Today’s Top News & Analysis

New drug prices next week

ORWE Q1 2024: The highest gross profit margin ever

ARCC Q1 2024: Net profits decline despite revenue growth

GBCO Q1 2024: Operationally driven net profits

PHDC Q1 2024: Tripled net profits on strong operations

CICH Q1 2024: Strongest quarterly set of results

RAYA Q1 2024: Better net profits growth on better operations and investment income

CSAG 9M 2023/24: Investment income drives the net profits growth

MACRO

New drug prices next week

Sources said that around 200 drugs will be subject to price increases between 5-20% next week. In addition, the price increases will include around 1,500 drugs over a 12-month horizon. (Enterprise)

CORPORATE

ORWE Q1 2024: The highest gross profit margin ever

Oriental Weavers [ORWE] posted a 4% y/y growth in net profits to EGP427mn in Q1 2024. However, clean earnings that exclude one-offs such as the China facility sale in Q1 2023, would have grown significantly by 341% y/y. Growth in normalized earnings is backed by:

· Higher revenues of EGP5bn (+22% y/y) driven by higher average selling prices, volume recovery, and the impact of EGP devaluation.

· The highest gross profit margin of 19% (+6pp y/y) as the rise in average selling prices, outpaced the increase in raw material costs in EGP terms.

Meanwhile, management expects the gross profit margin to normalize throughout 2024.

Results imply a TTM P/E of 7.5x. (Company disclosure)

ARCC Q1 2024: Net profits decline despite revenue growth

Arabian Cement [ARCC] posted a 37% y/y decline in net profits to EGP153mn in Q1 2024 despite a 13% y/y growth in revenues to EGP1.9bn and the net interest expenses decreasing to EGP12mn (-22% y/y).

The decline in net profits is mainly attributable to a 134% y/y increase in FX translations to EGP244mn, in addition to:

· The flat gross profit margin of 27% (+0.1pp y/y).

· Higher SG&A-to-revenues ratio at 2.8% (-0.5pp y/y).

Results imply a TTM P/E of 6.5x. (Company disclosure)

GBCO Q1 2024: Operationally driven net profits

GB Corp [GBCO] posted a 542% y/y growth in net profits to EGP667mn on:

· Higher revenues of EGP9bn (+90% y/y).

· Better gross profit margin of 29% (+6pp y/y).

GB Auto posted a 332% y/y growth in net profits to EGP406mn on higher revenues of EGP7.7bn (+98% y/y) and a 30% gross profit margin (+7pp y/y). (Company disclosure)

PHDC Q1 2024: Tripled net profits on strong operations

Palm Hills Development [PHDC] posted a 297% y/y growth in net profits to EGP1bn on:

· Higher revenues of EGP6.2bn (+77% y/y).

· Better gross profit margin of 38% (+5pp y/y).

· Improved SG&A-to-revenues ratio of 10% (+3pp y/y).

· Higher net interest income of EGP396mn (+8% y/y).

Results imply a TTM P/E of 4.7x. (Company disclosure)

CICH Q1 2024: Strongest quarterly set of results

CI Capital [CICH] posted 194% y/y increase in net profit after tax & minority interest to EGP939mn in Q1 2024. Revenues increased 89% y/y to EGP2.9bn thanks to growth across all verticals in addition to solid treasury and liquidity management. (Company disclosure)

RAYA Q1 2024: Better net profits growth on better operations and investment income

Raya Holding for Financial Investments [RAYA] posted a 131% y/y growth in net profits to EGP331mn due to:

· Higher revenues of EGP10bn (+59% y/y).

· Better SG&A-to-revenues ratio of 11% (+2pp y/y).

· Higher investment income of EGP54mn (+108% y/y).

However, the gross profit margin came in flat at 21% (-0.1pp y/y).

Results imply a TTM P/E of 12.6x. (Company disclosure)

CSAG 9M 2023/24: Investment income drives the net profits growth

Canal Shipping Agencies [CSAG] posted a 163% y/y growth in net profits to EGP571mn on:

· Higher revenues of EGP77mn (32% y/y).

