Today’s Top News & Analysis

Elsewedy Electric – Core Coverage Update

New committee to set fair prices of strategic commodities

Egypt negotiates the launch of a palm oil factory

Egypt's medical and pharmaceutical exports rise in 8M 2022, driven by cosmetics

Elsewedy Electric approves a credit facility agreement with Afrexim Bank

MICH to invest in new evaporation units

Kafr El Zayat Pesticides’ shareholders approve a stock split and a rights issue

Flourish Investment exits Electro Cable Egypt

Arabian Cement to pay cash dividends

AT Lease shareholders approve cash dividends

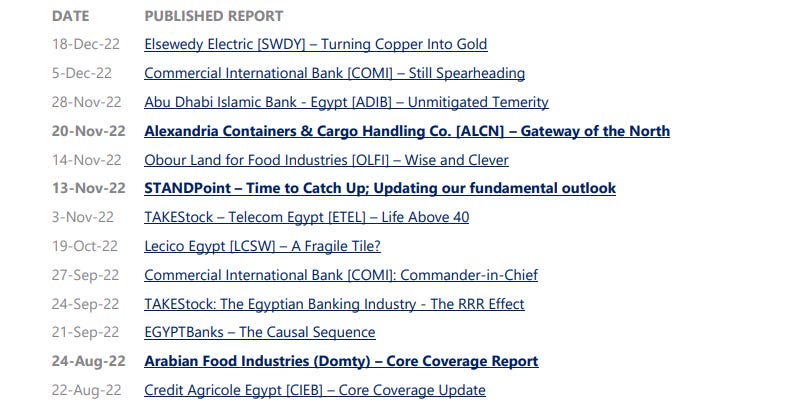

New Research

Elsewedy Electric – Core Coverage Update

Turning Copper Into Gold: A deeply-undervalued industrial leader; OW/M maintained but at a higher 12MPT

In view of higher commodity prices and a weaker EGP, Elsewedy Electric [SWDY] managed to grow its earnings, powered by a robust business model and shrewd management. Sprouting outside Egypt, SWDY was able to expand its business steadily through investments in several countries. This is reflected clearly in its strong results, having generated higher revenues (+53% y/y) and earnings (+35% y/y) in 9M 2022. SWDY currently trades at TTM P/E of 6.1x and EV/EBITDA of 4.6x, which in our view is decoupled from SWDY’s fundamentals. We revisit our financial model for SWDY and revise our estimates upward, reiterating our positive view with a 47% higher 12MPT of EGP21.0/share. Thus, we reiterate our Overweight/Medium Risk rating with a 72% upside.

For the full report, please click here.

Macro

New committee to set fair prices of strategic commodities

The Egyptian Ministry of Supply is setting up a new committee that will be tasked with setting a compulsory fair price for rice, in addition to non-compulsory fair prices for up to 15 other strategic commodities. (Enterprise)

Egypt negotiates the launch of a palm oil factory

Egypt is reportedly negotiating with Malaysia for the potential launch of a palm oil factory with a total investment of USD30mn. The factory will have two stages; the first stage is a warehouse for palm oil storage worth USD10mn, and the second will be a palm oil refinery worth USD20mn. (Mubasher)

Egypt's medical and pharmaceutical exports rise in 8M 2022, driven by cosmetics

In 8M 2022, Egypt’s total medical and pharmaceutical exports jumped 46% y/y to USD632mn, driven mainly by cosmetics which more than doubled to USD410mn (+112% y/y, 65% contribution), followed by medical industries which rose to USD69mn (+11% y/y, 4% contribution). Meanwhile, medicines fell to USD153mn (-14% y/y, -12% contribution). (Mubasher)

CORPORATE

Elsewedy Electric approves a credit facility agreement with Afrexim Bank

Elsewedy Electric [SWDY] and its subsidiary Elsewedy Electric Transmission & Distribution approved a credit facilities agreement from the African Export-Import Bank (Afrexim Bank) with a USD200mn limit. (Company disclosure)

MICH to invest in new evaporation units

Misr Chemical Industries [MICH] is reportedly looking to invest in new evaporation units, which will help upgrade its capacity regarding liquid caustic soda. According to the circulating news, the investment cost is around EGP130mn. (Mubasher)

Kafr El Zayat Pesticides’ shareholders approve a stock split and a rights issue

Kafr El Zayat Pesticides’ [KZPC] shareholders approved a 10-for-1 stock split, increasing the number of shares outstanding to 120mn with a par value of EGP1/share. Also, the shareholders approved increasing the company’s paid-in capital from EGP120mn to EGP180mn through a 50% rights issue at the new par value of EGP1/share plus EGP0.025/share of issuance fees. (Mubasher)

Flourish Investment exits Electro Cable Egypt

Flourish Investment sold its remaining 3% stake in Electro Cable Egypt [ELEC] by selling 107mn shares with an average price of EGP0.475/share. Flourish Investment sold its stake to Elsomow Group (a subsidiary of Aspire Capital Holding [ASPI]) which increased its stake to 13.5%. We note that Flourish Investment lowered its stake in ELEC last week from 9.99% to 3% by selling a total of 248mn shares to Elsomow Group and Alhosn Consultancy (both subsidiaries of ASPI) for EGP0.475/share. (Company disclosures: 1, 2)

Arabian Cement to pay cash dividends

Arabian Cement’s [ARCC] shareholders approved a cash dividend of EGP250mn, equivalent to EGP0.66/share, implying a 10.7% yield. (Company disclosure)

AT Lease shareholders approve cash dividends

AT Lease’s [ATLC] shareholders approved a DPS of EGP0.38/share for 2021/22, implying a 9.5% yield. (Company disclosure)