Today’s Trading Playbook

KEY THEMES

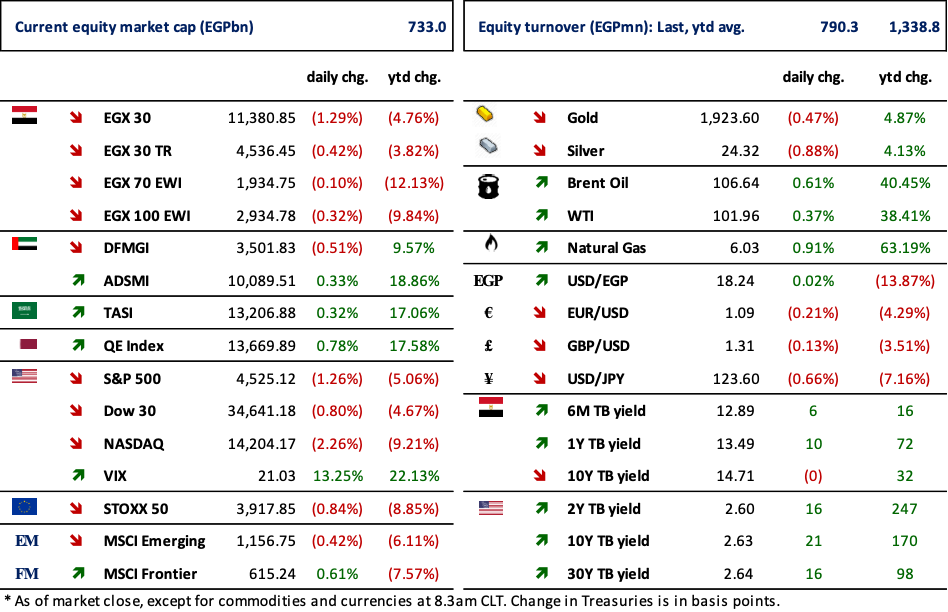

U.S equities slipped yesterday, with similar declines over Asian indices in view of anticipation of more hawkish Fed than previously expected. As a result, the U.S. dollar strengthened, while bond yield strengthened. Meanwhile, oil is marginally up, in anticipation of another fresh U.S sanctions to be placed over the Russian economy.

Here at home, the EGX30 slipped notably yesterday, mainly due to declines endured by Commercial International Bank [COMI] as the stock slipped c.3% on Tuesday, being an ex-dividends day, with a DPS of EGP1.35/share. The EGX30 is now traded at 2023e P/E of only 5.9x, implying an earnings yield of 17%. The bank is about to announce strong set of results in Q1 2022, where we expect annual earnings growth to be around 20%. COMI is currently traded at 2021 P/E of only 7x, which is far away its historical averages. We note that COMI is one of the 15 stocks we had picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. We have an Overweight rating on COMI, with a 12MPT of EGP72.0/share (ETR +55%).

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Minister of Public Business Sector, said that next week will witness the signing of a MoU between the Nasr Automobile Company and a Chinese company, in the field of electric cars, after an agreement with the German company, FEV, specialized in the field of car development consultancy. (Economy Plus)

The Egyptian export council for building materials has announced that Egypt exports of building materials have increased 29% in the first two months of the year compared to the same time last year to reach USD1.19bn compared to USD926mn. (Mubasher)

Egypt saw a rise in imports of the grain from Russia in March despite supply and payment disruptions following its invasion of Ukraine that also drove traders to seek shipments from other suppliers. Egypt received 479,195 tons of wheat from Russia in March 2022, 24% up from the same month last year. (Reuters)

CORPORATE NEWS

Rated Egyptian banks have little direct exposure to Russian and Ukrainian assets, according to an S&P Global Ratings report. (Enterprise)

Arabian Food Industries (Domty) [DOMT] BoD agreed to let Expedition Investments start their due diligence. (Company disclosure)

Heliopolis Housing & Development [HELI] is currently studying number of received bids for leasing the Show Land and Children Park at Merryland Park. (Arab finance)

Misr Beni-Suef Cement [MBSC] has bought back 41,300 shares in yesterday's trading session. (Al-Borsa)

GLOBAL NEWS

Saudi Arabia, the world's top oil exporter, raised crude prices for all regions, with those to Asia hitting all-time highs as disruption in Russian supplies support prices. (Reuters)

Global sovereign borrowing will reach USD10.4tn in 2022, nearly a third above the average before the coronavirus pandemic, S&P Global Ratings said in a report. Egypt is set to overtake Turkey as the region's largest issuer of sovereign debt, with USD73bn worth of bond sales, S&P analysts forecast. (Reuters)

Federal Reserve Governor Lael Brainard on Tuesday said she expects a combination of interest rate increases and a rapid balance sheet runoff to bring U.S. monetary policy to a "more neutral position" later this year, with further tightening to follow as needed. (Reuters)

Soaring global energy and food prices mean almost 60% of developed economies now have y/y inflation above 5%, the largest share since the late 1980s, while it is over 7% in more than half of the developing world. (Reuters)

3. Chart of the Day

Nouran Ahmed | Equity Analyst

Source: Fitch Solutions.

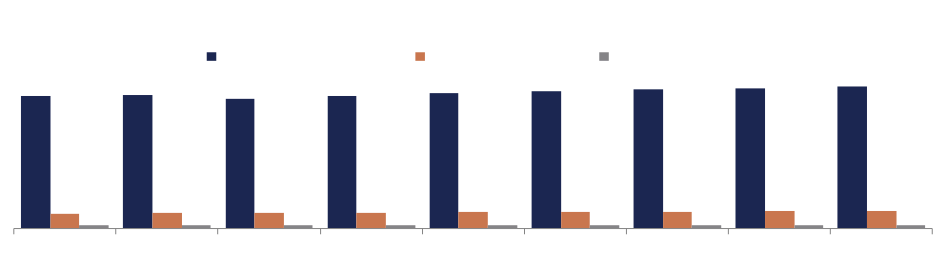

According to Fitch Solutions, Egypt's cheese consumption is expected to grow at a 4-year CAGR (2022-2026) of 2.05%, compared to 1.22% for liquid milk and 0.89% for butter over the same time horizon.