied a discount to the resulting group enterprise value, then we ran a sensitivity analysis to see how the group valuation would be impacted given different discount rates. We chose to apply a 25% discount to regional peers’ median multiples, which yielded lower adjusted multiples.

Furthermore, we accounted for intercompany eliminations by calculating the weighted average EV/EBITDA multiple of all businesses’ adjusted peers’ multiple which came out to 8x. Using TAQA’s consolidated EBITDA (after eliminations), we reached a group enterprise value of EGP10.3bn, net of the 25% discount and after accounting for the intercompany eliminations. After deducting net debt and minority interest and adding investments, we estimate TAQA’s fair value to hover around EGP7.9bn or EGP5.9/share, implying a 2022 P/E ratio of 14.7x.

Discounted Cash Flow (DCF) Valuation

A consolidated approach: Another alternative we used to value TAQA was discounting the group’s consolidated cash flows over the coming five years (2023-2027) based on basic key assumptions, namely:

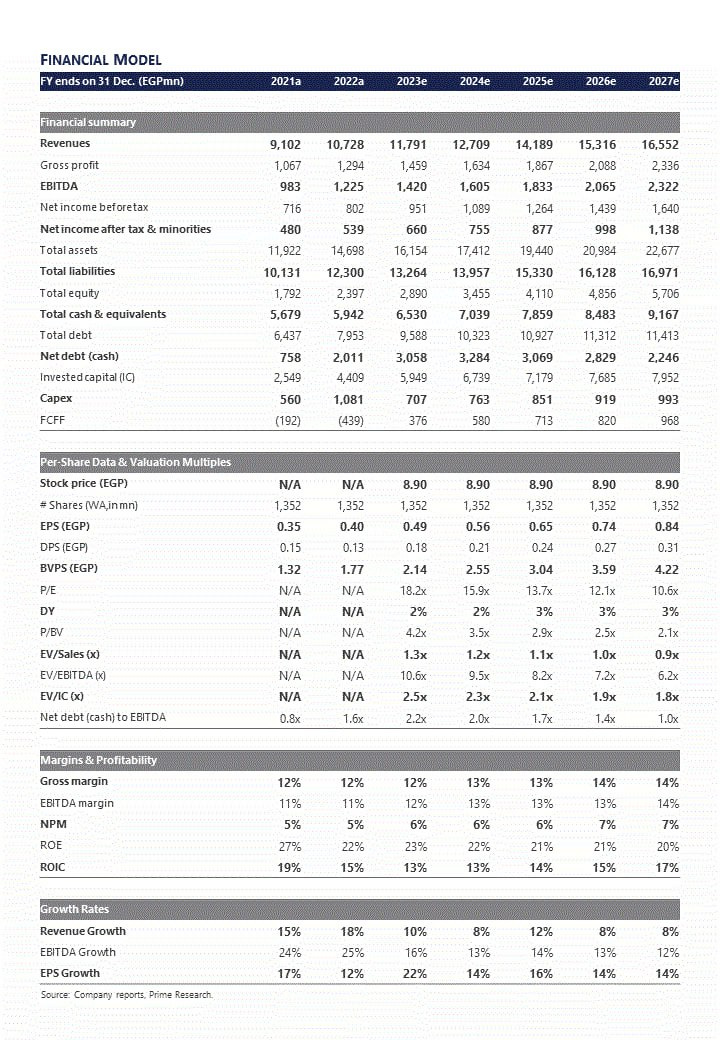

Revenues to grow at a 5y CAGR of 9% to EGP16.6bn by 2027.

EBITDA to grow at a 5y CAGR of 13% to EGP2.3bn by 2027.

NOPAT to grow at a 5y CAGR of 14% to EGP1.3bn by 2027.

Cumulative investment of EGP7.8bn over the coming five years, split between working capital (averaging 5% of revenues) and cumulative capex of EGP4.2bn (averaging 6% of revenues).

A weighted average cost of capital (WACC) ranging between 21% and 9% throughout our forecast horizon, culminating into a terminal WACC of 10.6%.

A terminal return on invested capital (ROIC) of 1x terminal WACC.

