1. Today’s Trading Playbook

KEY THEMES

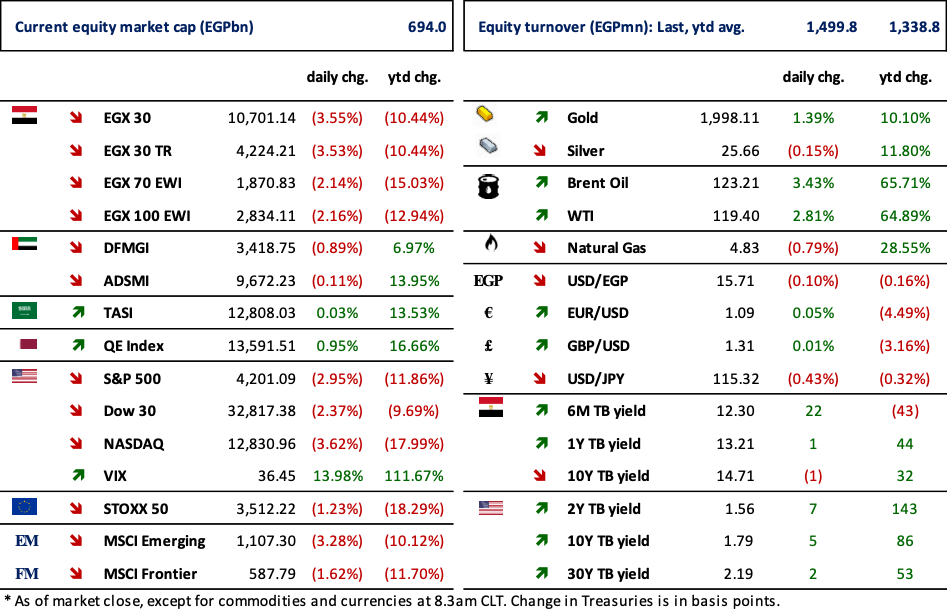

Oil prices bounced back after softening a bit yesterday upon hitting its 14-year high. Brent oil prices are now at USD127/bbl, in spite of stronger possibilities that EU countries will not boycott Russian crude output. Ultrahigh oil prices came coupled with unprecedented rally in other essential commodities including natural gas, aluminum, copper, and nickel. Meanwhile, the rally stretched over to include grains such as wheat, soybean, and corn. Fears of systematic risks has triggered safe haven buying, with gold prices flirting with the USD2,000 mark. The overwhelming situation in commodities market has sent messages to investors that the resulting inflation might be too wild to tame, hindering global growth. In response the sentiment for risk assets around the globe has deteriorated, with global equities witnessing a wide base sell-off. U.S. indices slipped between 2% and 3% yesterday. Despite the strong rally in gold prices, and in commodities in general, the U.S. dollar index [DXY] readings are at inches away from the 100 mark.

Here at home, the situation with foreign outflows triggered heavy losses on all key equity indices, with heavier losses taken in the blue chips index, the EGX30. A mechanic reaction to the new monocle through which global investors are looking at EMs right now, especially within the context of a once in a lifetime geopolitical jitter. Also, the static nature of the local FX rate, given the external vulnerabilities to global commodities market, affirmed this notion of exit and see. In terms of valuation levels, many blue chips names have become even cheaper, yet it seems this is a time in the market where momentum trading is going to be the theme. We reiterate that from a tactical standpoint, commodity linked stocks with local feedstock will witness improvement in short term earnings if the situation persists. Names such as Abu Qir Fertilizers [ABUK], Misr Fertilizers Production [MFPC], EK Holding [EKHO], Egyptian Financial and Industrial Co. [EFIC], Egypt Aluminum [EGAL], Misr Chemical Industries [MICH], Sidi Kerir Petrochemicals [SKPC], Qalaa Holdings [CCAP], and Alexandria Mineral Oils [AMOC] should benefit depending on the direction and the degree of the current conflict. However, from a pure valuation standpoint, we are still more interested in ABUK, EKHO, and MICH.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Ministry of Transportation is proceeding the second payment of Monorail project to Orascom-Arab contractors-ALSTOM alliance amounting EUR150mn. This is the second payment among EUR3.8mn costs of Monorail project. (Al-Mal)

