1. Today’s Trading Playbook

KEY THEMES

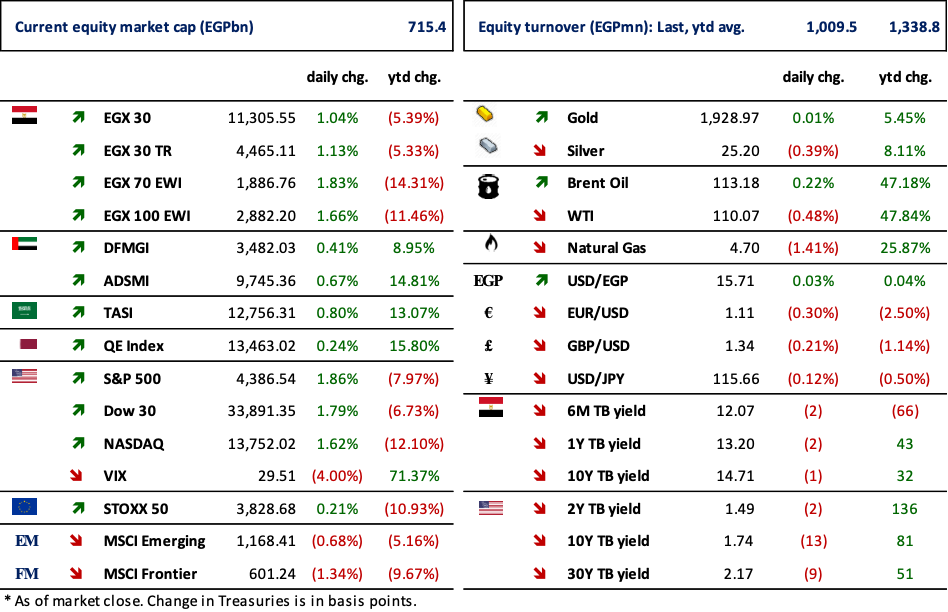

Oil prices surged drastically, with Brent oil price crossing over the USD118/bb. The recent bold price action was the product of buyers pricing in avoiding Russian output from the market. Meanwhile, such intensified rally was not matched by a strong performance in global equity markets. U.S. equity indices slipped on Friday, despite strong jobs numbers, as failure of de-escalation of the situation in Ukraine, threating more sanctions has clouded the atmosphere for global growth.

Elsewhere, Telecom Egypt [ETEL] has posted its 2021 results, recording a bottom line of EGP8.4bn (+74% y/y). We note that net earnings came exactly matching our estimates for the year. ETEL’s strong earnings growth came in light of (1) higher revenues of EGP37bn (+16% y/y), (2) higher gross profit margin of 41% (+176bps y/y), and (3) higher investment income from Vodafone Egypt [VODE] of EGP3.3bn (+51% y/y). Finally, ETEL’s BoD has suggested cash dividend distribution of EGP1.0/share, implying 5% in yield, and pending shareholders’ approval. We remind you that ETEL is one of the 15 stocks we picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. We have an overweight recommendation for ETEL, with our 12MPT of EGP28.10/share (ETR +45%).

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Egypt’s net foreign reserves rose marginally to USD40.99bn in February, up from USD40.98bn in January. (CBE)

Minister of Electricity said that electricity prices will not be hiked now despite the increase in natural gas prices, and the next increase will be on time next July 2022. (Economy Plus)

The General Authority for Supply Commodities (GASC) has approached the International Islamic Trade Finance Corporation to raise USD700mn, to finance import commodities, especially wheat, in light of the rise in wheat prices globally. (Shorouk News)

CORPORATE NEWS

Telecom Egypt [ETEL] reported an EAS-based net income after minority of EGP8.4bn (+74% y/y), in line with our estimates of EGP8.4bn, in 2021 on higher revenues of EGP37bn (+16% y/y), higher gross profit margin of 41% (+176bps), and higher investment income from Vodafone Egypt [VODE] of EGP3.3bn (+51% y/y). (Company disclosure)

Arab Ceramic - Ceramica Remas- [CERA] reported net earnings of EGP49mn (+61% y/y).Meanwhile, top line recorded EGP798mn (+24% /y/), whereas GPM improved to 11%. (Company disclosure)

Al Ezz for Ceramics & Porcelain’s [ECAP] BoD has suggested cash dividend distribution of EGP0.55/share, implying 6% in dividend yield. (Mubasher)

GLOBAL NEWS

The FAO food price index rises to a new all-time high in February. The February rise was led by large increases in vegetable oil and dairy price sub-indices. (FAO)

The ongoing war and associated sanctions will also have a severe impact on the global economy," IMF warned, noting that the crisis was creating an adverse shock to inflation and economic activity at a time when price pressures were already high. (Reuters)

China on Saturday targeted slower economic growth of around 5.5% this year as headwinds including an uncertain global recovery and a downturn in the country's vast property sector cast a pall on the world's second-largest economy. (Reuters)

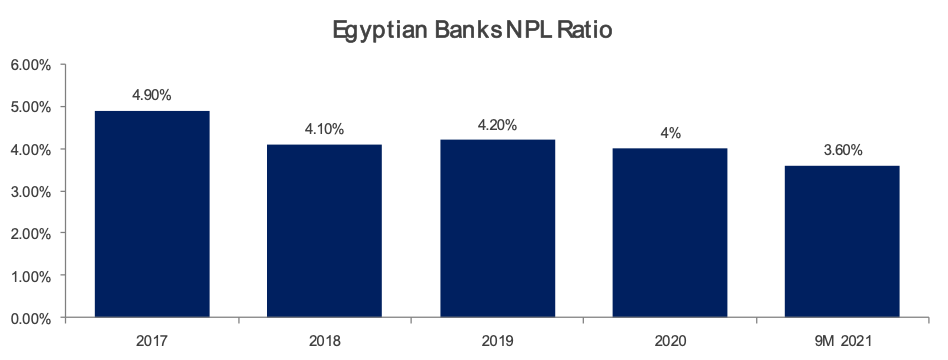

3. Chart of the Day

Source: CBE.

The credit quality of Egyptian banks has been steadily improving, as evidenced by its NPLS ratio, declining 130bps in approximately 4 years. Banks managed to navigate through the implications of the pandemic without negatively affecting their asset quality.