1. Today’s Trading Playbook

KEY THEMES

Last Thursday, we published our MACROView note regarding February 2022 inflation reading. In general, inflation recorded its highest reading since mid-2019, annual urban headline inflation in February came well above our expectations. Annual urban headline inflation surged to +8.8% y/y in February from +7.3% y/y in January 2022, owing to an unfavorable base-year effect, fuel price hike, and the ongoing effect of globally higher prices of commodities, primarily food. The acceleration in inflation reflects a continued increase in food basket inflation which stood at +17.6% y/y (vs. 12.4% y/y in January), while non-food inflation edged down to +4.9% y/y (vs. +5% y/y in January). As a result, we now anticipate inflation to average 9% in 2022, up from our previous forecast of 8.3%, and the CBE to begin its tightening cycle this March with a 50bps hike. We do not think the CBE will begin its tightening cycle with aggressive rate hikes, as uncertainty remains high, and a de-escalation of the conflict will have a significant impact on global commodity markets. For more details, please check out our MACROView note from Thursday.

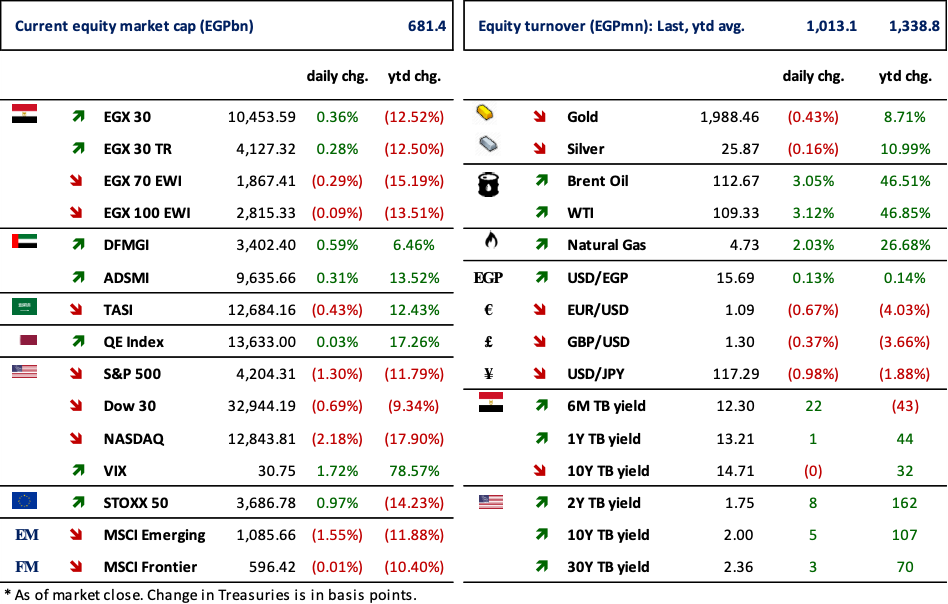

Elsewhere, major U.S. stock indexes stumbled on Friday as tech and growth shares led a broad decline and investors worried about the conflict in Ukraine while attention turned to the Federal Reserve's policy upcoming meeting. Meanwhile, according to Reuters, Russian forces fired eight missiles at a Ukrainian military facility near the Polish border on Sunday, with air raid sirens again waking up residents in Ukraine’s capital Kyiv. Furthermore, Brent oil prices settled near USD112/bbl last week, as buyers are still digesting the news of an emergency output boost to alleviate the pressures of tilted market.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

The Trade Ministry has banned the export of staple food commodities for three months as it looks to shore up supplies amid turmoil in the global food market caused by the conflict in Ukraine. Wheat, flour, oils and corn are all included in the export ban, along with lentils, pasta, and fava beans. (Enterprise)

Cabinet has reportedly reviewed last week the final version of a national strategy to develop the automotive industry. (Enterprise)

CORPORATE NEWS

Faisal Islamic Bank of Egypt's [FAIT] OGM held on 10 March 2022 has approved cash dividend distribution of EGP1.257/share, implying 10% in dividend yield. (Company disclosure)

El-Shams Housing & Development’s [ELSH] bottom line in 2021 dropped to EGP81.4mn (-46%y/y), where revenue slipped to EGP225mn (-31%y/y). Meanwhile, ELSH’s GPM increased to 86% (+6pp y/y). ELSH is currently trading at a 2021 P/E of 14.4x. (Company disclosure)

Raya Contact Center [RACC] is planning a share buyback program, where it targets to buy treasury shares up to 10% of its total outstanding shares at market prices. (Mubasher)

Tenth of Ramadan for Pharmaceutical Industries and Diagnostic Reagents –Rameda- [RMDA] has bought treasury shares on 10 March 2022 up to 1.2mn shares. (Company disclosure)

3. Chart of the Day

Amr Abdelrazek | Equity Analyst

aabdelrazek@egy.primegroup.org

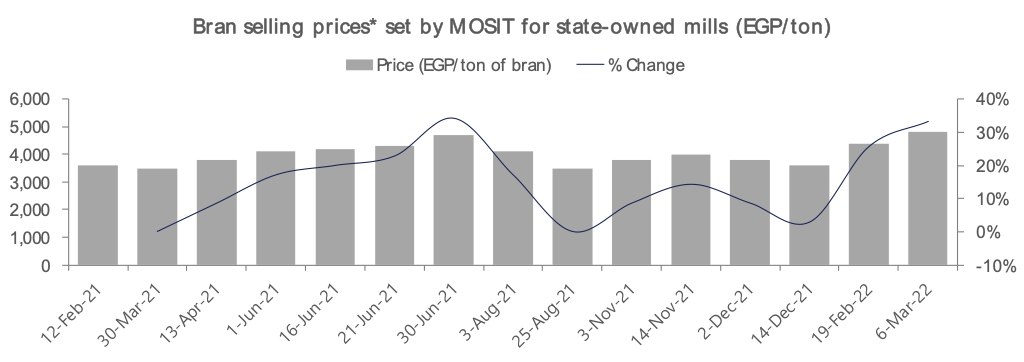

* Bran prices include supply services charges of EGP75/ton and packaging, loading, and unloading of EGP145/ton.

Source: Al-Mal, Prime Research.

In 6 March 2022, bran selling prices set by the Ministry of Supply & Internal Trade (MOSIT) for state-owned and private mills surged by 33% compared to 12 February 2021 (almost a year). Bran rose to EGP4,800/ton, the highest price ever, compared to EGP3,600/ton on 12 February 2021. Bran prices are expected to rise further due to the conflict in the Black Sea and the surge in prices of wheat and its substitutes.