Today’s Top News & Analysis

Egypt's CDS at an all-time high

EGP10bn worth of new export subsidies

Ten new companies to be added to the IPO program

Subsidized commodity prices going up

Abu Qir Fertilizers and Sidi Kerir Petrochemicals to be added to the IPO program

Banque Misr to launch a digital payment subsidiary

Alexandria Flour Mills to sell unused assets

MACRO

Egypt's CDS at an all-time high

Egypt's five-year credit default swaps (CDS) rose c.390bps in April, while the one-year swaps rose by almost 1,000bps in the same period. Currently, the five-year CDS is trading at a discount to the one-year CDS counterpart, which reflects investors’ worries about short-term default risk. (Enterprise)

EGP10bn worth of new export subsidies

The Ministry of Finance announced the launch of the sixth phase of its export subsidies program, in which it will pay c.EGP10bn worth of overdue export subsidies to companies. We note that there is a new export subsidies program worth EGP28-30bn scheduled for next fiscal year. (Enterprise)

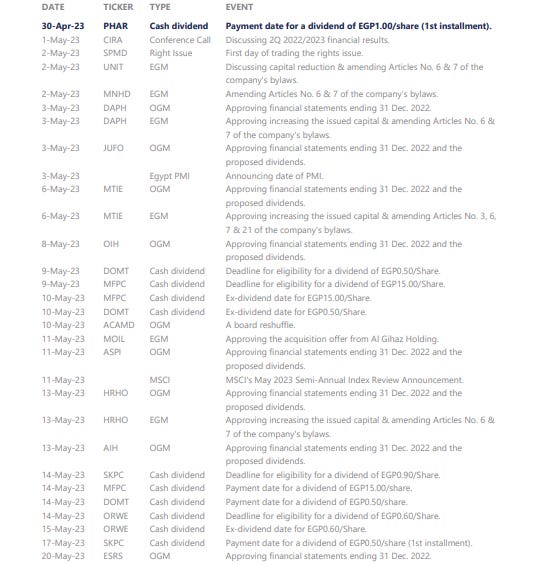

Ten new companies to be added to the IPO program

The Prime Minister said that the government is looking to raise c.USD2bn from the scheduled IPO program before June. Moreover, he also said that The Sovereign Fund of Egypt is currently working to add eight new military-owned companies to the program in addition to Safi and Wataniya. (Al-Borsa)

Subsidized commodity prices going up

The Ministry of Supply is planning to gradually raise commodity prices sold to ration card holders, in efforts to fund and provide those commodities better to the public. (Enterprise)

Corporate

Abu Qir Fertilizers and Sidi Kerir Petrochemicals to be added to the IPO program

The Egyptian government is looking to sell additional stakes in Abu Qir Fertilizers [ABUK] and Sidi Kerir Petrochemicals [SKPC] in its scheduled IPO program. Previously, the government had expressed its intention to sell additional stakes in Telecom Egypt [ETEL] and Export Development Bank of Egypt [EXPA]. (Al-Mal)

Banque Misr to launch a digital payment subsidiary

State-owned Banque Misr is reportedly launching a digital payments subsidiary within the next three months. Banque Misr has a 10% stake in Fawry [FWRY], the country’s largest electronic payment company in terms of number of transactions and POS's. (Asharq Business)

Alexandria Flour Mills to sell unused assets

Alexandria Flour Mills [AFMC] is planning to sell three production lines and 3,600sqm worth of land to capitalize on some of its unused assets, according to sources. Furthermore, AFMC has restarted production in two of its mills in a plan to utilize assets and maximize revenues. (Al-Mal)