Today’s Top News & Analysis

Egyptian abroad car import initiative could yield USD2.5bn

The government settles disputes with international firms amid efforts to attract more FDI

One Finance integrates its services into the Egyptian market

FAIT reports preliminary results for Q3 2022

Macro Group plans to acquire a new production line

CIRA’s 2022/23 enrollments reached c.48,000 students so far in 2022/23

Orascom Construction adds USD670mn of new awards during Q3 2022

Maridive receives a tender offer to acquire one of its subsidiaries

MACRO

Egyptian abroad car import initiative could yield USD2.5bn

The new cabinet initiative which will allow Egyptians abroad to import a new car while getting get a full rebate on all customs fees and taxes, is expected to yield USD2.5bn. (Enterprise)

The government settles disputes with international firms amid efforts to attract more FDI

The state has settled disputes with international companies including Dutch Future Pipe and Italy’s Maire Tecnimont, as it looks to improve the investment environment and attract more foreign inflows. (Enterprise)

One Finance integrates its services into the Egyptian market

One Finance launches its integrated services in the Egyptian market with a paid capital of EGP100mn.The company targets to contribute 13% of the consumer finance market share in 2026. (Company disclosure)

CORPORATE

FAIT reports preliminary results for Q3 2022

Faisal Islamic Bank of Egypt [FAIT] reported its Q3 2022 preliminary results. Below are our key takeaways so far:

• The bank managed to improve its net interest income (NII) by 9% q/q to EGP1bn though is still 22% lower y/y due to a higher interest cost.

• The bottom line decreased 2% q/q to EGP547mn in Q3 2022, which we think might be attributed to booked provisions against a reversal of EGP155mn in Q2 2022. Net earnings also decreased 18% y/y as the y/y decrease in NII filtered through.

• However, overall earnings grew at a satisfactory 36% to EGP2.3bn in 9M 2022. This comes on the back of the exceptional FX gains of EGP743mn recorded in Q1 2022. Adjusting for FX gains with the tax effect taken into consideration, 9M 2022 earnings were virtually flat y/y at EGP1.7bn (-0.5% y/y).

• NII decreased 15% y/y in 9M 2022 despite recent rate hikes, which we think could be due to the significant increase in cost of funding (CoF) that ate up the slower increase in yield.

With an annualized ROE of 17%, FAIT is now traded at an annualized P/E of 2.6x and a P/BV of 0.5x. (Company disclosure)

Macro Group plans to acquire a new production line

Macro Group Pharmaceuticals [MCRO] is planning to acquire a new production line in 2023. (Company disclosure)

CIRA’s 2022/23 enrollments reached c.48,000 students so far in 2022/23

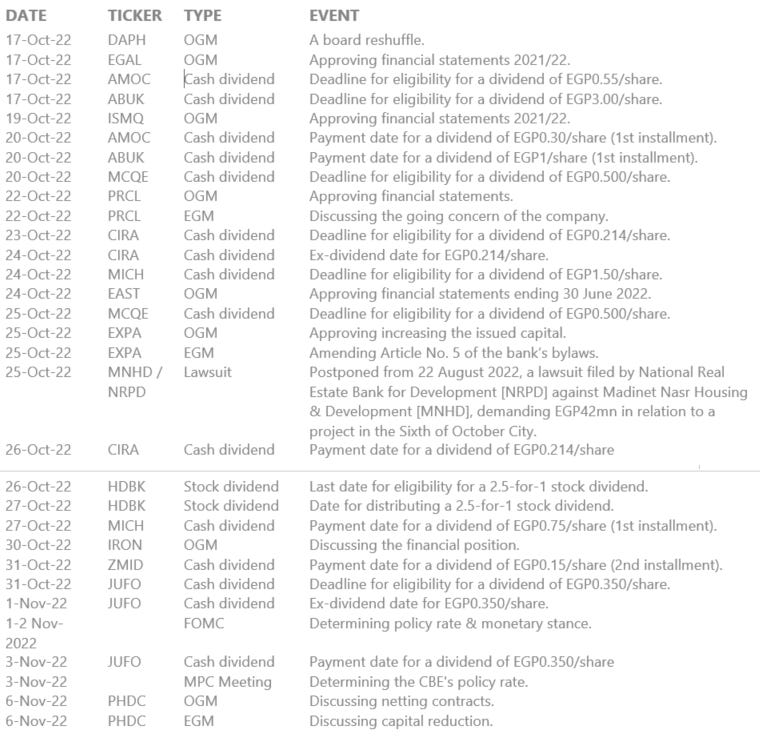

Cairo For Investment & Real Estate Development [CIRA] enrolled k-12 students so far for 2022/23 reached c.32,200 vs c.30,500 students last year. Regarding higher-ed enrolments, CIRA’s students reached c.16,000 vs c.14,000 in 2021/22. CIRA today has 23 faculties compared to 16 faculties last year as BUA is now operating with 7 new faculties. In addition, CIRA opened a new school in Quena under the brand name of Future, bringing the total number of CIRA's schools up from 24 to 25 this year. (Company disclosure)

Orascom Construction adds USD670mn of new awards during Q3 2022

Orascom Construction [ORAS] new awards reached USD670mn during Q3 2022, bringing total new awards during 9M to USD3.1bn and total backlog to USD6.1bn. Egypt's contribution came in at 70% of the new awards, while contribution from the US contributed the remaining 30%. (Company disclosure)

Maridive receives a tender offer to acquire one of its subsidiaries

Maridive and Oil Services [MOIL] received a tender offer to acquire a 100% stake in its subsidiary, Valentine Maritime, from Ancla Marine Ship Management. (Al-Mal)