Today’s Top News & Analysis

Egypt to keep LNG production at around 7.5mn tons

Egyptian Ministry of Agriculture releases amounts of corn and soybeans

CIB’s BoD proposes increasing authorized capital; issuing financial instruments

QNB Al Ahli’s BoD adjusts proposed dividends for 2022

ADIB’s 2022: Higher profitability on safer measures

Abu Qir Fertilizers’ H1 2022/23: Strong on higher urea prices and a weaker EGP

Kima’s preliminary Q2 2022/23: Strong annual growth but weak sequentially

EGYFERT’s 2022: Significantly higher profits, albeit with lower margins

Canal Shipping Agencies’ H1 2022/23: Net income jumps 311% y/y

KABO’s Q2 2022/23: An extraordinary quarter

East Delta Flour Mills’ prelim. Q1 2022/23: Earnings up on higher revenues and wider GPM

A block trade on EFG Hermes Holding's shares

Aman aims to expand inside and outside Egypt

MACRO

Egypt to keep LNG production at around 7.5mn tons

The Minister of Petroleum & Mineral Recourses expects Egypt’s production of liquefied natural gas (LNG) to remain consistent at around 7.5mn tons in 2023. Egypt recorded substantial LNG production levels in 2022, reaching 8mn tons (+14% y/y). Exports of natural gas in 2022 reached USD8.4bn (+140% y/y), driven by higher worldwide natural gas prices. Total production of petroleum products in 2022 reached 79.5mn tons (50.6mn tons of natural gas, 27.8mn tons of crude oil and its derivatives, and 1.1mn tons of butane). (Al-Arabiya)

Egyptian Ministry of Agriculture releases amounts of corn and soybeans

Last week, the Egyptian Ministry of Agriculture released from customs 156,000 tons of corn worth USD56mn and 43,000 tons of soybeans worth USD32mn, in addition to fodder worth USD8mn. (Mubasher)

CORPORATE

CIB’s BoD proposes increasing authorized capital; issuing financial instruments

Commercial International Bank – Egypt’s [COMI] BoD proposed the following:

(1) Doubling the bank’s authorized capital from EGP50bn to EGP100bn.

(2) Issuing financial instruments for no more than USD1bn to fund the bank’s expansion plans.

Both decisions are subject to OGM and CBE approval. (Bank disclosure)

COMI — Rating: OW / M, 12MPT: EGP54.5/share (29-Jan-2023)

QNB Al Ahli’s BoD adjusts proposed dividends for 2022

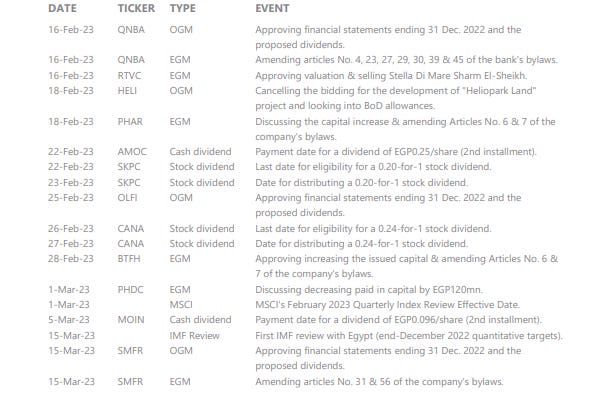

Qatar National Bank Al Ahli’s [QNBA] BoD agreed to cut in half the bank’s proposed cash dividend per share for the year 2022 from EGP1.5/share to EGP0.75/per share, subject to the approval of an OGM scheduled for 16 February 2023. (Company disclosure)

QNBA — Rating: OW / M, 12MPT: EGP19.5/share (7-Dec-2021)

ADIB’s 2022: Higher profitability on safer measures

Abu Dhabi Islamic Bank – Egypt [ADIB] announced its full stand-alone results for 2022. Figures showed the following:

· Net income increased by 54% y/y to EGP2.1bn, in line with our estimates of EGP2bn. This increase was mainly on the back of a 33% y/y increase in net interest income (NII) to EGP4.7bn (exactly in line with our estimates).

· ADIB managed to double its net fees and commission income y/y to EGP1bn, which also helped the bank reduce its cost-to-income ratio to 32% from 44% a year before.

· ADIB booked nearly 4x higher provisions than the year before amounting to EGP800mn, which pushed its cost of risk higher by 1.1pp y/y to -1.45%.

· On balance sheet side, the loan book grew by 17% y/y to EGP59.6bn, with a 1.8pp y/y lower NPL ratio of 2% and a much higher NPL coverage ratio of 229%.

· Deposits went up by 29% y/y, with the GLDR declining to 61% as the bank allocated more funds to interbank assets which reached EGP14.2bn.

· ADIB still has a positive asset repricing gap and a net positive foreign currency position, which makes the bank a beneficiary of both interest rate hikes and EGP devaluation.

