Today’s Top News & Analysis

Abu Dhabi Islamic Bank - Egypt — Core Coverage Report

GDP grew by 4.4% y/y in Q1 FY23

A new roadmap for FX management

Car sales continue to drop

Shareholders of Arab Cotton Ginning approved cash dividends

Ibnsina Pharma finishes off its share buyback program

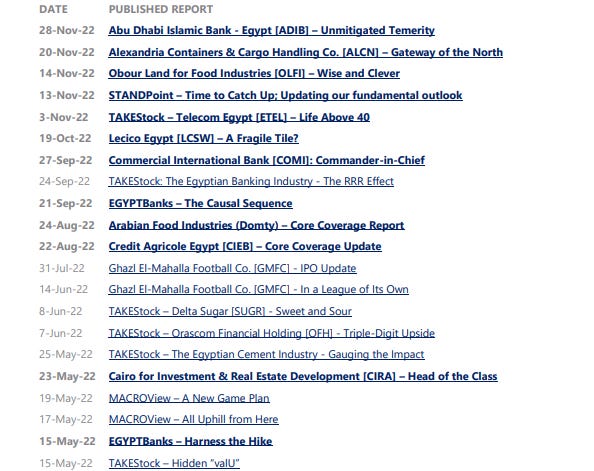

New Research

Abu Dhabi Islamic Bank - Egypt — Core Coverage Report

Unmitigated Temerity: Growth, Profitability, or Both? Reiterated at OW/M

In a fast-moving, rapidly changing, and increasingly competitive banking landscape, Abu Dhabi Islamic Bank - Egypt [ADIB] has been following a strategy of aggressive growth to pave its way to profitability. ADIB managed to solve a radical equation; not only did it restructure its business model with an emphasis on size growth, but it also did not let profitability fall by the wayside in the process. This eventually allows the bank to offer its investors above-average returns. The two questions we try to answer here are: (1) “How risky is this high return?” and (2) “Is this wave of fast-paced profitable growth sustainable?”

Overweight/Medium Risk; 12MPT of EGP22.6/share: Our residual income-based fair value (FV) is EGP28.5/share, assuming a long-term ROE of 17.5% and a terminal COE of 17%. However, we set our 12MPT at EGP22.6/share based on a P/BV of 0.8x, a c.20% discount to 2023e P/BV implied by our FV. Our 12MPT implies a 2022e P/E of 4.5x. As for the announced EGP1bn capital increase, our post-money valuation implies an FV of EGP24.8/share and a 12MPT of EGP20/share. Key catalysts: Strong loan book growth with improving economic conditions. Higher-than-expected earnings growth. Key risks: Deterioration in asset quality. High sensitivity to interest rate unfavorable fluctuations. Slower-than-anticipated earnings growth.

For the full report, please click here.

MACRO

GDP grew by 4.4% y/y in Q1 FY23

The Egyptian economy achieved annual growth rate of 4.4% during Q1 FY23, according to data from Ministry of Planning and Economic Development. Growth came despite continued global headwinds thanks to the pandemic and the war in Ukraine. (Enterprise)

A new roadmap for FX management

The CBE governor met with heads of Egyptian banks to decide upon new FX management strategy. The main takeaways were as follows:

(1) Hotels and tourism facilities are to deposit FX funds in local banks in exchange for funding incentives.

(2) Offering new USD-denominated CDs for Egyptian expats.

(3) Easing USD-depositing regulatory requirements.

(4) Contemplating the use of FX derivatives. (Asharq Business)

Car sales continue to drop

Egypt's car sales have dropped again in October 2022, where passenger vehicles sales decreased by 69% y/y, reaching c.6,100 car. In addition, buses and trucks sales dropped by 43% y/y and 63% y/y, respectively. (Enterprise)

CORPORATE

Shareholders of Arab Cotton Ginning approved cash dividends

Arab Cotton Ginning [ACGC] OGM held on 27 November 2022 approved paying a DPS of EGP0.15/share, implying 5% in dividend yield. (Company disclosure)

Ibnsina Pharma finishes off its share buyback program

Ibnsina Pharma [ISPH] has bought back 2mn shares yesterday. As of now, ISPH has bought back 10% of its total outstanding shares as treasury shares. (Company disclosure)