Today’s Top News & Analysis

ADQ to buy 20-25% of ELAB

April urban CPI rises 30.6% y/y

Egypt to receive “special treatment” by MSCI in equity indexes

Egypt raises its financing needs in FY24 budget; targets EGP70bn more in asset sales

Israel agrees to expand natural gas pipeline network to boost exports to Egypt

Orascom Construction to buy Melinda Gates stake at an 8% discount to EGX-listed stock

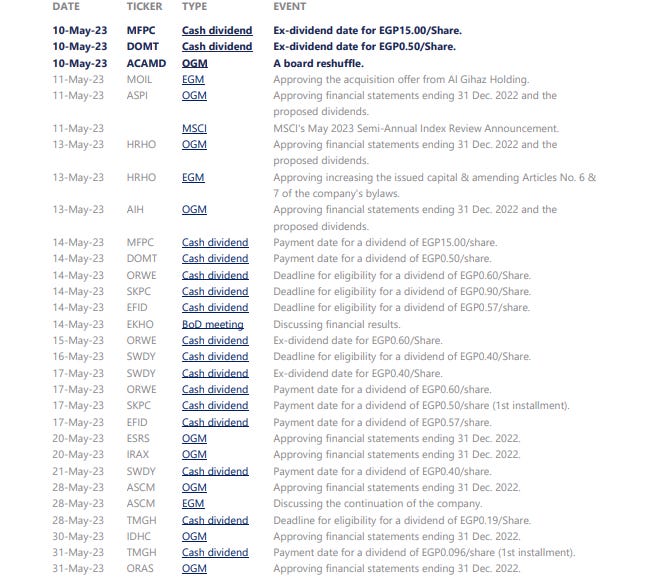

MOIL’s BoD approves Al Gihaz’s final offer

MACRO

ADQ to buy 20-25% of ELAB

A sub-fund of UAE-based ADQ Holding is reportedly close to purchasing a 20-25% stake in the Egyptian Linear Alkylbenzene Co. (ELAB). We had reported on 3 April 2023 that discussions were underway regarding the sale of ELAB to GCC strategic investors and/or listing it on the EGX. If completed before end of May, ELAB will be the first major deal off the government’s IPO program. (Asharq Business)

April urban CPI rises 30.6% y/y

Urban CPI in April 2023 climbed 30.6% y/y (vs. +32.7% y/y the previous month). Urban CPI also rose 1.7% m/m (vs. +2.7% m/m in March), according to CAPMAS. Our forecasts for April's urban CPI was higher at 31.8% y/y. (Bloomberg)

Egypt to receive “special treatment” by MSCI in equity indexes

Equity index provider MSCI will apply a “special treatment” to Egyptian securities listed in its indexes. The decision is driven by investor fears pertaining to FX illiquidity in Egypt. (Reuters)

Egypt raises its financing needs in FY24 budget; targets EGP70bn more in asset sales

Egypt raised its financing needs by 27% y/y to EGP2.14tn in FY24 budget. The new budget will look to increase the issuance of Treasury bills to EGP1.2tn (vs. EGP476bn in FY23) and decrease the issuance of Treasury bonds to EGP815.6bn (vs. EGP1.2tn in FY23). Meanwhile, the FY24 budget is targeting to achieve an additional EGP70bn from government offerings. (Asharq Business: 1, 2)

Israel agrees to expand natural gas pipeline network to boost exports to Egypt

Israel will expand its natural gas pipeline network to increase natural gas exports to Egypt. The expansion will entail the construction of a USD248mn pipeline in southern Israel, extending 65km to the Egyptian border and transporting 6bn cubic meter of natural gas annually. Egypt had previously signed an agreement to increase its imports of Israeli natural gas to use in their under-utilized liquefaction stations. Egypt’s two Mediterranean liquefied natural gas (LNG) plants are currently operating at a 63.5% utilization rate; the government is looking to reach full capacity by 2025 to meet Europe’s demand. (Economy Plus, Asharq Business)

Corporate

Orascom Construction to buy Melinda Gates stake at an 8% discount to EGX-listed stock

Orascom Construction’s [ORAS] shareholders agreed to buy back 6,517,444 shares or 5.58% of the company's total shares from Ms. Melinda Gates for USD3/share for a total value of USD19.6mn. While this implies an 11% premium to the Nasdaq Dubai-listed stock price of USD2.70/share, it implies an 8% discount to the EGX-listed stock price of EGP101.2/share. Also, this is 57% below our 12MPT of EGP215/share. We calculate that this share buyback should increase ORAS's EPS by c.6%, all else the same. (Company disclosure)

MOIL’s BoD approves Al Gihaz’s final offer

Maridive & Oil Services’ [MOIL] board of directors (BoD) approved KSA-based Al Gihaz Holding’s final offer presented to MOIL’s wholly-owned subsidiary Valentine Maritime Ltd. We had reported on 27 March 2023 that Al Gihaz and Valentine signed a preliminary MoU regarding the former’s purchase of a few naval units and the latter’s 60% stake in a Saudi subsidiary. The final offer is worth USD115.6mn and the details are as follows:

· USD71.8mn for the direct settlement of all outstanding bank debts pertaining to the naval units intended for purchase.

· USD28.5mn in cash for the settlement of outstanding obligations with suppliers pertaining to the naval units.

· USD300,000 in cash for Valentine’s stake in its Saudi subsidiary.

· USD15mn in cash contingent on Al Gihaz’s approval of settlement terms with other creditors. (Company disclosure)