Fundamental Thoughts

Today, the Central Bank of Egypt’s Monetary Policy Committee (MPC) meets for the fifth time this year, having raising interest rates by 200bps on 30 March. Last meeting was on 22 June, when the MPC kept interest rates unchanged at 18.25%/19.25% for overnight deposit/lending rates. There remain three more meetings before 2023 calls it a year. Our view is still the same. We think the MPC is more likely than not to maintain rates as is for a couple of reasons:

(1) June 2023 marked a peak month for headline urban inflation which hit 35.7% with core inflation hitting a record high of 41%. Our expectation is for inflation to remain high when July figures come out next week. We expect CPI to rise marginally (+1.4% m/m), with headline urban inflation hitting another high of 35.9% and core inflation remaining elevated close to 41%. However, we continue to highlight that such high inflation readings are still driven by cost-push dynamics rather than demand-pull. Thus, higher interest rates will fuel further inflation as companies pass on higher costs to consumers.

(2) Hiking interest rates further will only add insult to injury, further raising the Egyptian government’s cost of local debt, which would further exacerbate the budget deficit.

With three more meetings up its sleeve before yearend, we think the MPC will pass this time and not take an action.

—Amr Hussein Elalfy | Head of Research

Today’s Top News & Analysis

Gold demand in Egypt surges

EGP2bn more export subsidies

GASC contracts to purchase 360,000 tons of wheat

CIEB Q2 2023: Annually lush, quarterly steady

CIB issues new USD-denominated CDs

AlexFert marginally affected by natural gas cuts

Heliopolis Housing signs an agreement and is in talks for another

MACRO

Gold demand in Egypt surges

Gold demand in Egypt has almost tripled y/y in Q2 2023 to 10.4 tons compared to 3.3 tons in the comparable year. As for H1 2023, demand reached 18.6 tons, almost the same amount for all of 2022, which is a new record high for Egypt. (Enterprise)

EGP2bn more export subsidies

The Cabinet approved extending an additional EGP2bn to the 6th phase exports subsidies program. This puts the total amount of subsidy support at EGP12bn for this phase. Oriental Weavers Carpet [ORWE], Dice Sport & Casual Wear [DSCW], and Arabian Cement [ARCC] are amongst the beneficiaries from the program. (Enterprise)

GASC contracts to purchase 360,000 tons of wheat

TheGeneral Authority for Supply & Commodities (GASC), on behalf of the Ministry of Supply & Internal Trade, contracted through a global practice to purchase 360,000 tons of wheat, of which 60,000 tons are Romanian and 300,000 tons are Russian. (Al-Mal)

CORPORATE

CIEB Q2 2023: Annually lush, quarterly steady

Credit Agricole- Egypt [CIEB] announced the results for Q2 2023. Here are our main takeaways:

· Net income increased by 142% y/y to EGP1.29bn. Yet, sequential growth came in a bit tamer at 5% q/q although net interest income (NII) grew strongly by 15% q/q to EGP1.7bn (+103% y/y). This was due to a 47% q/q decline in net trading income to EGP81mn and the 42% q/q increase in other operating expenses to EGP85bn, which subdued bottom line growth.

· This increase in NII pushed the NIM up to 8.7%. Meanwhile, ROAE slipped slightly to 43% from 46% in Q1 2023, albeit still at very healthy levels.

· On the balance sheet front, loan book growth came in muted at 6% ytd, with corporate loans still leading.

· NPLs remained at the same levels at 2.7%, while coverage ratio upped slightly to 154% as CIEB chose to book provisions this quarter of EGP14mn against reversals of EGP3mn last quarter.

· Deposits, on the other hand, continued to grow with a strong pace by 24% ytd to EGP75bn. Accordingly, GLDR fell to 49% which is the lowest since December 2018.

· Alternatively, CIEB resorted to “Due from Banks” account which increased by 50% ytd to EGP31bn, in addition to a 28% ytd growth in financial investments to EGP17bn.

The bank is currently traded at an annualized P/E of 4.1x and a P/B of 1.4x. (Bank disclosure)

CIB issues new USD-denominated CDs

Commercial International Bank - Egypt [COMI] has reportedly issued new one-year CDs in USD with a monthly yield of 6% and a minimum ticket of USD10,000. (Masrawy)

AlexFert marginally affected by natural gas cuts

Egypt Kuwait Holding Co. [EKHO] clarified that its subsidiary AlexFert (a 69.4% effective stake) was marginally but not significantly affected by the recent cuts in natural gas. (Company disclosure)

Heliopolis Housing signs an agreement and is in talks for another

Heliopolis Housing & Development [HELI] signed an agreement worth EGP17.5mn with Matrix to run and operate the Merryland Park. HELI's BoD also approved a preliminary offer from a real estate developer to participate in the development of an integrated housing area with an area of 77.14 feddans, in New Heliopolis, in exchange for a percentage from revenues. Details of the agreement are still being negotiated. (Al-Mal)

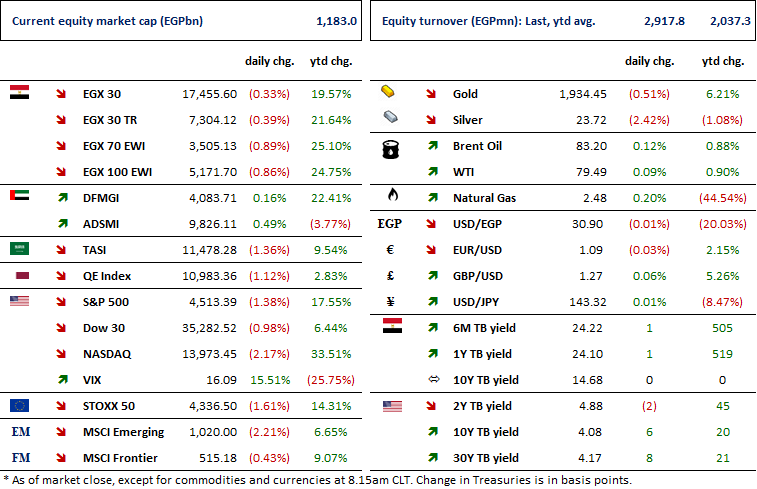

Markets Performance

Key Dates

3-Aug-23

Egypt PMI / July 2023 reading.

MPC Meeting / Determining the CBE's policy rate.

CCAP: EGM / Discussing the continuation of the company

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

27-Aug-23

SPMD: OGM / Approving financial statements ending 31 Dec. 2022.

28-Aug-23

ZMID: Cash dividend / Deadline for eligibility for a dividend of EGP0.150/Share.

31-Aug-23

ZMID: Cash dividend / Payment date for a dividend of EGP0.05/share (1st installment).

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).