Alexandria Containers Handling: The Ship Has Sailed

ALCN: Raising our 12MPT slightly, yet downgraded to N/M on recent stock rally

Neutral / Medium Risk

12MPT: EGP26.4 (was EGP26.1)

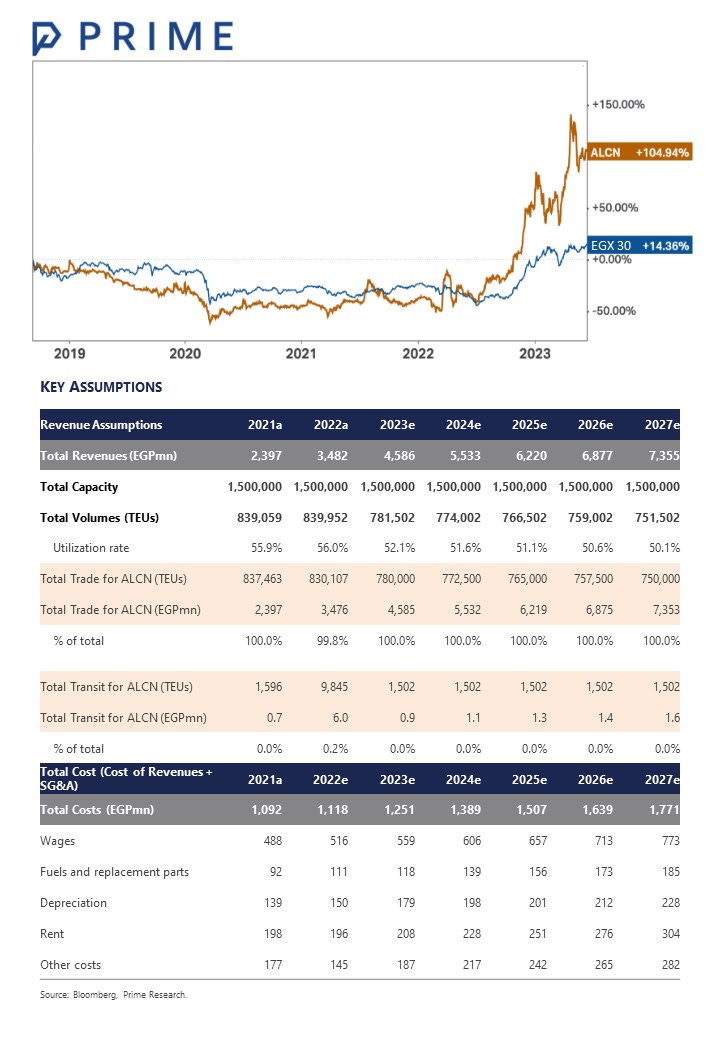

Since we published our CORECoverage report (20 Nov. 2022) and update (8 Feb. 2023) on Alexandria Containers Handling Co. [ALCN], the stock rallied beyond our 12MPTs, hitting a high of EGP26.7/share on 26 Apr. 2023, and generating a triple-digit return of more than 105%. Today, we affirm our positive view on ALCN’s strong, yet simple business model, which makes the company one of the key beneficiaries of a stronger USD with high margins and healthy unlevered balance sheet. Updating our valuation model, we raise our 12MPT slightly from EGP26.1/share to EGP26.4/share but downgrade our rating from Overweight / Medium Risk to Neutral / Medium Risk on the recent stock rally.