· Better gross profit margin of 44% (+2pp y/y).

· A 172% y/y growth in investment income to EGP547mn.

Results imply a TTM P/E of 7.6x. (Company disclosure)

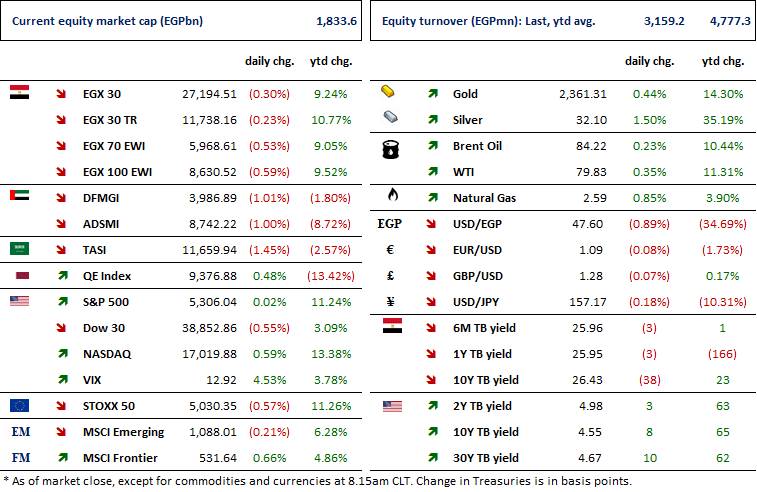

MARKETS PERFORMANCE

Key Dates

29-May-24

SKPC: Cash dividend / Payment date for a dividend of EGP0.75/Share (1st installment)

CICH: Cash dividend / Payment date for a dividend of EGP0.2169/Share.

AMIA: Stock dividend / Last date for eligibility for a 0.10-for-1 stock dividend.

SWDY: Cash dividend / Payment date for a dividend of EGP0.50/Share.

30-May-24

MASR: Cash dividend / Payment date for a dividend of EGP0.10/Share (1st installment)

AMIA: Stock dividend / Date for distributing a 0.10 for-1 stock dividend.

CCAP: OGM / Discussing agenda items.

TMGH: Cash dividend / Payment date for a dividend of EGP0.11/Share (1st installment)

ZMID: Cash dividend / Payment date for a dividend of EGP0.05/Share (1st installment)

ETEL: Earnings Announcement / Announcing Q1 2024 financial results.

2-Jun-24

CSAG: OGM / Approving the estimated budget of FY 2024/2025.

DSCW: Cash dividend / Deadline for eligibility for a dividend of EGP0.167/Share.

3-Jun-24

MSCI / MSCI's May 2024 Semi-Annual Index Review Effective Date.

4-Jun-24

Egypt PMI / May 2024 reading.

5-Jun-24

DSCW: Cash dividend / Payment date for a dividend of EGP0.167/Share.

6-Jun-24

ALCN: OGM / Approving the use of Corporate reserve shown in the audited financial statements.

ALCN: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

8-Jun-24

ESRS: OGM / Approving financial statements ending 31 Dec. 2023 and netting contracts.

ESRS: EGM / Discussing capital reduction.

9-Jun-24

BINV: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

BINV: EGM / Amending Article No. 19 of the company's bylaws.

CCAP: OGM / Approving financial statements ending 31 Dec. 2023.

10-Jun-24

HELI: Cash dividend / Deadline for eligibility for a dividend of EGP1.34/Share.

12-Jun-24

EGCH: EGM / Amending Article No. 4 of the company's bylaws.

IDHC: EGM / Amending Article No. 3 of the company's bylaws.

13-Jun-24

HELI: Cash dividend / Payment date for a dividend of EGP1.34/Share.

23-Jun-24

EGTS: OGM / Approving financial statements ending 31 Dec. 2023.