Today’s Top News & Analysis

LNG exports to be back in January

AFDB to lend Egypt USD131mn support package

DSCW Q3 2023: The low base year pushes the net profit growth further

ORAS Q3 2023: Lower revenues drive a decline in net profits

MFPC Q3 2023: Modest performance

EFIC Q3 2023: High USD-costs still affect profitability

MACRO

LNG exports to be back in January

An official in the Ministry of Petroleum & Mineral Resources reportedly said that Egypt will resume its exports of liquefied natural gas (LNG) by January 2024, aiming to export 1bn CBT/day. He added that local consumption through winter is expected to decrease to 6bn CBT/day. (Al-Arabiya)

AFDB to lend Egypt USD131mn support package

The African Development Bank (AFDB) signed a new supporting package with Egypt worth USD131mn for private sector development and to support Egypt's economic diversification. (Enterprise)

CORPORATE

DSCW Q3 2023: The low base year pushes the net profit growth further

Dice Sport & Casual Wear [DSCW] 9M 2023 net profits grew by 628% y/y to EGP279mn due to the low base year and the following:

· Higher revenues of EGP2.3bn (+56% y/y).

· Stronger gross profit margin of 30% (+9pp y/y).

· Better SG&A-to-revenues ratio of 3% (+2pp y/y).

· Other income grew to EGP96mn vs. only EGP721,780 last year.

Regarding Q3 2023, DSCW posted an EGP156mn in net profits vs. only EGP13mn a year earlier, this is due to:

· Higher revenues of EGP831mn (+49% y/y, +9% q/q).

· Stronger gross profit margin of 27% (+4pp y/y, -5pp q/q).

· The massively improved SG&A-to-revenues ratio of 24% (+11pp y/y).

· Other income grew to EGP99mn vs. only EGP28mn last year. (Company disclosure)

ORAS Q3 2023: Lower revenues drive a decline in net profits

Orascom Construction [ORAS] reported its Q3 2023, ORAS posted a 33% y/y decline in net profits to EGP16mn due to:

· Lower revenues of EGP802mn (-30% y/y).

· The gross profit margin slightly slipped to 8.3% (-0.3pp y/y).

· Higher net finance expense of EGP10mn (+4% y/y).

Regarding 9M 2023 results, ORAS posted EGP15mn (+98% y/y) in net profits despite a 23% y/y decline in revenues to EGP2.4bn and the gross profit margin slightly slipping to 8.3% (-0.3pp y/y). The growth in net profits is attributable to:

· Higher other income of EGP115mn vs. only EGP4mn last year.

· Net finance income of EGP15mn vs. net finance expense of EGP21mn last year.

· Income from equity-accounted investees grew to EGP14mn vs. only EGP6mn last year. (Company disclosure)

MFPC Q3 2023: Modest performance

Misr Fertilizers Production (MOPCO) [MFPC] announced the full results for Q3 2023:

· Net income declined by 5% y/y to EGP1.25bn on the back of :

1. Dramatically higher effective tax rate of 30%

2. Capital losses of EGP30mn

3. Expected credit losses of EGP0.58mn against reversals of EGP1.6mn last year

4. FX losses of EGP18mn

· This comes despite an increase in revenues by 5% y/y to EGP3.8bn. However, GPM remained around 46%.

· Also, MFPC managed to record huge net financing income of EGP262mn (+196% y/y).

· On a sequential basis, revenues are 15% q/q weaker. Meanwhile, net income is 17% lower q/q.

· For 9M 2023, net income increased slightly y/y by 3.2% to EGP5.2bn while revenues increased by 7% y/y to EGP12.3bn.

· There is a significant drop in MFPC’s GPM due to the substantial increase in USD-based cost, for the GPM dropped from 52.3% last year to 42.7%.

· However, the huge FX gains made up for the decline in gross profit and shrank the y/y difference.

· Now the annualized ROE for MFPC is at 16.5%. (Company disclosure)

EFIC Q3 2023: High USD-costs still affect profitability

Egyptian Financial & Industrial [EFIC] has announced consolidated financials for Q3 2023 where net income declined by 28% y/y to EGP80mn (-62% q/q) in spite of a 68% y/y increase in revenues to EGP1.36bn (-9% q/q). However, the huge increase in USD-based cost outpaced revenues’ growth due to the devaluation. This pushed the GPM down annually to 25.5% from 29% the year before, and also dropped quarterly from 34.5% in Q2 2023. This increase in revenues was subsided by the net financing expense of EGP19mn against EGP5.8mn last year. For 9M 2023, net income declined by 16% y/y to EGP515mn, while top line increased by 38% y/y. Annualized ROE now stands at 31%. (Company disclosure)

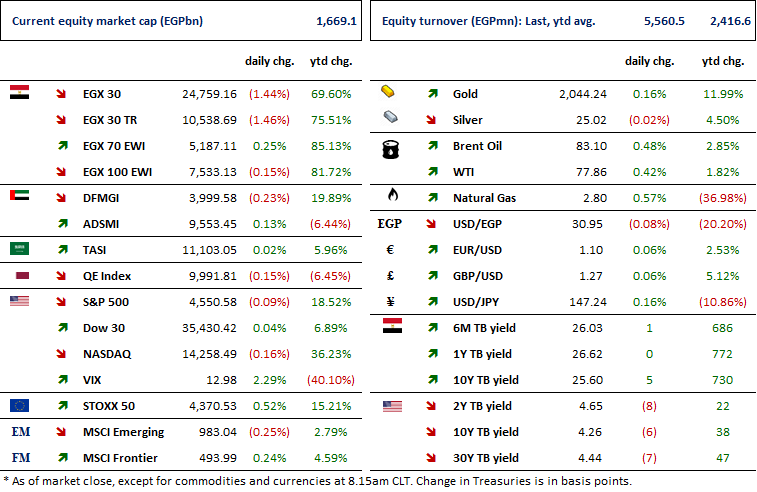

MARKETS PERFORMANCE

Key Dates

30-Nov-23

MICH: BoD meeting / Follow up on production, sales and exports.

DOMT: Cash dividend / Payment date for a dividend of EGP0.20/share.

EFID: Cash dividend / Payment date for a dividend of EGP0.428/share.

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

1-Dec-23

MSCI / MSCI's November 2023 Semi-Annual Index Review Effective Date.

3-Dec-23

MASR: OGM / Discussing netting contracts.

5-Dec-23

Egypt PMI / November 2023 reading.

11-Dec-23

LCSW: OGM / Considering the distribution of treasury shares.

12-Dec-23

ARCC: OGM / Discussing dividends distribution.

13-Dec-23

EFIH: EGM / Amending some articles of the Company's bylaws.

14-Dec-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

19-Dec-23

CIRA: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

20-Dec-23

MCQE: Cash dividend / Payment date for a dividend of EGP0.50/share (2nd installment).