Fundamental Thoughts

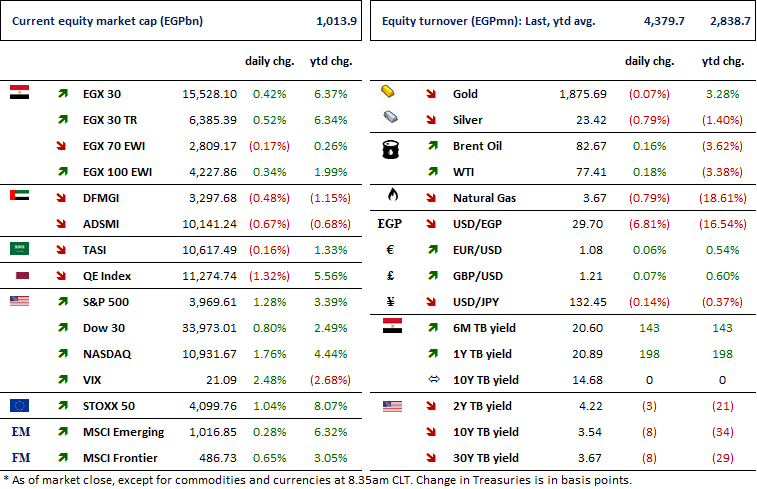

Yesterday marked yet another historic moment for the Egyptian pound (EGP), having fallen as much as 14% intraday to EGP32.2/USD before cutting its losses in half to end the day down only 7%. While a weaker EGP should bode well for Egyptian assets overall, the reaction of Egypt’s stock market was curious. As the U.S. dollar (USD) started to climb higher early in the day, so did EGX 30 and EGX 70 EWI which by noon had risen as much as 4.4% and 2.8%, respectively. As the USD continued to climb further to a peak of EGP32.2 by 1 pm, both market indices had already begun their south journey. It appears that Egyptian institutions led the pack lower, making up 27% of yesterday’s trading but ending the day as net sellers. On the other hand, Arab investors (10% of trading) ended as net buyers. One explanation that some market participants used to justify that sudden pullback had to do with the introduction of yet another high-yield CD by Egypt’s largest private-sector bank, Commercial International Bank – Egypt [COMI]. Both COMI’s local shares (-4%) and GDRs (+14%) traded heavily with some 31mn and 20mn changing hands, respectively. Both instruments now reflect an implied exchange rate of EGP30/USD.

COMI introduced 22.5%/22%, annual/monthly EGP-denominated CDs. Although this piece of news was known the day before, investors (the story goes) thought such a move would negatively impact COMI’s profitability as investing the proceeds of that high-yield CD sale may prove difficult in the current market environment with treasuries yielding just 20%. We tend to think differently. First, the above view makes that dangerous “ceteris paribus” assumption (i.e. “all else being equal”). We think this will eventually manifest itself in higher Treasury yields down the road. That said, we think COMI’s decision is rather tactical (as opposed to strategic) in an attempt to safeguard its deposit base and market share, thus avoiding churn to National Bank of Egypt or Banque Misr. While such high-yield CDs will likely pressure COMI’s net interest margin (NIM), we think the effect on profitability will depend on how much of these CDs’ proceeds will represent out of the bank's total pool of deposits. We note that more than 50% of COMI's deposits are in low-cost current and savings accounts (CASA) which should give the bank some room to maneuver with such a high-cost product. Our banking analyst, Amany Shaaban, tried to gauge the impact on COMI’s 2023 net income (which we estimate at EGP19.2bn), assuming EGP10bn going into these high-yield CDs. If these deposits were new to COMI, then the impact would be EGP0.5bn or 2.5%. If these deposits were coming from within COMI, then the impact would be EGP1.2bn or 6%. Thus, noting that such CDs will only last for 1.5 years, one cannot build a long-term opinion on a short-term maneuver that is aimed at protecting the bank’s deposit base. Furthermore, since a stronger USD bodes well for COMI, we think its price weakness seen yesterday is not justified by any means.

— Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

USD/EGP FX rate records an all-time low at EGP32.2

A new subsidized lending initiative by the Egyptian government

High expectations for oil prices in 2023

Egypt Aluminum [EGAL] raises local selling prices to EGP94,000/ton

Telecom Egypt denies obtaining new frequencies

Misr Beni Suef Cement to reduce capital through treasury shares write-off

South Valley Cement comments on a bankruptcy lawsuit against the company

A shareholder decreases his stake in Arab Cotton Ginning Co.

GlobalCorp closes its third issuance worth EGP1bn

MACRO

USD/EGP FX rate records an all-time low at EGP32.2

In a rough trading day, the EGP weakened against the USD where the USD/EGP FX rate settled at around EGP29.70 as per the CBE's website. We note that the FX rate's all-time low was recorded yesterday at EGP32.2. This comes right after the International Monetary Fund's (IMF) press release where it directed the CBE towards maintaining a durably flexible exchange rate. (Asharq Business)

A new subsidized lending initiative by the Egyptian government

The Cabinet announced yesterday that the Egyptian government will subsidize EGP150bn worth of loans to the industrial and agricultural sectors with an 11% interest rate and an EGP75mn cap per company. This comes after the CBE canceled its 8% industrial initiative back in November. Of the total initiative value, EGP140bn will finance working capital needs, with EGP10bn to finance capital spending. This should bode well for many industrial companies due to their high reliance on credit facilities to finance working capital. (Economy Plus)

High expectations for oil prices in 2023

Brent crude oil prices are expected to surpass USD100/bbl in 2023, according to ING. This is in view of (1) rising demand as China attempts to stimulate its economy and (2) a diminished supply due to western sanctions against Russia, adding further to the inflationary pressure. (Asharq Business)

CORPORATE

Egypt Aluminum raises local selling prices to EGP94,000/ton

Egypt Aluminum [EGAL] has reportedly raised its local selling prices to EGP94,000/ton, in addition to a 14% value-added tax, effective 9 January 2023. EGAL stated that this increase is on the back of the recent EGP devaluation. (Al-Borsa)

Telecom Egypt denies obtaining new frequencies

Telecom Egypt [ETEL] denied obtaining its mobile operator, WE, any new frequencies, citing negotiations with the National Telecom Regulatory Authority. (Company disclosure)

Misr Beni Suef Cement to reduce capital through treasury shares write-off

Misr Beni Suef Cement’s [MBSC] BoD approved reducing the company's paid-in capital from EGP750mn to EGP679mn by writing off c.7mn treasury shares (9.4% of total shares outstanding) with a par value of EGP10/share. (Company disclosure)

South Valley Cement comments on a bankruptcy lawsuit against the company

South Valley Cement [SVCE] clarified that the bankruptcy lawsuit filed by Reliance Heavy Industries against SVCE has been dismissed by Cairo Economic Court back on 31 July 2022. (Company disclosure)

A shareholder decreases his stake in Arab Cotton Ginning Co.

A shareholder, Islam Mohamed El-Sayed Aly Hussein, cut his stake in Arab Cotton Ginning Co. [ACGC] by 0.231% from 5.230% to 4.999% for a sum of 630,000 shares for EGP2.1mn (EGP3.29/share). (Company disclosure)

GlobalCorp closes its third issuance worth EGP1bn

GlobalCorp closed the third issuance of a securitized bond worth EGP1bn, as a part of its EGP1.6bn program. The bond was comprised of three tiers (24, 36, and 60 months), all of which got an A+ credit rating. (Al-Mal)