Today’s Top News & Analysis

Annual CPI eases in October for the first time in six months

TSFE to finalize the sale of seven hotels by year end

Euroclear requires tax exemptions on Egyptian treasuries for system integration

MASR Q3 2023 prelim.: Strong net profit growth on higher revenues and gross profit margin

POUL Q3 2023: Turning into profitability on higher revenues and other income

Ezz Elsewedy signs an agreement with Egyptian government to assemble cars

Fawry denies any system breach or data leakage

MACRO

Annual CPI eases in October for the first time in six months

The annual headline urban CPI eased to 35.8% y/y in October 2023, from 38% in September 2023. This marks the first easing in six months. (CAPMAS)

TSFE to finalize the sale of seven hotels by year end

The Sovereign Fund of Egypt (TSFE) will finalize the sale of a stake in a group of historic hotels by the end of the year. The portfolio includes seven hotels, among them the Cairo Marriott, Marriott Mena House, the Winter Palace, and the Cecil. (Reuters)

Euroclear requires tax exemptions on Egyptian treasuries for system integration

The European clearing house, Euroclear, has reportedly made it a condition to exempt treasury bills and bonds issued by the Ministry of Finance from taxes to complete the integration with its systems that allow for direct debt settlement. The sources added that Egypt categorically refuses to comply with the demand of the global institution, which has led to the stalling of the agreement, after negotiations resumed last May. Egypt has been seeking for years to link with the institution which facilitates global debt clearing to encourage the entry of foreign investors into government debt. The two parties have already signed a preliminary agreement, but the contract has not been completed yet. (Al-Borsa)

CORPORATE

MASR Q3 2023 prelim.: Strong net profit growth on higher revenues and gross profit margin

Madinet Masr for Housing and Development [MASR] reported its Q3 2023 preliminary results posting a 151% y/y growth in net profits to EGP773.2mn on higher revenues of EGP2.2bn (+85% y/y) and improved gross profit margin of 67.1% (+10.6pp y/y). MASR, recorded its highest contract sales in Q3 2023 at EGP9.6bn (+192% y/y). (Company disclosure)

POUL Q3 2023: Turning into profitability on higher revenues and other income

Cairo Poultry [POUL] turned into profitability, posting net profits of EGP362mn in Q3 2023 vs. net losses of EGP16mn a year earlier. Recording profits was due to:

· Higher revenues of EGP2.96bn (+82% y/y).

· The strong gross profit margin of 34.3% vs. only 15.2% last year.

· Posting other income of EGP68mn (+87% y/y). (Company disclosure: 1, 2)

Ezz Elsewedy signs an agreement with Egyptian government to assemble cars

Ezz Elsewedy Automotive Factories (ESAF), a sister company to Elsewedy Electric [SWDY], has signed an agreement with the Egyptian government to assemble petrol and electric vehicles. ESAF will receive more than USD15mn of investment and aims to assemble 50k Proton-branded petrol cars and EVs annually in the coming years. The firm will offer the vehicles competitive prices in the Egyptian market and export some abroad. (ESAF)

Fawry denies any system breach or data leakage

Fawry [FWRY] has denied in an official statement any system breach or data leaks of any information or banking details of any of the company's clients. (Company disclosure)

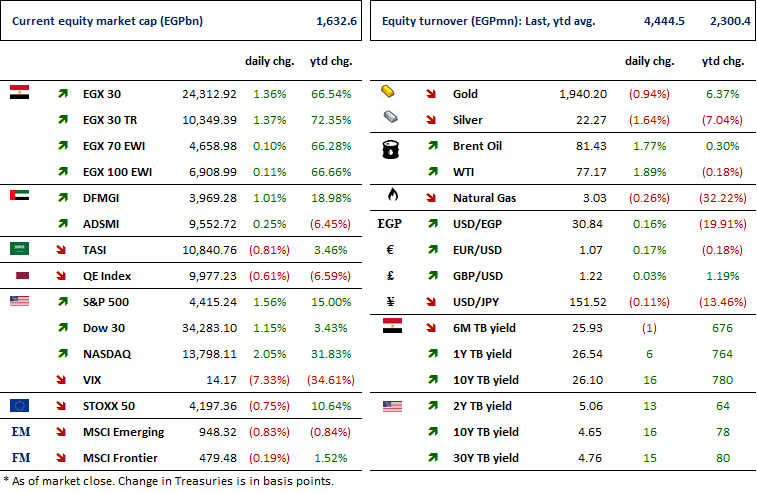

MARKETS PERFORMANCE

Key Dates

12-Nov-23

CIRA: Cash dividend / Payment date for a dividend of EGP0.24/share

EKHO: BoD meeting / Discussing financial results.

14-Nov-23

ISPH: BoD meeting / Discussing financial results.

MSCI: MSCI's November 2023 Semi-Annual Index Review Announcement.

ETEL: Conference Call / Discussing Q3 2023 financial results.

20-Nov-23

EGAL: Cash dividend / Deadline for eligibility for a dividend of EGP6.5/Share.

23-Nov-23

EGAL: Cash dividend / Payment date for a dividend of EGP6.5/share.

CSAG: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

CSAG: EGM / Approving increasing the issued capital & amending Article No. 3 of the company's bylaws.

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

27-Nov-23

ETEL: EGM / Amending Article No. 5 of the company's bylaws.

30-Nov-23

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).