1. Today’s Trading Playbook

KEY THEMES

Last Thursday, EFG Hermes [HRHO] reported a net profit of EGP402mn (-14% y/y, +13% q/q) in Q4 2021. This was mainly due to a high comparable base in the year-ago quarter, coupled with holding & treasury activities revenues, which halved y/y on reported realized and unrealized losses on investments/seed capital. Group operating revenues during the quarter recorded EGP2.0bn (+19% y/y, +70% q/q). The quarter witnessed the consolidation of its 51%-owned aiBank during the last two months of 2021. Hence, aiBank contributed only EGP38mn to HRHO’s bottom line in 2021, counting in only November and December. From an annual perspective, HRHO’s bottom line grew to EGP1.5bn (+12% y/y) on 12% growth in total group revenues to EGP6.1bn. Furthermore, opex growth was slower at 9% y/y due to lower other operating expenses. If we were to normalize for the one-offs witnessed in 2020, HRHO’s bottom line would have been higher 51% y/y in 2021. That said, TTM ROAE came in at c.10%.

HRHO’s 2021 results (ex-one-offs) clearly show HRHO standing on concrete grounds with growth backed by solid operations. HRHO is currently trading at a TTM P/E of 12x and a P/BV of 1.0x. In view of 2021 results, we raise our 12MPT to EGP20.0/share (from EGP14.8/share) to account for a 75% probability of success of First Abu Dhabi Bank’s (FAB) attempted acquisition of HRHO at an FX-adjusted EGP22/share (USD1.2/share offer adjusted for the new USD/EGP FX rate). With an upside of 10%, we cut our investment rating from Overweight to Neutral.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

The CBE is working to streamline import procedures for a list of essential commodities agreed upon by the supply and finance ministries, amid pressure on imports caused by the Russia-Ukraine war. (Cabinet statement)

Egypt successfully closed its maiden Samurai bond issuance, selling USD500mn of the JPY-denominated bonds in Japan. (Cabinet statement)

Egypt is in talks with Argentina, India, France and the United States for future wheat imports but is in no rush to buy at the moment, Minister of Supply said. (Reuters)

CORPORATE NEWS

EFG Hermes’s [HRHO] BoD has suggested a 20% bonus share distribution, pending shareholders’ approval. (Company disclosure)

Cement Factories are reportedly interested in using Mazut as replacement to coal in the mean time until coal prices calm down. (Al-Borsa)

Macro Group Pharmaceuticals [MCRO] plans to conclude acquisition deals for companies operating in the field of pharmaceuticals and nutritional supplements during 2022. (Al-Mal)

Palm Hills Developments [PHDC] has concluded a Sukuk issuance worth of EGP3.251bn. We note that the issuance will finance PHDC’s Badya project. (Arab finance)

Waha Investment Management Company has purchased 1.5mn shares of TMG Holding [TMGH] at an average price of EGP9.03/share, raising Waha’s stake in TMGH to 5.015% from 4.942%. (Arab finance)

Abu Dhabi Islamic Bank’s [ADIB] OGM has approved raising the bank’s paid in capital by EGP2bn to EGP4bn distributed over 200mn shares at a par value of EGP10/share. (Company disclosure)

A trade took place on Contact Financial Holding [CNFN] for a total number of 9.36mn shares at a price of EGP3.99/share within the context of CNFN’s ESOP program. (Mubasher)

Telecom Egypt [ETEL] said that it is completed of the entire civil works for the passage of submarine cables in the Suez Canal Road, which is one of the most important and shortest strategic axes for crossing international submarine cables from east to west. (Arab Finance)

Alexandria Medical Services [AMES] announced its 2021 results, reporting an increase in bottom line of 27% y/y to EGP26.4mn. Meanwhile top line came in at EGP271mn with a 20% y/y growth. (Mubasher)

Alexandria Container and Cargo Handling [ALCN] announced its 8M 2021/22 results, reporting a bottom line growth of 12.9% y/y to EGP987mn. Meanwhile revenues increased 55% y/y to EGP1.5bn. (Mubasher)

Acrow Misr for Scaffolding and Formwork [ACRO] approved to establish two subsidiaries in Tunisia and Jordan. (Mubasher)

GLOBAL NEWS

Emerging-market equity funds have lost a combined USD8.1bn over the past four weeks, while USD5.7bn has been drained from EM bond funds. Mutual funds that invest in emerging market (EM) equities and bonds have faced huge outflows over the past month, as the intensifying Russia-Ukraine crisis spawns fears over higher inflation and slower economic growth in these markets. (Reuters)

The European Central Bank does not expect the war in Ukraine to push the euro zone into stagflation even if it does push up inflation due to higher energy prices and push down growth, President Christine Lagarde was quoted as saying on Saturday. (Reuters)

JPMorgan analysts have slapped a sell, or 'underweight', recommendation on emerging market local currency sovereign debt due to the global fallout from the Russia-Ukraine crisis. (Reuters)

3. Chart of the Day

Mona Bedeir | Chief Economist

Source: Fao.

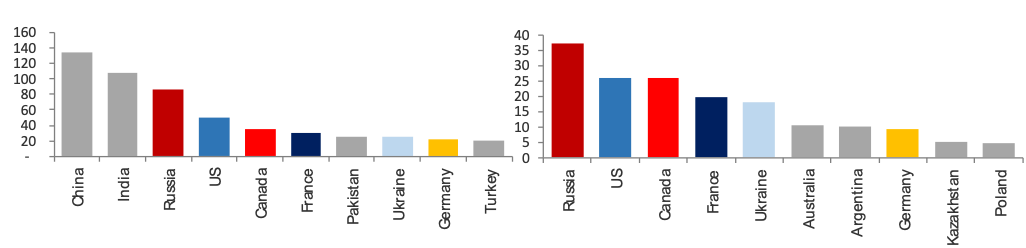

Because domestic consumption is significant in countries such as China and India, not all global wheat producers are exporters, according to FAO most recent data. A sharp price increase, on the other hand, could entice top producers to increase their exports as buyers seek alternatives to the Black Sea due to Russia's invasion of Ukraine, which threatens to disrupt supplies from the two major exporters. Recently, India, the world’s second-largest producer of wheat, is reportedly in “final” talks to begin exporting wheat to Egypt.