1. Today’s Trading Playbook

KEY THEMES

Russia's invasion of Ukraine continues to exacerbate the case for risk assets, particularly in emerging markets (EMs). Locally, the crisis has already begun to fuel capital outflows from the domestic debt market, according to Reuters. A mild sell-off of Egyptian government bonds that began on Thursday accelerated on Monday as European markets opened, Reuters detailed yesterday. Foreign investors withdrew USD3bn from Egypt on Thursday. We know from history that geopolitical tensions have been detrimental to EM assets. That said, Egypt was already under pressure from a tightening Fed, increased debt obligations, and a longer-than-expected rally in global commodity prices prior to the escalation. These pressures were manifested in: (1) a significant deterioration in commercial banks' net asset liability position which stood at USD11.4bn at the end of January; (2) a higher budget deficit which rose to 4.7% of GDP in 7M FY22 from 4.4% in 7M FY21, while the primary deficit inched down to 0.21% of GDP in 7M FY22 from 0.3%; and (3) a wider current account deficit to USD4bn in Q1 FY22 from USD2.8bn Q1 FY21.

In a similar vein, we released yesterday our preliminary assessment of the economic impact of the current geopolitical tensions on Egypt. Our conclusion shows how susceptible inflation and CAD are to shockwaves caused by the disruption of trade with Russia, as the price of certain commodities, most notably grains, increased. Inflation, in our opinion, will remain elevated, and we will likely need to adjust our annual inflation forecast for 2022 in the near future. We see risk accumulating on the Central Bank of Egypt's ability to keep inflation expectations well-anchored around its target range of 7% +/- 2%. The crisis appears to have had a greater impact on inflation than growth, given that Fed tightening continues to jeopardize capital inflows into EMs and the USD/EGP exchange rate's stability. As a result, we continue to see the CBE leaning toward tightening its stance in 2022, possibly sooner than anticipated. Moreover, Egypt retains an open door to additional IMF assistance if the crisis continues to wreak havoc on the country's external balance.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Egypt's PMI posted 48.1 in February, as Egyptian non-oil companies endured a solid decline in operating condition. The index was below the 50.0 neutral mark for the fifteenth month running and only fractionally higher than January's nine-month low of 47.9. (PMI Markit)

The Suez Canal Authority expects to earn an additional USD700mn this year from the recent increase in transit fees, and its revenues are expected to surpass USD7bn if global trade continues to expand and oil prices continue to rise. (Economy plus)

CORPORATE NEWS

Ezz Steel's [ESRS] consolidated EPS grew to EGP6.61 vs. a loss per share of EGP5.8/share in 2020. Net earnings after minority grew to EGP3.5bn vs. net losses of EGP3.2bn in net losses in 2020. This comes in light of a 75% leap in top line, coupled with GPM improving to 20% vs. 3% before. Also, borrowing costs contracted considerably. Furthermore, ESRS upped its selling prices by 3% to EGP15,500/ton (including VAT) effective today, 3 March 2022. (Company release)

Al Ezz for Ceramics & Porcelain [ECAP] reported financial figures for 2021 with EGP107mn net profit vs. EGP14mn net loss the year earlier. Meanwhile, top line grew with 36% to EGP1,402mn, with GPM of 30% up from 23% a year earlier. Top line came 4% above our estimates, while GPM and bottom line were in line with our estimates. ECAP's BoD has proposed a cash dividend of EGP0.55/share, implying a 6% yield. (Company disclosure)

Amer Group Holding’s [AMER] consolidated net profit after tax surged to EGP83.21mn (+226% y/y) on 29% growth in revenue to EGP1784mn, amid stable GPM y/y of c. 8%.AMER is currently trading at a 2021 P/E of 11.0x. (Company disclosure)

Nilesat’s [EGSA] BoD has proposed a cash dividend distribution of USD0.4/share, implying a 9% yield. (Mubasher)

Telecom Egypt [ETEL] and AFR-IX Telecom, one of the telecommunications companies and the provision of infrastructure services in Barcelona, signed an agreement on landing the Medusa submarine cable in Egypt, which is one of the largest submarine cable systems in the Mediterranean. (Egyptian Cabinet)

The Financial Regulatory Authority (FRA) approved Palm Hills Developments [PHDC] to reduce its paid-up capital to EGP6,081mn through the cancelation of 41mn treasury shares at a par value of EGP2/share. (Arab finance)

Dice Sport & Casual Wear [DSCW] purchased an additional 24% stake in its subsidiary Textile Print Plus at a total value of EGP2mn. DSCW’s stake in Textile Print Plus is currently 100%. (Company disclosure)

Egypt Aluminum [EGAL] said that the state of the car rims project is still in the first phase of the contract which is the feasibility study. (Mubasher)

Al-Tariq Automotive has acquired 23% of International Co. for Leasing (Incolease) [ICLE] with a total value of EGP189mn and an average price of EGP41/share. This deal implies 2021 P/E and P/BV for ICLE at 10.0x and 1.2x respectively. We note that this compares to TTM P/E and P/BV for AT Lease [ATLC] of 4.2x and 1.2x, respectively. We note that in 2021, ATLC booked EGP64mn of securitization gains, which helped the company achieve a bottom line of EGP134mn (+81% y/y). (Mubasher)

GLOBAL NEWS

Balancing high U.S. inflation against the complex new risks of a European land war, Federal Reserve Chair said Wednesday the central bank would begin “carefully” raising interest rates at its upcoming March meeting but be ready to move more aggressively if inflation does not cool as quickly as expected. (Reuters)

Soaring Brent crude oil prices are tracking the same path as in 2007-2008, when they hit a record USD150/bbl before demand destruction kicked in and prices crashed in a global recession. (Reuters)

European Central Bank Governing Council member Mario Centeno warned on Wednesday that Russia's invasion of Ukraine could lead to a combination of low growth and high inflation, known as stagflation, in Europe. (Reuters)

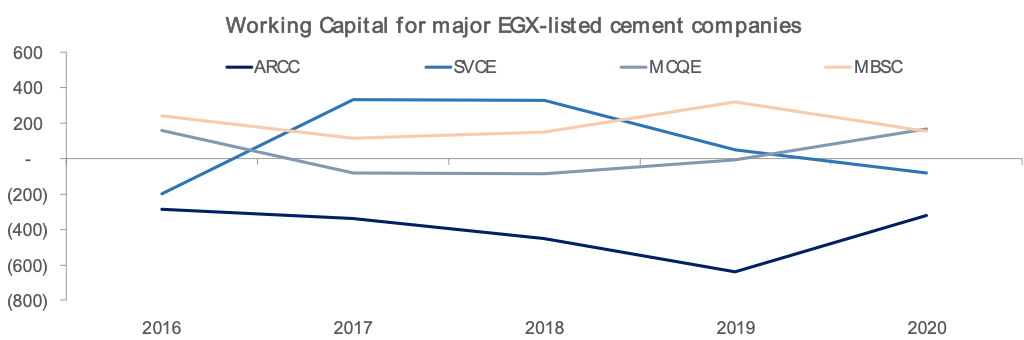

3. Chart of the Day

Source: Companies' financials, Prime Research.

Working Capital for major EGX-listed cement companies: The chart shows that Misr Cement – Qena [MCQE] and South Valley Cement [SVCE] have a fluctuating working capital. Meanwhile, ARCC always has a negative working capital, while Misr Beni Suef Cement [MBSC] always has a positive working capital. ARCC's negative working capital is due to its policy of having low inventory levels and receiving payments before production. On the other hand, MBSC has a net cash of more than EGP1.1bn; hence, it does not rely much on liabilities.