· NIM widened to 5%, while ROAE increased to 28% (up from 24% a year before).

· ADIB is currently traded at a P/E of 5.1x and a P/BV of 1.3x. (Bank disclosure)

ADIB — Rating: OW / M, 12MPT: EGP27.4/share (29-Jan-2023)

Abu Qir Fertilizers’ H1 2022/23: Strong on higher urea prices and a weaker EGP

Abu Qir Fertilizers [ABUK] has announced the full financials for H1 2022/23. Below are our main takeaways:

· Higher global urea prices, coupled with EGP devaluation, pushed ABUK’s revenues to jump 80% y/y to EGP11.2bn.

· Although the new gas price formula links it to global urea prices, which should imply a higher price, ABUK still managed to expand its GPM by 2.2pp y/y to 65%.

· Both ABUK’s production and sales volumes exceeded its own guidance for the period by 19% and 11%, respectively. This, along with significantly higher prices, pushed ABUK’s net profits to increase by 126% y/y to EGP7.2bn.

· ABUK booked FX gains in Q2 of EGP1.6bn against EGP24mn a year before.

· Higher interest rates increased interest income to EGP175mn against only EGP19.5mn a year before, while borrowing costs also increased to EGP11.6mn against EGP1.1mn a year before.

· Sequential growth was also strong with net earnings growing by 59% q/q to EGP4.5bn on 34% q/q higher revenues of EGP6.4bn. (Company disclosures: 1, 2)

ABUK — Rating: OW / M, 12MPT: EGP40/share (13-Nov-2022)

Kima’s preliminary Q2 2022/23: Strong annual growth but weak sequentially

Egyptian Chemical Industries (Kima) [EGCH] reported its preliminary results for H1 2022/23.

Kima recorded a bottom line of EGP604mn (+82% y/y) on 33% higher top line of EGP2.8bn. Meanwhile, GPM expanded to 48% (+3 pp y/y). Strong annual growth comes in light of:

(1) Elevated y/y urea prices.

(2) Weaker EGP, which boosts selling prices.

(3) Interest income increased by EGP133mn.

However, sequentially Q2 was very weak, as both revenues and net profit declined q/q by 20% to EGP1.2bn and 72% to EGP133mn, respectively. GPM for Q2 also narrowed significantly from 57% in Q1 to 36%, which we suspect could be due to lower volumes in addition to the sequential decline in global urea prices. (Company disclosure)

EGYFERT’s 2022: Significantly higher profits, albeit with lower margins

Samad Misr (EGYFERT) [SMFR] reported the full results of 2022, where net profits leaped almost 13x y/y to EGP7.5mn in 2022 on the back of a higher top line of EGP264mn (+359% y/y). This was mainly due to higher global urea prices and the EGP devaluation. Still, EGYFERT’s GPM declined from 5.3% in 2021 to 3.7% in 2022. (Company disclosure)

Canal Shipping Agencies’ H1 2022/23: Net income jumps 311% y/y

Canal Shipping Agencies [CSAG] H1 2022/23 results showed net income rising to EGP289.5mn (+311% y/y) on revenues of EGP35.7mn (+2.3% y/y). The increase in bottom line profits is attributable to:

(1) GPM widening by 17.8pp y/y to 35.4%.

(2) Damietta Container Handling Co.’s [DCCC] investment income of EGP114.3mn (+226% y/y).

(3) Port Said container Handling Co. [POCO] investment income of EGP86.3mn (+183% y/y).

(4) FX gains of EGP86.8mn. (Company disclosure)

KABO’s Q2 2022/23: An extraordinary quarter

El Nasr Clothing & Textiles Co.'s [KABO] reported preliminary consolidated net profits after minorities of EGP11mn in Q2 2022/23 vs. EGP1mn a year before. The huge growth in net profit is attributable to:

(1) Revenues growing by 44% y/y to EGP124mn (+33% q/q).

(2) GPM expanding by 5.4pp y/y to 28% (flat q/q). (Company disclosure)

East Delta Flour Mills’ prelim. Q1 2022/23: Earnings up on higher revenues and wider GPM

East Delta Flour Mills [EDFM] reported Q1 2022/23 net profit of EGP56.7mn (+17% y/y) on higher revenues of EGP264.9mn (+18% y/y). Meanwhile, GPM expanded by 2pp y/y to 30%. (Company disclosure)

A block trade on EFG Hermes Holding's shares

In Monday's session, a block trade was executed on EFG Hermes Holding's [HRHO] shares worth EGP1.8bn or 91.9mn shares, at an average price of EGP19.3/share. This was a part of ownership restructuring for HRHO. (Company disclosure)

Aman aims to expand inside and outside Egypt

Aman, a subsidiary of Raya Holding [RAYA], aims to expand its footprint geographically both locally and regionally. (Al-Mal)