1. Today’s Trading Playbook

KEY THEMES

Abu Qir Fertilizers’ [ABUK] stock price surged notably yesterday. The reason is viewed in light of roaring urea prices once more, after a short correction in prices. We note that we initially predicted that urea prices would start to decelerate as the winter season concludes. However, the recent escalation in the Russia-Ukraine conflict resulted in a series of events that worsened the current scene of global supply in nitrogen fertilizers market. Such events have led urea prices to climb above the USD1,000/ton mark, with Egypt’s urea spot prices settling at USD1,100/ton. This took place after:

(1) Russia decided to suspend exports of fertilizers as many exporters were already struggling to export in view of the wave of economic sanctions placed on the country.

(2) Ukraine announced the suspension of fertilizers exports to maintain local inventory at such critical times.

(3) Norway’s Yara International has announced the suspension of urea production amid elevated natural gas prices.

In view of the above, ABUK is set for a historical fiscal year, with urea prices already averaging USD701/ton so far in 2021/22. ABUK is one of the names we picked at the beginning of the conflict as a beneficiary of higher commodity prices, as the stock lagged most of its peers within the materials universe in 2021, despite depicting superior fundamentals. We also remind you that ABUK is one of the 15 stocks we picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. We have an Overweight rating on ABUK, with a 12MPT of EGP31.0/share (ETR +38%). ABUK is currently traded at 2021/22e P/E of only 4x, with a forward dividend yield of 11%.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Several cargoes totaling 189,000 tons of Ukrainian, Russian and Romanian wheat are on their way to Egypt. According to Supply Minister, Egypt will receive 63,000 tons of wheat from each country in the coming days. (Enterprise)

Some goods imported by companies and organizations for their own use — as opposed to for resale or as raw materials for manufacturing, for example — will be exempted from filing certain customs forms with banks, including letters of credit. (Enterprise)

CORPORATE NEWS

Egyptian Chemical Industries [EGCH] reported H1 2021/22 financial figures recording EGP331mn net profit vs. EGP631mn in net losses a year earlier. Top line grew significantly with +206% reaching EGP2,116mn. Meanwhile, GPM turned to 46% from -7% a year earlier. (Company disclosure)

Raya Holding’s [RAYA] net earnings after minority EGP487mn in 2021 vs. EGP62mn in net losses. Turning to profitability was sponsored by 57% higher revenues to EGP16.8bn. We note that RAYA’s consolidated financials saw income arising from deconsolidation of EGP327mn in 2021. RAYA is currently traded at 2021 P/E of 9x, with ROAE of 36%. Furthermore, RAYA’s subsidiary Aman Holding will be establishing a JV with TAQA Arabia, a subsidiary of Qalaa Holdings [CCAP], to digitize Egypt’s energy sector. The paid capital for the new JV will be EGP20mn, with Aman Holding stake at 51%, whereas TAQA Arabia’s stake at 49% (Company disclosure)

The number of shares that reportedly responded to Macro Group Pharmaceuticals’ [MCRO] IPO stabilization fund have amounted to 10.7mn shares. We note that MCRO’s public offering tranche were amounted to 13.2mn shares. (Mubasher)

The Minister of Petroleum, Tarek El-Molla, has reportedly decided to appoint Abed Abd El-Al as Abu Qir Fertilizers’ [ABUK] new CEO. (Mubasher)

Marseilia Egyptian Gulf Real Estate [MAAL] BoD approved the bonus shares distribution of 10%. (Arab finance)

Misr Insurance Holding has tapped Zaki Hashem & Partners as legal advisors for the process of the IPO related to its subsidiary, Misr Life Insurance, on EGX. (Enterprise)

GLOBAL NEWS

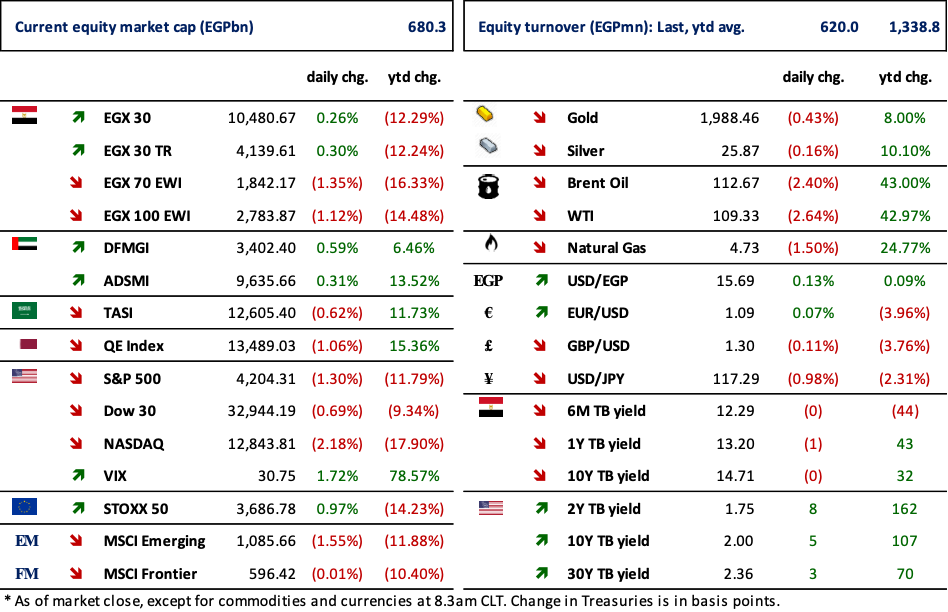

Oil prices slipped notably Monday, extending last week's decline as diplomatic efforts to end the war in Ukraine were stepped up and markets braced for higher U.S. rates.(Reuters)

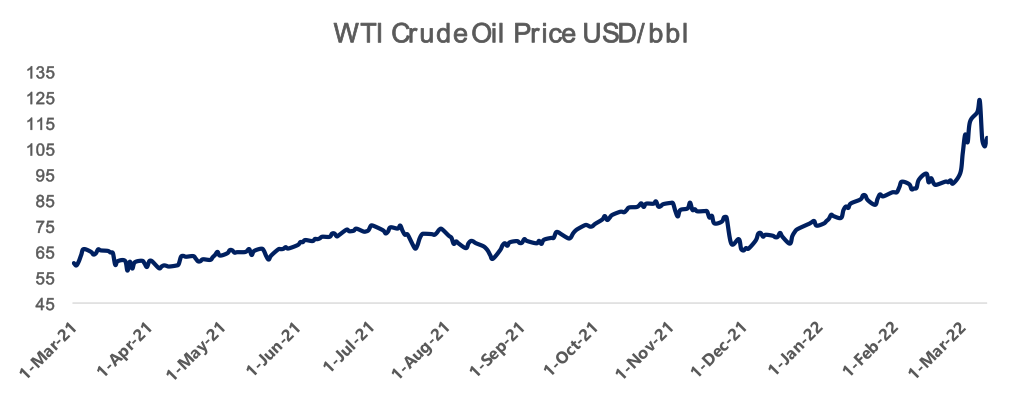

3. Chart of the Day

Research Team

Source: Bloomberg.

The WTI Crude oil price has surged 80% y/y to USD109.33/bbl in light of fears of catastrophic supply concerns.