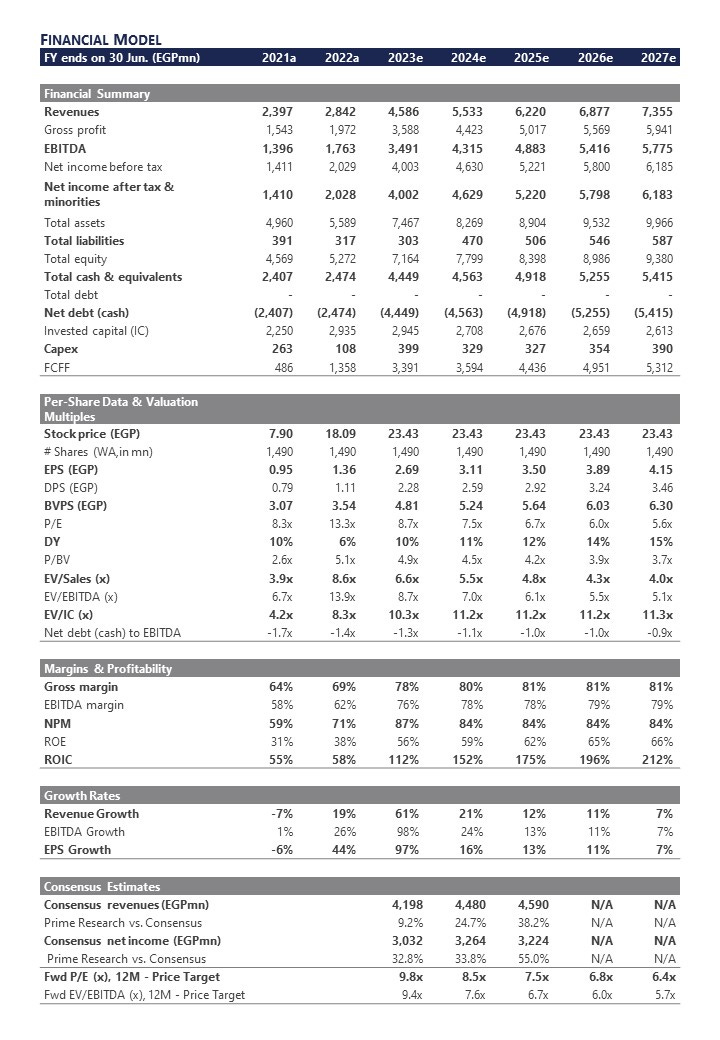

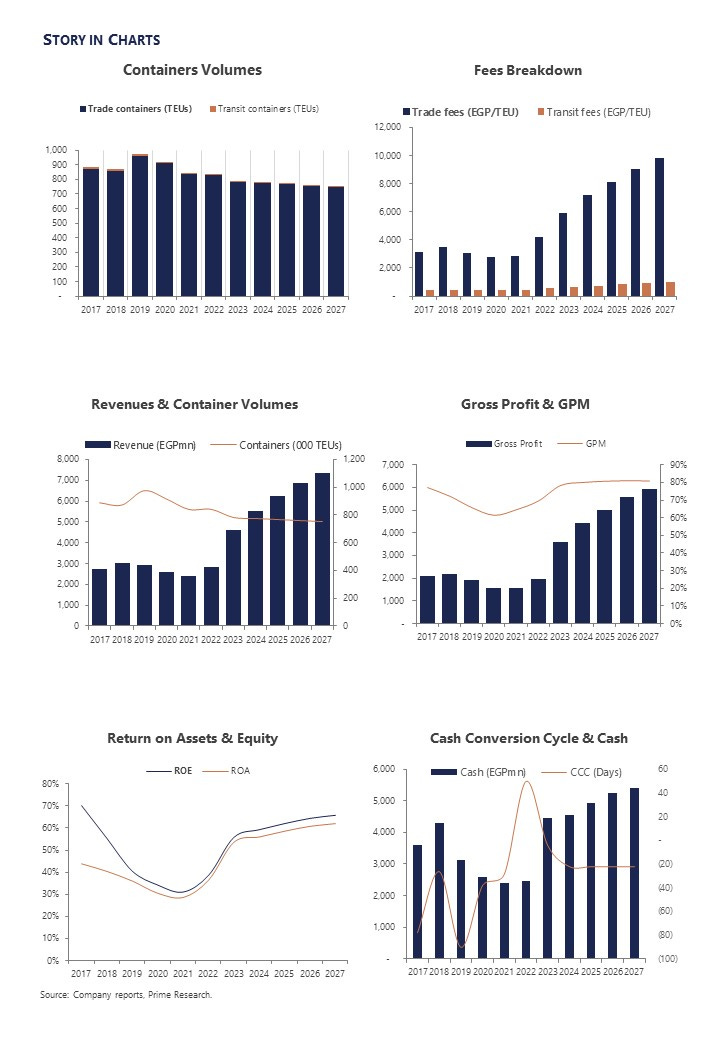

Unrivaled fundamentals: ALCN boasts unrivaled characteristics, namely a negative cash conversion cycle, a debt-free and cash-heavy balance sheet, a regular and generous dividend payout, very high margins and ROEs, and—most notably—USD-linked revenues. Currently, the only peers close to ALCN are Damietta Containers Handling Co. [DCCC] and Port Said Containers Handling Co. [POCO]. Both companies, listed on the EGX but are yet to trade, have lower revenues and margins compared to ALCN’s. We consider ALCN to be a good choice for value and income-based investors and as a hedge against local currency fluctuations.

