Today’s Top News & Analysis

Summary of the Cabinet press conference held yesterday

EZDK’s BoD approves de-listing from EGX

Western Desert Gas Complex gets major upgrades

BTFH’s EGP10bn capital increase 95.5% subscribed

MACRO

Summary of the Cabinet press conference held yesterday

The Egyptian Cabinet held a press conference yesterday discussing the government’s offerings program and highlighting the latest macro KPIs for FY23. Here are our key takeaways:

Regarding the offerings program, The Sovereign Fund of Egypt (TSFE) successfully sold stakes in several companies worth a total of USD1.9bn, almost hitting the USD2bn target, of which USD1.65bn will be in USD. Another USD1bn will be announced in upcoming deals. The done deal list is as follows:

· A USD700mn by Icon Group, which is owned by TMG Holding [TMGH], for a 37% stake through a capital increase of a group of hotels.

· The sale of 25-30% stakes in ELAB, ETHYDCO, and Egyptian Drilling Company, worth a total of USD800mn by Abu Dhabi Holding (ADQ).

· The exit of some public-sector shareholders from Al-Ezz Dekheila Steel Co. (EZDK) [IRAX] by selling a 31% stake in the company or the equivalent of USD241mn, 60% of which will be in USD and the remaining 40% in EGP.

As for the upcoming offerings, they are as follows:

· Gabal El-Zeit Wind Farm sale to be finalized by October 2023 for USD300mn.

· The sale of National Petroleum Co. (Wataniya) to be finalized by October 2023.

· The government is also looking to offer 21 water desalination plants with a total capacity of 3.3mn cubic meters for a total investment of more than USD3bn.

Meanwhile, the Ministers of Planning & Finance announced some macro KPIs for FY23, with the following key takeaways:

· Total state revenues came at EGP1,501bn (+11.5% y/y), including EGP1,211bn in tax revenues (+22% y/y).

· Total expenditures recorded EGP2,130bn (+16.3% y/y).

· The primary surplus recorded EGP157bn (+57% y/y).

· Total budget deficit recorded EGP618bn (6.2% of GDP vs. 6.1% the year before).

· The government is targeting a debt to GDP ratio of 75-80% during the next 4-5 years.

· The government is also targeting a credit line worth USD3bn until the end of the year.

The government also announced several incentives for investors, including incentives for green hydrogen investments, a 3-year tax exemption for 20 industrial sectors from real estate taxes, and more facilities to acquire the golden license, among other incentives. (Cabinet)

CORPORATE

EZDK’s BoD approves de-listing from EGX

Al-Ezz Dekheila Steel Co.’s (EZDK) [IRAX] BoD, in response to certain shareholders' desire to divest from the company including the Egyptian government, approved to voluntarily de-list from the EGX. EZDK will acquire shares from shareholders seeking to exit, thus violating the EGX listing rules and hence the delisting decision. Following the de-listing procedures, shareholders will have the option to sell their shares for EGP1,250/share (a 53% premium to Monday’s closing price) or keep them. EZDK will finance 60% of the government's exit, worth USD144.6mn, with the help of a long-term USD125mn loan from Emirates NBD (reportedly), with the remaining paid in EGP. The acquisition will cost EGP8.75bn if all the company's shares are bought out. The EGP1,250-a-share puts the company’s valuation at EGP24.4bn, which implies an LTM P/E ratio of 8.6x and an LTM EV/EBITDA of 2.2x compared to 5.6x and 1.7x, respectively, based on Monday’s closing price. (Company disclosure, Asharq Business)

Western Desert Gas Complex gets major upgrades

The Minister of Petroleum & Mineral Resources inaugurated the first phase of the connection project between the Raven gas field, located north of Alexandria, and the GASCO-operated Western Desert Gas Complex in Alexandria. This connection will increase and help ensure a steady supply of natural gas as it will supplement the complex’s main supply from the Western Desert fields. Furthermore, Enppi and Petrojet are currently implementing an expansion project in the Western Desert Gas Complex (Train-D), which will increase the complex’s production capacity and maximize the benefit from the increased supply of natural gas. The complex processes natural gas to produce higher valued derivatives such as the ethane/propane (E/P) mixture, the main feedstock of Sidi Kerir Petrochemicals (Sidpec) [SKPC] and the Egyptian Ethylene Production Co. (ETHYDCO). The increased production capacity will help ensure a steady flow of the feedstock and alleviate E/P supply shortage fears. (Ministry Statement)

BTFH’s EGP10bn capital increase 95.5% subscribed

Shareholders of Beltone Financial Holding [BTFH] have reportedly subscribed to 95.5% of its EGP10bn capital increase. (Al-Mal)

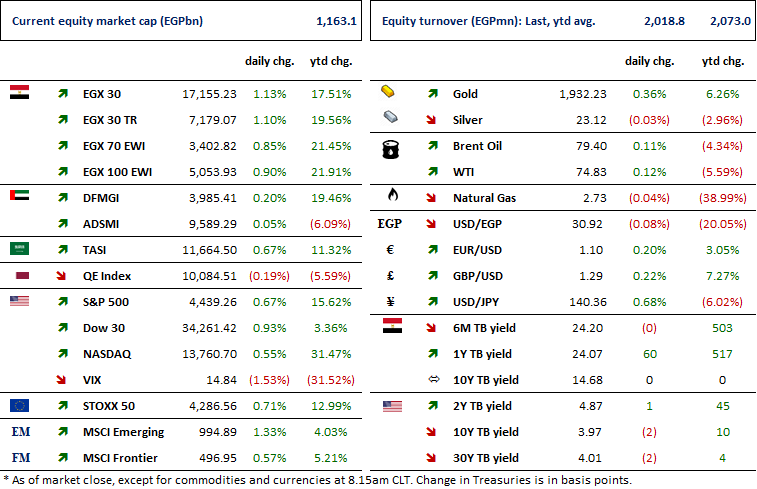

Markets Performance

Key Dates

12-Jul-23

OCDI: OGM / Discussing netting contracts.

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

19-Jul-23

PACH: OGM / Board election.

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.