Today’s Trading Playbook

Amr Hussein Elalfy CFA | Head of Research

KEY THEMES

One of the measures used to gauge investor sentiment in the market is the number of IPOs. In 2020, we only saw one IPO. Before end of February 2020, we saw an IPO by Emerald for Real Estate Investment [EMRI], a small-cap real estate operator, just before the onset of the COVID-19 crisis in Egypt and the world. Basically, this left investors with the same investment opportunity set they started the year with. We understand there are just more than a handful of listings planned for 2021, including:

1. E-Finance, a state-owned e-payment processor (IPO).

2. Taaleem, an education management arm partly owned by CI Capital Holding [CICH] (IPO).

3. Ebtikar, a non-banking financial services firm owned by MTIE and B Investments [BINV] or one or more of its subsidiaries (IPO).

4. Banque du Caire, a state-owned bank, of which IPO has been repeatedly shelved due to market conditions (IPO).

5. Galina Holding, an agrifood company (IPO).

6. Emerald Development & Projects Management (IPO on Nilex).

7. Integrated Diagnostics Holding [LSE: IDHC] (dual listing).

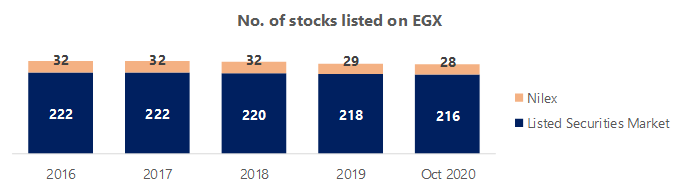

Until market sentiment improves and the impact of the second wave of COVID-19 is figured out, we could see the number of listed stocks increase some other way. There are currently 244 stocks listed on the EGX, 216 of which on the listed securities market and 28 on Nilex, the small-cap exchange. The number of stocks may increase on account of potential spinoffs that we alluded to on Sunday. On Monday, Egyptian Iron & Steel [IRON] confirmed its intention to spin off its mining and quarrying activities in a separate company, which could unlock the hidden value in the company, be it in the new spinoff company or its parent company which we understand owns a huge land bank that exceeds 3mn sqm. So, until investor sentiment improves to pave the way for more IPOs, we could see the number of listed stocks increase by at least five over the next few months by way of spinoffs.

Source: EGX.