Today’s Top News & Analysis

NFAs fall further in June 2023

Egypt and Turkey aim to increase trade to USD15bn within five years

Tourism revenues reached USD10.3bn in 9M FY23

Dragon Oil to boost its oil production in Egypt to 70,000 bpd in October

Fertilizers producers deny any negative effect from gas supply cuts

AMOC 2022/23: Q4 net losses mute annual growth

RTVC 2022: Improved net losses but lower revenues

EFID negotiates IFC for a USD45mn loan

MACRO

NFAs fall further in June 2023

Net Foreign Assets (NFAs) for the Egyptian banking system declined for the second consecutive month, yet at a sharper pace, by USD2.7bn to a negative USD27.2bn in June 2023 vs. a negative USD24.5bn in May 2023. (CBE)

Egypt and Turkey aim to increase trade to USD15bn within five years

Egypt and Turkey intend to increase the volume of trade to USD15bn within five years. Currently, the trade volume between the two countries stands at USD10bn. Meanwhile, negotiations will take place soon to explore the possibility of conducting trade using local currencies. (CNBC Arabia)

Tourism revenues reached USD10.3bn in 9M FY23

Egypt’s tourism revenues grew 26% y/y to USD10.3bn in 9M FY23, reflecting a 32% y/y rise in the number of tourists visiting Egypt to the equivalent to 10mn tourists. The number of tourism nights also increased 27% y/y to 110.5mn. (Al-Arabiya)

Dragon Oil to boost its oil production in Egypt to 70,000 bpd in October

Dragon Oil, a fully-owned subsidiary of Emirates National Oil Co. (ENOC), reportedly intends to increase its oil production in Egypt by 27% to 70,000 bpd in October. Meanwhile, Dragon Oil will start production from the North Safa field in the Gulf of Suez within two months. The North Safa field has a capacity of 15,000 bpd and reserves of c.170mn bbl. (Asharq Business)

CORPORATE

Fertilizers producers deny any negative effect from gas supply cuts

Abu Qir Fertilizers [ABUK], Misr Fertilizers Production (MOPCO) [MFPC], and Samad Misr (Egyfert) [SMFR] have all denied any negative effect on their production from the recent cuts in natural gas supplied by the Egyptian government on the recent heat wave. ABUK also added that the gas supply is back to its normal levels as of 1 August 2023. (Companies disclosures: 1, 2, 3)

AMOC 2022/23: Q4 net losses mute annual growth

Alexandria Mineral Oils Co. [AMOC] reported its preliminary consolidated results for 2022/23, recording net profits of EGP1.3bn (+11% y/y) on higher revenues of EGP24bn (+31% y/y) and a GPM of 9% (-5pp y/y). However, AMOC reported net losses of EGP64.5mn in Q4 2022/23 (vs. net profits of EGP408mn in Q3 2022/23 and EGP449mn in Q4 2021/22) with revenues of EGP6.5bn

(-8% q/q, +5% y/y) and a GPM of 7% (-1pp q/q, -12pp y/y). (Company disclosure)

RTVC 2022: Improved net losses but lower revenues

Remco for Touristic Villages [RTVC] reported 2022 consolidated net losses of EGP232mn vs. EGP455mn a year earlier. Revenues dropped by 49% y/y to EGP588mn due to a huge decline in real estate revenues to EGP225mn (-76% y/y). Meanwhile, RTVC recorded a gross loss of EGP17mn vs. a gross profit of EGP294mn last year. (Company disclosure)

EFID negotiates IFC for a USD45mn loan

Edita Food Industries [EFID] negotiates with the International Finance Corporation (IFC) to secure a USD30mn loan and another USD15mn loan that IFC will help EFID obtain. The USD45mn loan will provide EFID with the needed capital needs. (Al-Borsa)

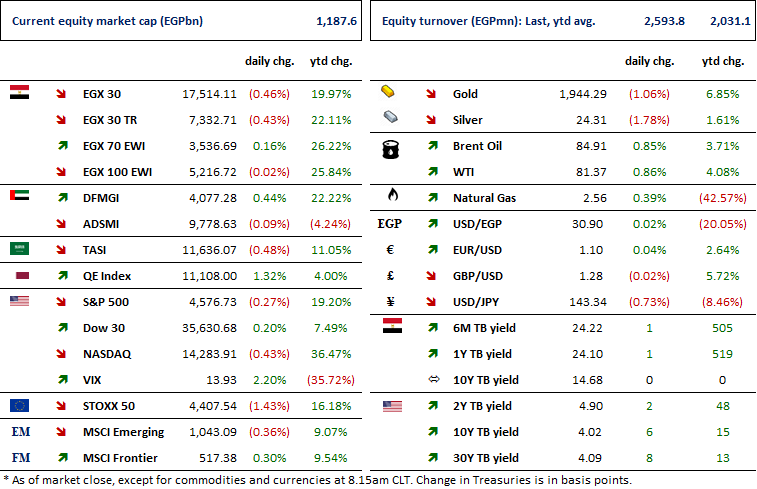

Markets Performance

Key Dates

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

28-Aug-23

ZMID: Cash dividend / Deadline for eligibility for a dividend of EGP0.150/Share.

31-Aug-23

ZMID: Cash dividend / Payment date for a dividend of EGP0.05/share (1st installment).

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).