Today’s Trading Playbook

KEY THEMES

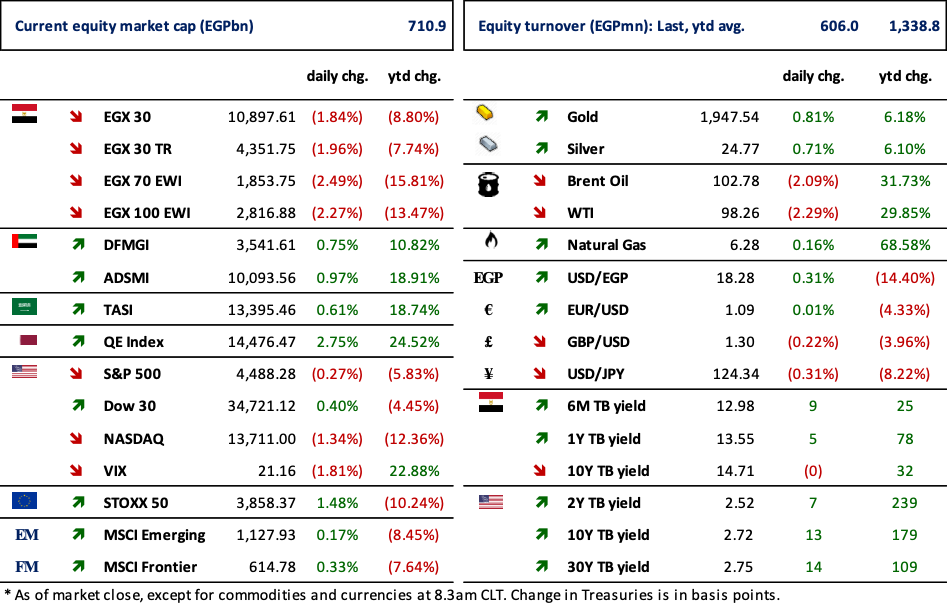

Global shares went down in its first trading day of the week, dragged by ongoing anticipation of the ECB decision this Thursday regarding its monetary stance. While bond yields continued to climb, the euro strengthened marginally on relief that the far right did not win the first round of French presidential elections. Elsewhere, oil prices slipped in light of plans to release volumes of crude from strategic reserves, while with ongoing COVID-19 lockdowns in China continue.

Here at home, the EGX30 dropped notably for the fifth session in a row, weighed down by the recently announced economic data related to inflation and international reserves. The inflation readings represent the first double digit reading since May 2019.

Annual urban headline inflation accelerated to +10.5% y/y in March from +8.8% y/y in February 2022, owing to a cocktail of an unfavorable base-year effect, demand seasonality induced by Ramadan, and the effect of higher global commodity prices—primarily food. Meanwhile, monthly inflation increased to +2.2% m/m, the highest level since December 2018. This was owing to a 4% monthly increase in food costs and a 1.5% monthly increase in non-food inflation. We believe that another 200-300bps is still expected, and the CBE’s inflation target may be revised upward. The CBE will have two inflation readings for March and April at its next meeting on 19 May. Both are on track to exceed the upper end of the current CBE target; we project April inflation to be between 10.6-11%, implying that another 100bps rate hike could be in the cards. For more details, check out our MACROView note from yesterday.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Annual core inflation rose to 10.1% from 7.2% in February, the highest since June 2019.Monthly core CPI inflation, also rose to 3.1% in March compared to 1.2% in February 2022. (CBE)

The EU is looking to up its imports of liquefied natural gas (LNG) from Egypt in the short term — and contribute to building a local green hydrogen production facility in the long term. (Cabinet statement)

The Ministry of Finance is currently negotiating with shipping agents to pay the local trading expenses for shipments in EGP instead of USD. (Economy Plus)

CORPORATE NEWS

Alexandria Flour Mills [AFMC] expects net income of EGP20mn and revenues of EGP218.8 in 2022/23, as per the budget approved by its board on 21 March 2022. On the revenues side, this compares to estimated revenues of EGP202.1 mn in 2021/22 and reported revenues of EGP185.5mn in 2020/21. On the net income side, this compares to a targeted EGP8mn in 2021/22 and an actual EGP18.1mn in 2020/21. (Company disclosure)

Alexandria Pharmaceuticals and Chemical Industries [AXPH] reported a 25% decrease in bottom line of EGP71.25mn during 8M 21/22. (Mubasher)

Rakta Paper Manufacturing achieved net earnings of EGP388mn during 8M 2021/22 vs. net losses of EGP46mn a year earlier. (Company disclosure)

Cleopatra Hospitals [CLHO] bought back 854,000 of treasury shares during last Thursday’s session. (Company disclosure)

Raya Holding [RAYA] bought back 1.1mn of treasury shares during last Thursday’s session. (Mubasher)

GLOBAL NEWS

An aggressive Federal Reserve, soaring inflation and geopolitical uncertainty from the war in Ukraine are muddying the outlook for the upcoming U.S. earnings season, leaving some strategists wary of surprises as corporate results kick off this week. (Reuters)

Russia will take legal action if the West tries to force it to default on its sovereign debt, Finance Minister told the pro-Kremlin Izvestia newspaper on Monday, sharpening Moscow's tone in its financial wrestle with the West. (Reuters)

China's producer prices and consumer prices rose faster than expected in March as Russia's invasion of Ukraine, persistent supply chain bottlenecks and production snags caused by local COVID-19 flare-ups added to commodity cost pressures. (Reuters)

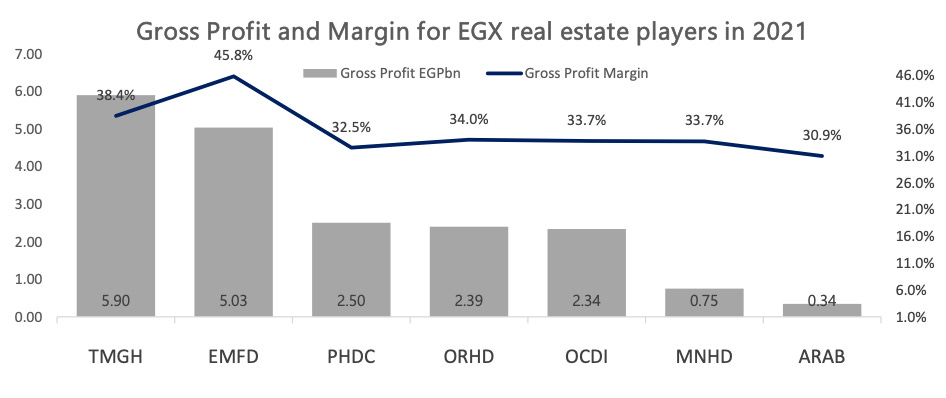

3. Chart of the Day

Hossain Zaman | Equity Analyst

Source: Companies disclosure, Prime Research.

Emaar Misr for Development [EMFD] achieved the highest gross profit margin compared to its peers in 2021.