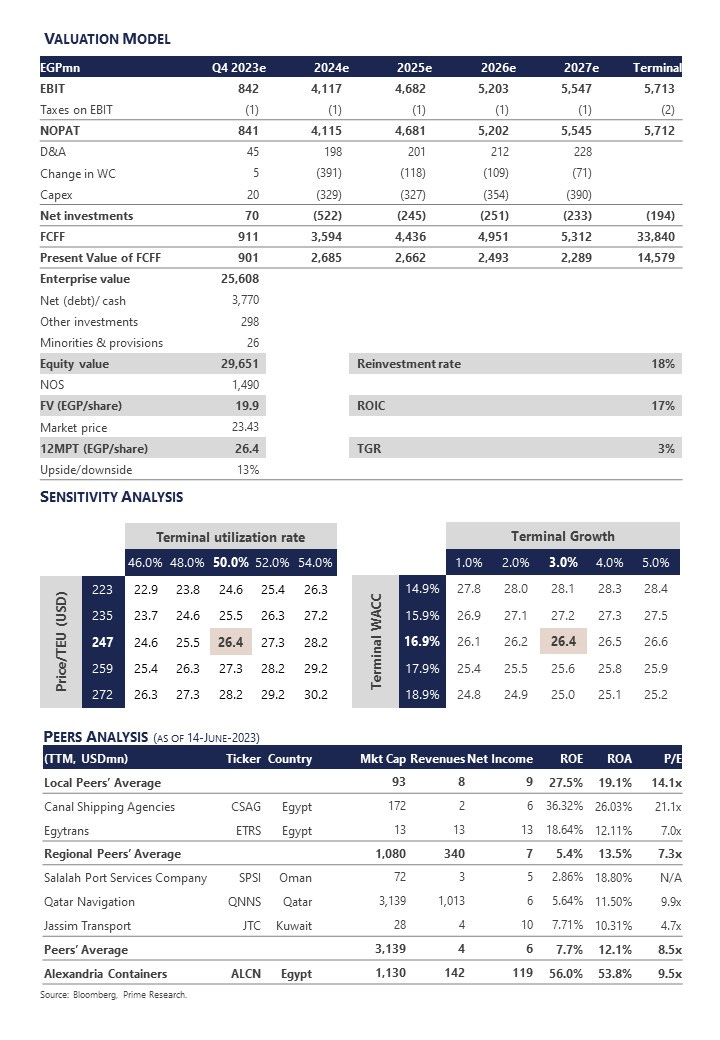

What changed? We revised our financial model, with very minor adjustments to volumes and prices of the trade containers segment and no change in the transit containers segment. Nevertheless, the most significant change came from our revised annual FX forecast, in which we use an average of EGP25.8/USD in 2022/23 (vs. EGP25.0/USD previously) all the way to EGP39.7/USD in 2026/27 (vs. EGP30.2/USD previously). Our base-case scenario is still intact; we believe the current economic reforms and government programs to support external trade should boost ALCN’s volumes in the near future.

12MPT raised slightly, downgraded to N/M, and removed from SPP: Our updated 5y DCF model yielded a fair value of EGP19.9/share and a 12MPT of EGP26.4/share, implying a 2023/24e P/E of 8.5x and suggesting an upside potential of 13%. Thus, we downgrade our rating from Overweight / Medium Risk to Neutral / Medium Risk. As a result, we remove ALCN from our STANDPoint Portfolio (SPP). Key Catalysts: Further EGP devaluation. Government’s trade support programs. Higher EGP interest rates. Key Risks: New competition from EGMPT in Alexandria Port. Investors’ focus shifting to upcoming IPOs in the sector (i.e. DCCC and POCO). A stronger EGP.