Today’s Top News & Analysis

Egypt signs exploration agreements worth USD319.5mn

Electricity cuts till the end of August

More green hydrogen plants

Egypt's external debt rises in Q3 2022/23

QIA and ETEL talks continue

OLFI to invest EUR2.5mn by the end of 2023

MACRO

Egypt signs exploration agreements worth USD319.5mn

Egypt signed three natural gas and oil exploration agreements worth USD319.5mn and will include drilling at least 13 wells:

· Two contracts went to ExxonMobil Egypt and the Egyptian Natural Gas Holding Co. (EGAS) to explore in the Mediterranean in the offshore Cairo and Masry concessions.

· One contract went to The Kuwait Foreign Petroleum Exploration Co. (Kufpec), Pico Petroleum, and the Egyptian General Petroleum Corporation (EGPC) to explore in the Gulf of Suez in the Geisum and Tawila concession. (Cabinet Statement)

Electricity cuts till the end of August

The Egyptian Prime Minister has said that the current electricity crisis will continue for at least one month from now, till the end of August. The Egyptian government is working on solutions to the problem, including scheduled power cuts, more mazut imports, rationing electricity, and work from home Sundays for government entities. (Enterprise)

More green hydrogen plants

Switzerland-based energy investment firm SmartEnergy is currently in talks with the Egyptian government to build a green hydrogen plant with total investments of USD1bn, according to sources. (Enterprise)

Egypt's external debt rises in Q3 2022/23

Egypt's external debt has risen in Q3 2022/23 to USD165.4bn compared to USD162.9bn (+1.5% q/q, +5% y/y). In another news, Egypt has received a USD616mn loan from the Arab Monetary Fund (AMF) to support the financial sector in Egypt. (Enterprise: 1, 2)

CORPORATE

QIA and ETEL talks continue

Reportedly, Qatar Investment Authority (QIA) and Telecom Egypt [ETEL] may finalize talks within two months QIA’s acquisition offer on a part of Vodafone Egypt [VODE]. It is worth mentioning that the Egyptian government wants to keep a minority stake in VODE. (Al-Borsa)

OLFI to invest EUR2.5mn by the end of 2023

Obour Land for Food Industries [OLFI] will invest EUR2.5mn by the end of 2023, dedicated to Obour Farm. As a reminder, in our Core Coverage Update for OLFI last April, we mentioned that OLFI is expecting to receive 1,000 cows (EUR2,500/cow), while the herd should be 2,500 cows. (Al-Mal)

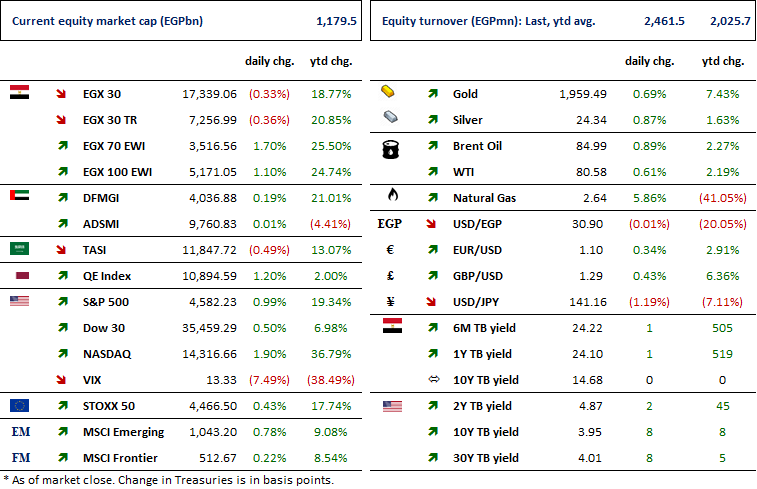

Markets Performance

Key Dates

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

31-Aug-23

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).