Today’s Top News & Analysis

TAKEStock: ETEL - Life Above 40; More about the underlying business, not just a stake sale

Egypt's net foreign reserves inch higher

Egypt PMI still below the 50 mark

CIB announces record-breaking Q3 2022 results

MNHD reports Q3 2022 results

PACHIN received its third acquisition offer for 100% of the company

e-finance establishes an electronic industrial platform

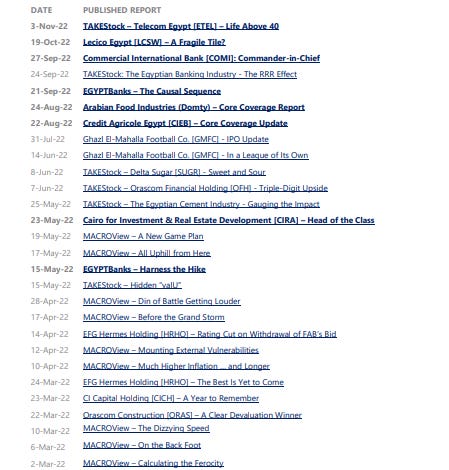

NEW RESEARCH

TAKEStock: ETEL - Life Above 40; More about the underlying business, not just a stake sale

Last Thursday, we published another edition of our TAKEStock series, where we raised our price target for Telecom Egypt [ETEL] from EGP28.1/share to EGP46.7/share. For more details, please read the full note.

MACRO

Egypt's net foreign reserves inch higher

Egypt’s net foreign reserves inched up to USD33.41bn in October 2022, up from USD33.20bn in September. This is down 18% ytd and y/y. (CBE)

Egypt PMI still below the 50 mark

Egypt’s PMI index registered 47.7 in October, climbing just 0.1 points from September and remaining firmly before the 50.0 threshold that separates growth from contraction. (PMI)

CORPORATE

CIB announces record-breaking Q3 2022 results

Commercial International Bank (CIB) [COMI] reported Q3 2022 results, where it reached the highest quarterly earnings of all time of EGP4.4bn (+25% q/q, +16% y/y), breaking its previous record of EGP4.2bn in Q1 2022. Only this time the record earnings are remarkably all from core banking activities with no non-recurring items.

· Higher interest rates pushed COMI's net interest income (NII) to hit a new record of EGP8bn, surging 13% q/q and 25% y/y.

· The leap in interest income is justified by the strong growth in the bank's loan book reaching EGP198bn (+4% q/q, +21% ytd). We note that this growth was mostly organic not just induced by the EGP depreciation as EGP-denominated loans represented 88% of growth.

· High sovereign yield also boosted net income, as FI-OCI reached EGP230mn (+7% q/q, +20% ytd), contributing to total assets growth to EGP590bn (+13% q/q, +19% ytd). However, this strong growth did not affect COMI's trademark asset quality, as the NPL ratio stood at 4.6% and coverage ratio at 216%.

· The bank chose to book relatively higher provisions of EGP248mn for the first time this year, given the increasing volatility, yet 9M 2022 provisions (i.e. EGP263mn) are still 80% lower y/y. This brings COMI's annualized cost of risk for 9M 2022 to -0.2%, with no other expected reversal for the rest of the year.

· While the bank recorded much higher other operating expenses of EGP889mn (+250% q/q), it was offset by a higher net trading income of EGP418mn (+99% q/q) and higher net Fees and commissions of EGP835mn (+28% q/q).

· Unlike the previous quarter, the bank managed to grow its deposits in Q3 2022 by 16% q/q, as it took a proactive move with the 3-year 14% CDs to lock in funds, growing the pool of deposits to EGP498bn (+23% ytd). This in turn blocked any possible higher cost of funding in the future.

· This exceptional quarter raises COMI's annualized NIM to 6.5% and pushes annualized ROE to as high as 24%.

· COMI is now traded at an annualized P/E of 5.5x and a P/BV of 1.5x. (Company disclosure)

MNHD reports Q3 2022 results

Madinet Nasr Housing & Development’s [MNHD] Q3 2022 net earnings skyrocketed to EGP308.1mn vs. EGP23.9mn a year earlier. The enhancement in earnings was due to the increase in operating revenues to EGP1.2bn (+189% y/y). Meanwhile, gross profit and EBITDA margins came in at 56% (+28.4pp y/y) and 38% (+23.3pp y/y), respectively. In 9M 2022, gross contracted sales came in at EGP6.7bn compared to EGP2.1bn a year before as MNHD launched new projects this year, whereas deliveries came in at 1,113 (+95% y/y). (Company disclosure)

PACHIN received its third acquisition offer for 100% of the company

Paints & Chemical Industries (PACHIN) [PACH] received a binding tender offer from National Paints Holding Ltd. to acquire 100% of PACH at an initial price of EGP29/share (37% above the closing price on 3 November). Consequently, SIPES is reportedly looking to raise its offer to match National Paints’ offer. To recap, PACH received two acquisition offers for a majority stake in the company from Saybad Industrial Investment at an average price of EGP17.625/share, that it later withdrew, and another offer from SIPES at an average price of EGP18/share. (Company disclosure, Amwal Al-Ghad)

Rimco reportedly eyes a 20% stake in Edita

News reported that UAE-based Rimco plans to gradually increase its stake in Edita Food Industries [EFID] to 20%, having recently raised its stake from 3.97% to 5.35%. (Shorouk News)

e-finance establishes an electronic industrial platform

e-finance [EFIH] announced its partnership with the Ministry of Planning and the Ministry of Trade & Industry about establishing an electronic industrial platform. The protocol aims to provide design, management, and operational services to the industrial sector. (Company disclosure)