Today’s Top News & Analysis

CBE issued guidelines for establishing digital banks

FRA issues regulations for NBFC’s use of Fintech

EBRD grants financing worth USD532mn to private sector SMEs

Two petroleum companies could offer stakes on the EGX

Exports of cast iron and steel increased by 46% in 5M 2023

Egypt builds its first drilling rig

BlockRock looking to invest in Egypt

Egypt to invest EGP100bn for petroleum extraction

Export subsidies worth EGP7.5bn to be distributed

98% subscription to BTFH's capital increase

EGX transfers EZDK’s shares to Schedule D

MACRO

CBE issued guidelines for establishing digital banks

The Central Bank of Egypt issued rules for establishing digital-only banks. The requirements are:

· The issued and paid-in capital cannot be less than EGP2bn for digital banks not committed to financing large corporations, while it cannot be less than EGP4bn for banks that will finance large companies.

· The majority shareholder must be a financial institution with experience in the field with a stake of no less than 30%.

· Submitting a detailed feasibility study with the intended target market and the products offered.

· An IT strategy with cybersecurity plans.

· In addition to the same rules, regulations, and oversight that govern the Egyptian banking sector. (Asharq Business)

FRA issues regulations for NBFC’s use of Fintech

The Financial Regulatory Authority (FRA) issued three new rules to regulate the use of Fintech in non-banking financial companies (NBFCs):

1. Specific requirements for equipment, technological infrastructure, information systems, and means of protection and insurance.

2. Specific requirements for creating a digital identity, digital contracts, and digital records.

3. Allowing the creation of a registry to outsource Fintech service providers. (FRA)

EBRD grants financing worth USD532mn to private sector SMEs

The European Bank for Reconstruction & Development (EBRD) granted a financing agreement worth USD532mn to aid the development of SMEs in the Egyptian private sector. The funds will be allocated to:

· National Bank of Egypt (USD400mn).

· Banque Misr (USD100mn).

· The Mediterrania Capital IV Fund (EUR30mn). (Ministry Statement)

Two petroleum companies could offer stakes on the EGX

The Minister of Petroleum & Mineral Resources is discussing with shareholders of Misr Petroleum and the Cooperation Petroleum Co. to offer partial stakes on the EGX in the coming period. (Al-Borsa)

Exports of cast iron and steel increased by 46% in 5M 2023

Egyptian exports of cast iron and steel reached USD943mn (+46% y/y) in 5M 2023. The exports reached 69 different countries, with 16 countries not receiving exports during the same period last year. (Al-Borsa)

Egypt builds its first drilling rig

Egypt completed building its first drilling rig at the Egyptian-Chinese Co. for the Manufacturing of Drilling Rigs in Ain Sokhna. The drilling rig was delivered to the Egyptian Drilling Co. (EDC) at a cost of USD6.5mn. We note that a 25-30% stake of EDC was added to the pre-IPO fund, which we had reported on 21 June 2023. Meanwhile, the drilling rig is the first of seven rigs to be manufactured in the factory, with a capacity of 2000 hp. (Ministry Statement)

BlockRock looking to invest in Egypt

BlackRock’s Managing Director met with the Egyptian Prime Minister to explore investment opportunities in Egypt. (Cabinet Statement)

Egypt to invest EGP100bn for petroleum extraction

The Egyptian government plans to invest EGP100bn this year to develop Egypt’s extraction capabilities. The funds will be divided between crude oil extraction (EGP23bn), natural gas extraction (EGP64bn), and other extractions (EGP13bn). Meanwhile, the government aims this year to increase petroleum exports by 15% y/y to USD9.8bn, increase exports of liquefied natural gas (LNG) by 30% y/y to 13.6bcm, and achieve an oil balance surplus of USD3bn. (Al-Borsa)

Export subsidies worth EGP7.5bn to be distributed

The Minister of Finance announced that EGP7.5bn of export subsidies will be distributed to 750 companies as part of the first installment in the sixth phase of the immediate cash payment initiative. The funds will be distributed through National Bank of Egypt, Banque Misr, Banque du Caire [BQDC], and Export Development Bank of Egypt [EXPA]. The second installment is due 20 July 2023, while the third is due 3 August 2023. (Al-Borsa)

CORPORATE

98% subscription to BTFH's capital increase

Shareholders of Beltone Financial Holding [BTFH] have subscribed to 98% of the EGP10bn capital increase at a par value of EGP2/share. Additionally, the remaining unsubscribed amount of 100.4mn shares will be offered in a second phase subscription. (Company disclosures: 1, 2)

EGX transfers EZDK’s shares to Schedule D

In light of Al-Ezz Dekheila Steel Co.’s (EZDK) [IRAX] decision to voluntarily de-list from the EGX, the Securities Listing Committee approved transferring the company’s shares to Schedule D as of today’s trading session. The different rules and procedures of Schedule D are:

A 5% price limit.

No pre-trading session.

No temporary suspension limits. (EGX)

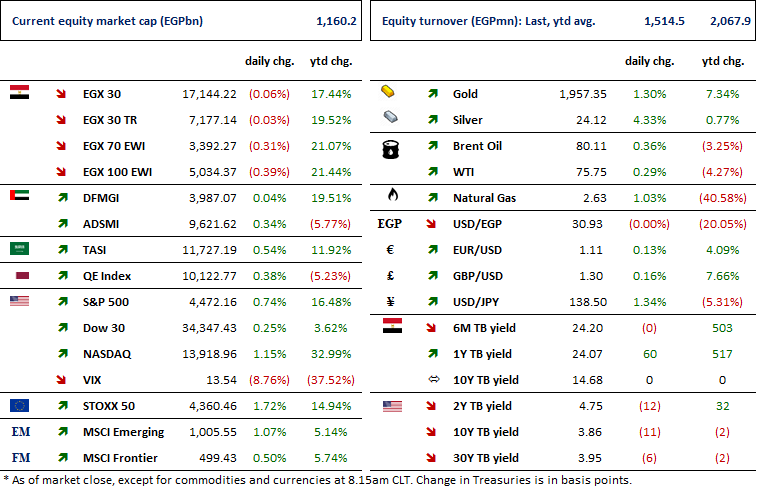

Markets Performance

Key Dates

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

19-Jul-23

PACH: OGM / Board election.

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.