Today’s Top News & Analysis

The Qatari Baldna to invest in the dairy sector in Egypt

CBE may receive new USD deposits from UAE and KSA

Egypt plans to attract USD25bn as direct foreign investments

EIPICO denies receiving any new loans for EIPICO III

MACRO

The Qatari Baldna to invest in the dairy sector in Egypt

A cabinet statement said that the SC Authority signed a USD1.5bn agreement with the Qatari-based Baladna to:

· Establish a cattle farm with 20,000 cows.

· Allocating 280,000 acres for feed and other agricultural needs to support the cattle farm.

The project is dedicated to enhancing food security while opening job opportunities and implementing Egypt's plans to reduce the reliance on imports. We note that Baladna is already present in the Egyptian dairy sector through its 15.03% stake in Juhayna Food Industries [JUFO]. (Cabinet)

CBE may receive new USD deposits from UAE and KSA

Sources reported that the Central Bank of Egypt (CBE) may receive USD5bn deposits from the United Arab Emirates and Saudi Arabia. This may be done through renewing deposits due to expire next year. (Al-Borsa)

Egypt plans to attract USD25bn as direct foreign investments

The head of the General Authority for Investment & Free Zones said that Egypt plans to attract USD25bn as direct foreign investments through the next five years. He added that USD12bn of which is expected to be obtained by FY24 end which is 10-15% y/y increase. (Asharq Business)

CORPORATE

EIPICO denies receiving any new loans for EIPICO III

EIPICO [PHAR] said that there are no new loans dedicated to EIPICO III, adding that the project should be worth c.USD100mn which is more than EGP2bn, in addition, it will be opened in 2024. We made a calculation to reach the total investment of EIPICO III as follows reaching USD101-104mn which corresponds with the management's plans:

· Management previously took a USD65mn loan and a USD10mn as credit facilities, which sums up a USD75mn.

· PHAR will invest EGP300-400mn from its sources (equivalent to USD10-13mn).

PHAR already increased its capital by EGP496mn (equivalent to USD16mn), and it was dedicated to EIPICO III. (Company disclosure)

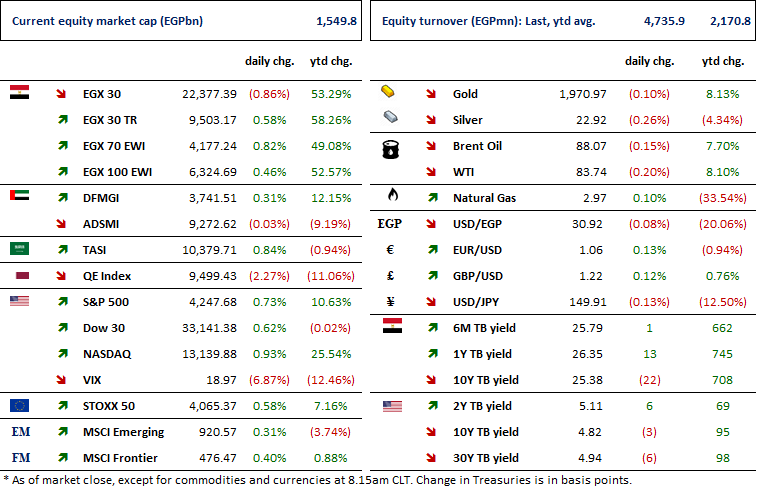

MARKETS PERFORMANCE

Key Dates

25-Oct-23

ORAS: Cash dividend / Ex-dividend date for EGP8.51/Share.

EGAL: OGM / Approving financial statements for 2022/2023.

MCQE: Stock dividend / Last date for eligibility for a 0.33-for-1 stock dividend.

26-Oct-23

MCQE: Stock dividend / Date for distributing a 0.33 for-1 stock dividend.

ABUK: Cash dividend / Payment date for a dividend of EGP2.00/share (1st installment).

MNHD: Cash dividend / Payment date for a dividend of EGP0.075/share (2nd installment).

EAST: Cash dividend / Payment date for a dividend of EGP2.00/share (1st installment).

MICH: Cash dividend / Payment date for a dividend of EGP1.50/share (1st installment).

29-Oct-23

PRCL: OGM / Approving financial statements ending 30 June 2023.

PRCL: EGM / Amending Article No. 3 of the company's bylaws.

31-Oct-23

ORAS: Cash dividend / Payment date for a dividend of EGP8.51/share.

MCRO: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

2-Nov-23

MPC Meeting / Determining the CBE's policy rate.

4-Nov-23

MFPC: EGM / Approving the merger contract & amending some articles of the Company's bylaws.

5-Nov-23

Egypt PMI / October 2023 reading.

EFID: OGM / Approving proposed dividends for 31 Dec. 2022.

AMOC: Cash dividend / Deadline for eligibility for a dividend of EGP0.65/Share.

6-Nov-23

EFIH: Cash dividend / Deadline for eligibility for a dividend of EGP0.177/Share.

7-Nov-23

EFIH: Cash dividend / Ex-dividend date for EGP0.177/Share.

8-Nov-23

AMOC: Cash dividend / Payment date for a dividend of EGP0.45/share (1st installment).

9-Nov-23

EFIH: Cash dividend / Payment date for a dividend of EGP0.177/share

DOMT: OGM / Approving the proposed dividends.