More Results + One Acquisition

Stocks mentioned: PACH, BTFH, DCCC, POCO, OIH, BINV, OFH, CICH, LUTS

NEW RESEARCH

Alexandria Containers Handling [ALCN] – The Ship Has Sailed

Since we published our CORECoverage report (20 Nov. 2022) and update (8 Feb. 2023) on Alexandria Containers Handling Co. [ALCN], the stock rallied beyond our 12MPTs, hitting a high of EGP26.7/share on 26 Apr. 2023, and generating a triple-digit return of more than 105%. Today, we affirm our positive view on ALCN’s strong, yet simple business model, which makes the company one of the key beneficiaries of a stronger USD with high margins and healthy unlevered balance sheet. Updating our valuation model, we raise our 12MPT slightly from EGP26.1/share to EGP26.4/share but downgrade our rating from Overweight / Medium Risk to Neutral / Medium Risk on the recent stock rally.

For the full report, please click here.

Today’s Top News & Analysis

Trade deficit decreases by 50% y/y in March 2023

Egypt released higher values of goods in April and May; backlog reached USD5.5bn by May

India considers barter-trade with Egypt

Minister of Finance highlights key macro indicators and targets

Government to issue list of custom-exempted goods under free trade agreement

Wind power consortium negotiates with international IFAs

MSC led consortium wins tender to Tenth of Ramadan dry port

PACHIN 9M 2022/23: Back in the green

BTFH Q1 2023: Net losses on high costs

Egypt to sell 20% of Damietta Containers Handling Co.

OIH Q1 2023: Strong bottom line despite operating losses

BINV to acquire a 51-90% stake of OFH in a share swap

Reefy receives an EGP200mn loan from EBRD

AlGioshy Steel to offer 30% in an IPO in 2024

LUTS to enter the sugar distribution market

MACRO

Trade deficit decreases by 50% y/y in March 2023

Egypt’s trade deficit decreased to USD1.96bn in March 2023 (-50% y/y) as exports decreased by 34.6% to USD3.75bn (vs. USD5.72bn a year earlier) and imports decreased by 40.6% to USD5.71bn (vs. USD9.61bn a year earlier). (Al-Borsa)

Egypt released higher values of goods in April and May; backlog reached USD5.5bn by May

Egypt’s Minister of Finance declared that the Egyptian government cleared goods from ports in April and May 2023 at an average monthly rate of USD8.4bn, a faster pace than the average monthly rate of USD5bn Q1 2023. He also added that by the end of May 2023 the imports backlog yet to be released reached USD5.5bn in ports. (Asharq Business)

India considers barter-trade with Egypt

It has been reported that India is considering a proposal to begin barter trade in goods like fertilizers and gas with Egypt as part of a wider deal that could see India extending a credit line worth several billion dollars to Egypt. An agreement is likely to be announced later this month during Indian Prime Minister first visit to Egypt. (Reuters)

Minister of Finance highlights key macro indicators and targets

The Minister of Finance stated that Egypt's foreign direct investments (FDIs) grew by 75% y/y to USD5.7bn in H1 FY23. While he added that the FY24 budget targets a primary surplus of around 2.5% of GDP vs. 1.5% in the current fiscal year. (Al-Borsa)

Government to issue list of custom-exempted goods under free trade agreement

It has been reported that the Egyptian government is about to announce the list of goods to be covered by customs exemptions under the African Free Trade Agreement within days, with expectations that certain cars are to be included. (Al-Mal)

Wind power consortium negotiates with international IFAs

The consortium led by UAE-based Masdar, which includes Infinity Power and Hassan Allam Utilities negotiates with 4 international IFAs to advise on the establishment of the wind power station of USD10b. (Al-Borsa)

MSC led consortium wins tender to Tenth of Ramadan dry port

A consortium led by Italy’s Mediterranean Shipping Company (MSC) won the tender to establish and operate the 250-feddan Tenth of Ramadan dry port as announced by The Minister of Transport. The dry dock aims to serve the industrial area in Badr, Ain Sokhna, East Port Said, the new capital and the Tenth of Ramadan. (Ministry of Transportation)

CORPORATE

PACHIN 9M 2022/23: Back in the green

Paints & Chemical Industries’ (PACHIN) [PACH] 9M 2022 net income came at EGP26mn compared to a net loss of EGP0.9mn. Revenues increased by 11% y/y to EGP723.9mn, while GPM increased by 8.9pp y/y to 16.5%. In similar news, the Financial Regulatory Authority (FRA) approved for National Paints Holding to renew its offer to buy the remaining c.19% of PACH's shares at EGP39.8/share. (Company disclosures: 1, 2)

BTFH Q1 2023: Net losses on high costs

Beltone Financial Holding [BTFH] announced a net loss of EGP52mn in Q1 2023, against net profit of EGP3.8mn last year. This came despite a satisfying 28% y/y increase in total revenues to EGP137mn. The losses can mainly be attributed to: (1) the sharp increase in financing costs to EGP51mn (+85% y/y) and (2) a 105% y/y increase in SG&A. This came despite a 259% y/y increase in FX gains to EGP18mn. (Company disclosure)

Egypt to sell 20% of Damietta Containers Handling Co.

