Today’s Top News & Analysis

Egypt targets a 21% increase in income tax revenue in FY24

CBE to stop the use of some prepaid cards for foreign-currency transactions

Egypt’s foreign currency deposits rise, local currency deposits fall in April

NFAs improve marginally in April 2023

The Interior Ministry grants foreign investors a one-year, renewable residency

Saudi Arabia and UAE to pump USD100mn investments in the poultry sector in Egypt

Elsewedy Electric Q1 2023: Turning copper into gold indeed

FAIT Q1 2023: A Q4 2022 replica?

OLFI Q1 2023: Higher earnings on price-driven revenue growth despite lower volumes

DOMT Q1 2023: Better net profits, margins, and revenues

POUL Q1 2023: Outstanding revenue and earnings growth

Misr Cement Qena to undergo a 33% stock dividend

LUTS to pump EGP250mn investments during 2023

MACRO

Egypt targets a 21% increase in income tax revenue in FY24

Egypt aims to achieve a 21% increase in income tax proceeds to reach EGP220bn in the FY24 vs. a target of EGP182bn in the current fiscal year. (Asharq business)

CBE to stop the use of some prepaid cards for foreign-currency transactions

The CBE will stop the use of some prepaid cards for foreign currency transactions that aren’t linked to bank accounts. (Enterprise)

Egypt’s foreign currency deposits rise, local currency deposits fall in April

Foreign currency deposits rose to EGP1.53tn at the end of April vs. EGP1.49tn at the end of March. While the local currency deposits recorded EGP5.61tn at the end of April vs. EGP5.614tn at the end of March. (Al-Mal: 1, 2)

NFAs improve marginally in April 2023

Net Foreign Assets for the Egyptian banking system improved in April 2023 for the first time since December by USD163mn to reach USD24.1bn from USD24.3bn in March 2023. (Al-Borsa)

The Interior Ministry grants foreign investors a one-year, renewable residency

The Interior Ministry agreed to grant the foreign investors a one-year residence “for non-tourism purposes “renewable for 6 months or a year additionally by submitting investment plans to the General Authority for Freezones and Investments (GAFI). (Al-Mal)

Saudi Arabia and UAE to pump USD100mn investments in the poultry sector in Egypt

Saudi Arabia and UAE agreed to invest USD100mn in the poultry sector in Egypt to provide all derivatives that enter into the poultry industry. (Mubasher)

Corporate

Elsewedy Electric Q1 2023: Turning copper into gold indeed

Elsewedy Electric's [SWDY] consolidated Q1 2023 net profits came in at EGP2.9bn, a 282% y/y growth on revenues of EGP33.3bn (+80% y/y). Results came in way better than our expectations almost across the board. The revenue mix was as follows:

· Wires & cables revenues of EGP17.9bn (+93% y/y, +58% vs. Pre, 54% of total sales).

· Turnkey revenues of EGP11.6bn (+53% y/y, 34% of total sales). Turnkey projects backlog reached EGP122bn, with EGP37bn of new awards during Q1 2023.

· Other business revenues of EGP3.9bn (+124% y/y, +28% vs. PRe, 12% of total sales).

Meanwhile, GPM reached 18.4% (+6pp y/y, +4pp vs. PRe), supported by the increase in the wires & cables margins which reached 20.6% (+9.3pp y/y, +7.8pp vs. PRe). GPM for the turnkey segment increased slightly to 11% (+1pp y/y, -1pp vs. PRe). Other electrical products and renewables segments maintained the highest margins at 55% for both. (Company disclosure)

FAIT Q1 2023: A Q4 2022 replica?

Faisal Islamic Bank of Egypt [FAIT] announced the results for Q1 2023, where net income increased by 81% y/y, yet it slipped 2% q/q to EGP2.1bn. Meanwhile, net interest income (NII) increased 24% q/q to EGP1.4bn (+14% y/y), reflecting higher interest rates. Other key takeaways include:

• Earnings growth is mainly attributable to huge FX gains of EGP1.6bn (+117% y/y) given the EGP depreciation, just like we saw in Q4 2022.

• This has given the bank the capacity to increase provisions by 129% y/y to EGP436mn.

• The bank managed to grow its deposits by 6.5% ytd to EGP132bn, a bit higher than gross loans growth which grew by 5% ytd to EGP15bn. This implies a GLDR of 11.3%, almost the same as last year’s.