CORPORATE NEWS

TMG Holding's [TMGH] unaudited KPIs for 2021 showed consolidated net income of EGP1.78bn (+8% y/y) on 9% growth in revenue to EGP15.35bn vs. EGP14.09bn and a higher gross profit margin of 33% compared to 29% a year earlier. TMGH is currently trading at a 2021 P/E of 10.1x. We note that TMGH’s BoD has recommended distribution of EGP0.17/share in cash dividends for the year 2021, implying 2% in yield. (Company disclosure)

Palm Hills Developments [PHDC] net earnings in 2021 grew by 16% y/y to EGP824mn on 18% leap in total revenues to EGP7.7bn. GPM dropped 5pp y/y to 34%. PHDC has achieved new sales of EGP17.3bn, growing by 35% y/y. We note that PHDC’s BoD has recommended distribution of EGP0.10/share in cash dividends for the year 2021, implying 7% in yield. (Company disclosure)

Emaar Misr Development [EMFD] net earnings in 2021 surged by 118% y/y to EGP4.1bn on 136% jump in total revenues to EGP11.0bn. (Company disclosure)

Credit Agricole – Egypt’s [CIEB] BoD has adjusted its DPS suggestion for the year 2021 to EGP0.74 from EGP0.99. The new DPS will imply 10% in yield, pending shareholders’ approval. (Company disclosure)

Macro Group Pharmaceuticals’ [MCRO] 2021 figures showed net income of EGP148mn

(+10% y/y) on higher revenues of EGP594mn (+38% y/y) and higher GPM of 80%

(+120bps y/y). (Company disclosure)

Oriental Weavers Carpet [ORWE] aims to start operating a new factory in the tenth of Ramadan City effective next June as part of the group’s expansion strategy, which aims to pump USD15mn in 2022, with the aim of adding a number of new looms and machines, as well as raising efficiency in some factories to increase production. (Arab finance)

The Ministry of Supply & Internal Trade (MOSIT) released a decree to increase the coarse bran selling price for state-owned and the private mills to EGP4,800/ton (+11.6%)compared to EGP4,300/ton of bran in February including supply services charges of EGP75/ton of bran and packaging, loading, and unloading of EGP145/ton of bran. (Al-Mal) In our view, any increase in coarse bran prices is positive for EGX-listed state-owned mills

The Qatari Baladna Company for Dairy & Juice Industry acquired a 5% stake in Juhayna Food Industries [JUFO], with a total value of EGP285.8mn. (Qatar stock exchange)

3. Chart of the Day

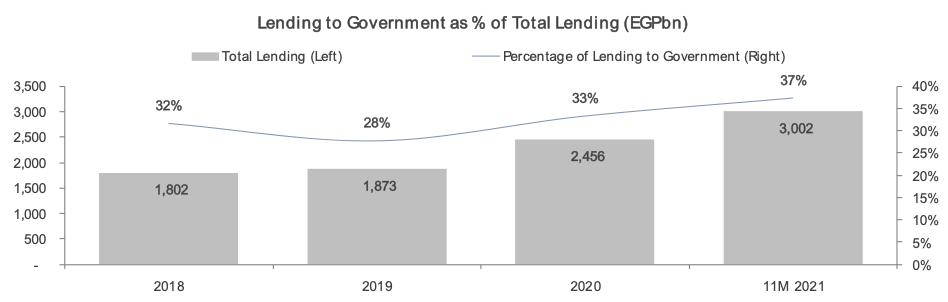

Source: CBE.

Egyptian banks' tendency to seek lower risk through loans to the government substantially increased since the breakout of the pandemic in 2020. Public-sector loans as a percentage of total market loans increased by almost 10 percentage points in the past two years.