The Holding Co. for Maritime & Land Transport approved to sell a 20% stake in Damietta Container Handling Co. [DCCC] through an IPO on the EGX or to a strategic investor, according to sources. We note that the BoD of the Suez Canal Economic Zone (SCZone) recently approved to sell 20% stake in Port Said Container Handling Co. [POCO] on the EGX. (Al-Mal)

OIH Q1 2023: Strong bottom line despite operating losses

Orascom Investment Holding’s [OIH] net income after minority increased by 42% y/y to EGP109mn even with no gains from discontinued operations this year. Meanwhile, OIH recorded lower operating losses of EGP19mn vs. EGP48mn last year. The improvement came in light of higher operating revenues of EGP38mn and gains on revaluation of assets of EGP22mn. However, OIH recorded 66% y/y higher FX gains of EGP170mn, which covered for the operating losses and allowed for the decent increase in bottom line. (Company disclosure)

BINV to acquire a 51-90% stake of OFH in a share swap

B Investments Holdings' [BINV] BoD held on 15 June 2023 approved the acquisition of a stake ranging from 51% to 90% in Orascom Financial Holding [OFH] through a share swap of 1 share of BINV's to 56.7 of OFH's. Based on the proposed share swap ratio and BINV's last closing price of EGP20.41/share, we calculate that this transaction implies a valuation of EGP0.36/share for OFH (a 49% premium to its Thursday's closing price). We note that OFH is part of our STANDPoint Portfolio. (Company disclosure)

Reefy receives an EGP200mn loan from EBRD

CI Capital Holding’s [CICH] microfinance arm Reefy is receiving an EGP200mn loan from European Bank for Development & Reconstruction (EBRD) for financing private MSMEs. The loan targets companies owned by youth and is expected to help Reefy furtherly expand its customer base. (EBRD)

AlGioshy Steel to offer 30% in an IPO in 2024

AlGioshy Steel plans to offer a 30% stake on the EGX by 2024. The IPO is meant to fund the company's expansion plans to add new production lines and increase production capacity. (Al-Borsa)

LUTS to enter the sugar distribution market

Lotus Agriculture Development’s [LUTS] managing director reported that LUTS will start a sugar distribution subsidy. LUTS is negotiating with El Nobaria For Sugar Refining to have a part of its production distributed through its arm for sugar distribution. In addition, LUTS is approaching an export agreements to gulf countries, worth EGP1bn starting 2024 until 2026. (Al-Mal)

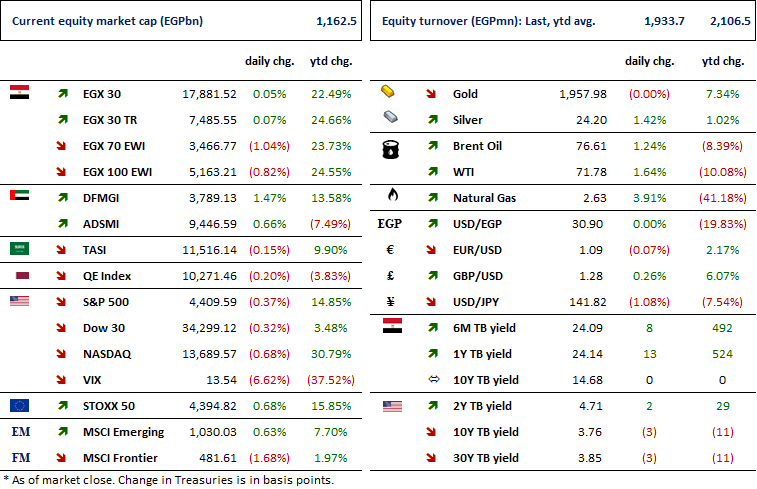

Markets Performance

Key Dates

18-Jun-23

MOIL: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

MOIL: EGM / Discussing the continuation of the company.

19-Jun-23

SUGR: Cash dividend / Deadline for eligibility for a dividend of EGP2.550/Share.

EXPA: Capital increase / Capital increase subscription starting date.

EXPA: Right Issue / First day of trading the rights issue.

20-Jun-23

SUGR: Cash dividend / Ex-dividend date for EGP2.550/Share.

22-Jun-23

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.

4-Jul-23

ISPH: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

ISPH: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

5-Jul-23

Egypt PMI: June 2023 reading.

6-Jul-23

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

BTFH: Capital increase / Capital increase subscription closing date.

9-Jul-23

EGCH: EGM / Approving the final cost of the nitric acid and ammonium nitrate project.

ETRS: EGM / Approving increasing the issued capital & amending Articles No. 7, 8 & 47 of the company's bylaws.

10-Jul-23

MCRO: EGM / Amending Article No. 3 of the company's bylaws.