A terminal growth rate of 3%.

As such, we reached an enterprise value of EGP8.8bn, from which we deducted net debt and minority interest and added investments. Thus, we estimate TAQA’s fair value to hover around EGP7.4bn or EGP5.5/share, implying a 2022 P/E ratio of 13.8x.

Summary valuation: Combining both valuations together yields an average equity value of EGP7.7bn or EGP5.7/share, suggesting a 12MPT of EGP7.4/share which implies a 2022 P/E ratio of 18.6x.

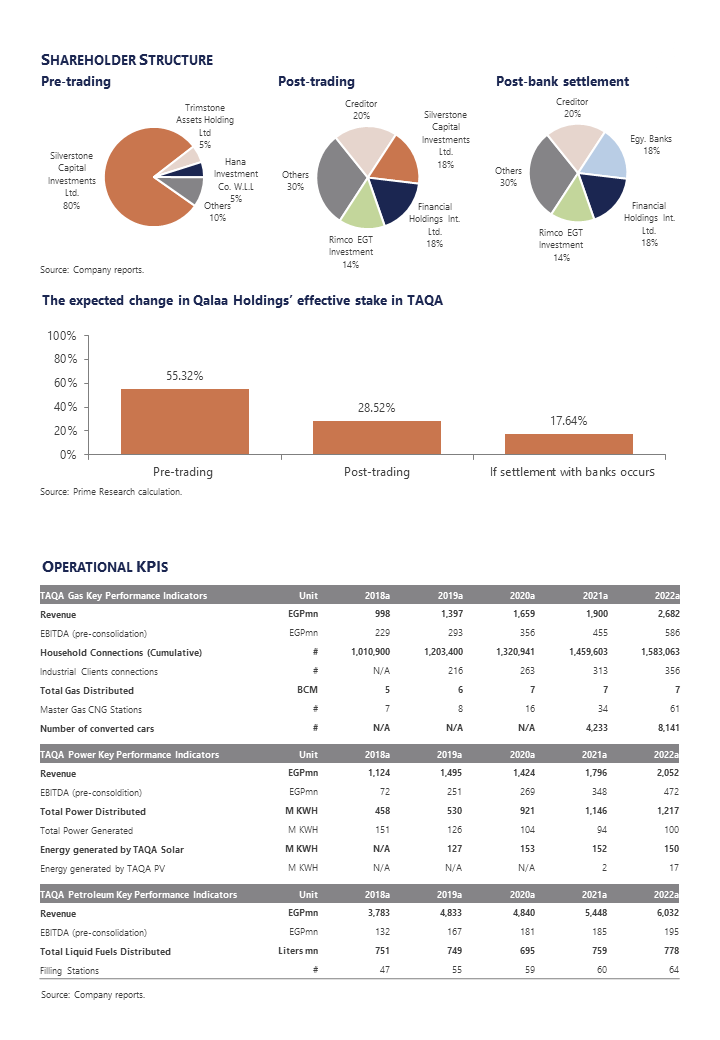

What this all means for Qalaa Holdings: Qalaa Holdings [CCAP] currently (pre-trading) has a 55.3% effective stake in TAQA through its subsidiaries, Silverstone Capital Investments Lts. (a 61.56% stake), Trimstone Assets Holding Ltd. (full ownership), and Citadel Capital for International Investments Ltd. (full ownership). Thus, both of our valuation methods (relative and DCF) suggest that TAQA would contribute some EGP4.1-4.4bn to CCAP’s valuation or EGP2.2-2.4/CCAP share, the midpoint of which is 82% of CCAP’s latest market price. However, TAQA’s shareholder structure will change as CCAP reduced its debts by transferring 20% of Silverstone’s stake to a creditor, within a week after the start of trading. Following the restructuring, CCAP will only have a 28.5% effective stake through Silverstone, Trimstone, Citadel Capital, Nile Energy (full ownership), and Stratford Investments (full ownership). CCAP is also currently negotiating with several banks to have some of their debts written off in exchange for the rest of Silverstone’s 17.68% stake. There is no timetable for this, but If a settlement with the banks is reached, CCAP’s effective stake would become 17.63%.