Today’s Trading Playbook

Youssef Ghazy | Equity Analyst

KEY THEMES

Fawry’s [FWRY] net earnings grew 13% to EGP186mn in 2021, implying a net margin of 11%. Such earnings growth came on the back of double-digit top line growth of 34% y/y to EGP1.66bn vs. EGP1.2bn a year before. Around 56% of revenue growth was driven by banking services, of which revenues grew 135% y/y to EGP411mn, contributing 25% to revenues (vs. 14% a year before). Both acceptance and agent banking, its two sub-segments, led the growth (+254% y/y to EGP167mn and +91% y/y to EGP244mn, respectively). Meanwhile, alternative digital payments (ADP) revenues increased by 9% to EGP985mn, contributing 20% of revenue growth and still representing the bulk of revenues, albeit with a lower contribution of 59% (vs. 73% a year before). Furthermore, microfinance was on track, almost doubling y/y to EGP136mn (+89% y/y).

Total throughput value increased by 61.5% to EGP131bn in 2021, up from EGP81bn a year before, thanks to: (1) myFawry app nearly reaching 5mn of cumulative downloads (+181% y/y) and (2) the mobile wallet processed value jumping 95% y/y to c.EGP40bn. Also, the number of transactions increased by 4.6% y/y to 1.15mn in 2021.

Gross profit reached EGP932mn (+40% y/y) in 2021, implying a higher GPM of 56.2% vs. 54.1% a year before. Such margin expansion came in despite aggressive spending on marketing and human resources. FWRY has promoted its digital payments channel through expansion of its POS network by creating a new FawryPlus branch and growing the audience for its myFawry app. In 2021, FWRY kicked off its partnership with Alsoug, one of the Sudanese leaders in tech innovation. This marked FWRY's first investment outside Egypt, as part of its strategy to tap underserved international markets by delivering technology and partnering with strong local businesses.

FWRY is currently trading at 2021 EV/EBITDA of 27.5x and P/E of 80.9x.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

The state wants to attract USD10bn in fresh investment annually over an unspecified four-year period by opening the door to “private sector participation in state-owned assets,” President said in a televised speech yesterday. (Egyptian presidency)

Only e-invoices will be accepted as proof companies for VAT payment on goods and services starting next July. (MoF)

More than 56% of Egyptian adults — nearly 37mn people — held a bank account, mobile wallet or pre-paid card at the end of 2021, up from almost 53% the year before. (Economy Plus)

Indonesia has clarified that its export ban on palm oil only encompasses processed products like cooking and frying oil, and not crude palm oil. Egypt is one of the largest buyers of palm oil in the world, and Indonesia accounted for almost 90% of our supply in 2020. (Enterprise)

CORPORATE NEWS

Oriental Weavers Carpet’s [ORWE] Nefertari Factory’s investments cost, which contains 22 looms, amount to more than EGP760mn. Most of the factory's production will be directed to export. Accordingly, ORWE is expected to reach sales of EGP11.4bn with EGP6bn to be generated from exports. (Egyptian Cabinet)

Around EGP600bn of proceeds have been collected within the context of the 18% p.a. high-yield one-year CDs offered by state-owned banks, namely National Bank of Egypt and Banque Misr. (Al-Mal)

CI Capital [CICH] shareholders approved dividend distribution of EGP0.25/share, a 7% dividend yield. (Mubasher)

A subsidiary of El Garhy Steel has acquired a majority stake in the National Glass and Steel Co. from Abu Dhabi Islamic Bank-Egypt [ADIB]. Garhy Steel unit El Wehda Industrial Development bought around 13.3mn shares at EGP2.25/share for a total of EGP 30mn. (Enterprise)

The Saudi Seventh Investment Company (SSIC) has purchased another 6.5% of Rameda [RMDA], raising its total stake to 11.01%. (Enterprise)

Etisalat Misr reported revenues of AED1.3bn (c. EGP6.6bn) in Q1 2022, up 15% from the same quarter last year. Top line growth was mainly driven by an increase in subscribers and mobile data and voice revenues. The company’s subscriber base in Egypt grew 6% y/y to reach 28.1mn subscriber. (Enterprise)

GLOBAL NEWS

High food and energy prices are set to stick around for years, the World Bank has warned in its latest commodities report. The war in Ukraine has dealt a major shock to commodity markets, altering global patterns of trade, production, and consumption in ways that will keep prices at historically high levels through the end of 2024. (World Bank)

The dollar stood at its highest level since the early days of the pandemic on Wednesday and was heading for its best month since 2015, supported by the prospect of U.S. rate hikes and on safe-haven flows fanned by slowing growth in China and Europe. (Reuters)

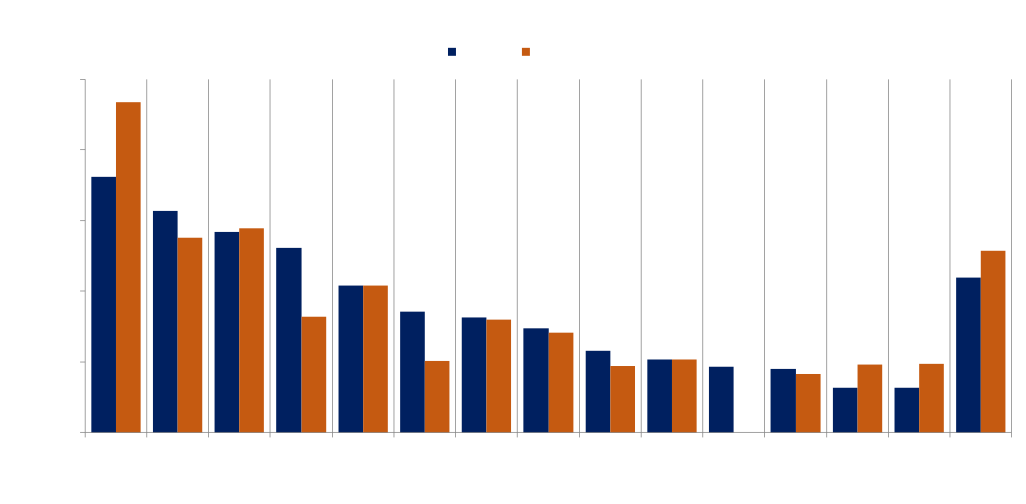

3. Chart of the Day

Abdelkhalek Mohamed | Equity Analyst

aabdelkhalek@egy.primegroup.org

Source: Export Council for Building Materials, Refractories, and Metal Industries reports.

The Egyptian cement industry is starting to recover, where local demand for cement has increased 5% from 12.7mn tons in Q1 2021 to 13.3mn tons in Q1 2022. The slight increase in demand, coupled with the increase in cement prices, should lead to healthy profit margins for cement producers.