Annualized ROAE stands at 38%, whereas the CAR is now at 24.4%. FAIT is currently traded at an annualized P/E of 1.9x and a P/BV of 0.7x. (Company disclosure)

OLFI Q1 2023: Higher earnings on price-driven revenue growth despite lower volumes

Obour Land Food Industries [OLFI] reported Q1 2023 net profits of EGP115mn (+27% y/y) on higher revenues of EGP1.5bn (+59% y/y). Revenue growth was driven by 85% y/y higher prices averaging EGP52.8/kg of white cheese. However, sales volumes dropped by 14% y/y to 26,100 tons. Despite the higher costs due to the EGP devaluation and USD shortage, OLFI's GPM increased slightly by 0.9pp y/y to 23.4%. We note that our latest rating for OLFI is Overweight / Medium Risk with a 12MPT of EGP11.8/share. (Company disclosure)

DOMT Q1 2023: Better net profits, margins, and revenues

Arabian Food Industries [DOMT] posted strong net profits in Q1 2023, recording EGP151mn (+200% y/y) on the back of:

• Higher revenues of EGP1.7bn (+56% y/y).

• GPM expanding to 26% (+2pp y/y).

• Better SG&A-to-revenues ratio of 13% (-3pp y/y). (Company disclosure)

POUL Q1 2023: Outstanding revenue and earnings growth

Cairo Poultry [POUL] reported Q1 2023 net profits of EGP547mn, growing more than 10x y/y on the back of:

• A 91% y/y increase in revenues to EGP2.8bn due to higher selling prices with a slight increase in volumes.

• GPM expanded by 20pp y/y to 32%. This was due to the wise planning of the company in stocking low-priced raw materials.

• SG&A-to-revenues ratio fell by 2pp y/y to 4%.

• Other operating income of EGP47mn (+66% y/y).

Earnings growth came despite recording net interest expenses of EGP31mn, which climbed more than 4x y/y. Additionally, the company booked FX losses of EGP61mn vs. FX gains of EGP5mn in Q1 2022. (Company disclosure)

Misr Cement Qena to undergo a 33% stock dividend

Misr Cement Qena's [MCQE] BoD approved a 33% stock dividend, thus raising its capital from EGP720mn to EGP960mn through. (Company disclosure)

LUTS to pump EGP250mn investments during 2023

Lotus Agriculture Development [LUTS] intends to make investments worth EGP250mn to cultivate 1,500 acres during the current year. LUTS started trading yesterday for the first time with a par value of EGP0.1/share with a total share of 560mn shares. (Al-Borsa)

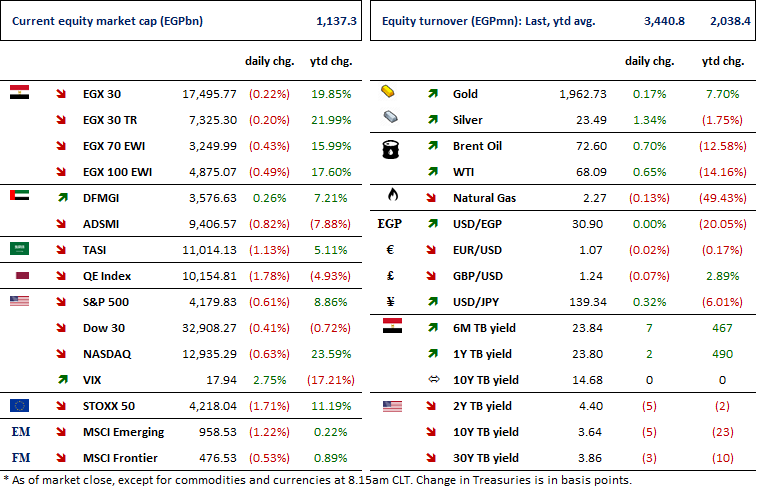

Markets Performance

Key Dates

1-Jun-23

BTFH: Capital increase / Last day for eligibility for the capital increase.

SPMD: Right Issue / Last day of trading the rights issue.

MSCI: MSCI's May 2023 Semi-Annual Index Review Effective Date.

4-Jun-23

HELI: OGM / Approving financial statements.

5-Jun-23

JUFO: Cash dividend / Deadline for eligibility for a dividend of EGP0.15/Share.

6-Jun-23

BTFH: Capital increase / Capital increase subscription starting date.

JUFO: Cash dividend / Ex-dividend date for EGP0.15/Share.

CSAG: OGM / Approving the estimated budget of FY 2023/2024.

CSAG: EGM / Amending Article No. 3 of the company's bylaws.

7-Jun-23

ATQA: EGM / To renew the company's license for 25 years starting from the end of the previous license (30 May 2023).

8-Jun-23

JUFO: Cash dividend / Payment date for a dividend of EGP0.15/Share.

BTFH: OGM / Approving financial statements ending 31 Dec. 2022.

BTFH: EGM / Amending Article No. 29 of the company's bylaws.

15-Jun-23

ZMID: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

17-Jun-23

MICH: EGM / Amending Article No. 6 of the company's bylaws for increasing the authorized capital from EGP400mn to EGP1bn.

18-Jun-23

MOIL: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

MOIL: EGM / Discussing the continuation of the company.