Today’s Top News & Analysis

Egyptian gas imports fall to zero per day

Travco announces 50% cancellation rate in tourists bookings

GAFI grants four new golden licenses

Government approves production capacity increase for cement factories

Bahraini GFH considers investing USD500mn in Egypt

Official cigarette prices to increase by 12%

KABO FY 2022/23 prelim.: Turning into net profits

EKHO increases its share in BKH to 94%

MACRO

Egyptian gas imports fall to zero per day

In a statement issued yesterday, the Egyptian Cabinet explained that the reason behind the continuous electricity blackouts are due to a sharp fall in the country's gas imports from 800mn cbt/day to zero cbt/day as the war in Gaza pushed Chevron to halt its exports to Egypt. (Cabinet, Enterprise)

Travco announces 50% cancellation rate in tourists bookings

Travco Travel Company, the Egyptian global tourism company, announced a 50% cancellation rate in its bookings for the remaining months of the year due to the Israeli war on the Gaza Strip. Travco is the agent for the German tour operator "TUI" in Egypt and holds a 20% market share of incoming tourist flows into the country. He also noted that bookings for the upcoming year are experiencing significant slowdown, and that the highest cancellation rates are from Germany, England, Belgium, and Sweden. (Asharq Business)

GAFI grants four new golden licenses

The General Authority for Investment and Freezones (GAFI) granted four golden licenses yesterday to Samsung, GASCO, Fayoum Storage and Warehouses Company, and EgyptSat Auto. Samsung is expected to invest around USD55mn in its new phone assembly facility while EgyptSat Auto will build an EGP300mn factory and GASCO will invest USD380mn to expand its gas complex. (Cabinet)

Government approves production capacity increase for cement factories

The Ministry of Trade and Industry has approved a 10% increase in the production capacity of cement factories over the quantity specified for each factory in November. This increase aims to meet the current high demand for the product. If demand continues to rise, factories will raise their production by 15% in December, with anticipation of normalizing price levels after the production increase next month. (Al-Borsa)

Bahraini GFH considers investing USD500mn in Egypt

It has been reported that the Bahrain based GFH Financial Group (GFH) is considering investments in Egypt next year that reach USD500mn through its arms in healthcare, education and logistics. The sources also added that GFH's education investment arm, Brits, has appointed a financial advisor in Egypt to acquire a pre-university educational institution. The company is also reportedly in advanced talks with a specialized education investment platform owned by a major financial institution and a sovereign entity to explore investment opportunities. (Al-Borsa)

Official cigarette prices to increase by 12%

The Egyptian House of Representatives approved a decision to increase cigarette prices by at least 12%. The cigarette's minimum and maximum prices are allowed now to be raised by 12% per year over five years. This will help the producers to overcome the increase in the cost of sales due to the devaluation. The decision means that the taxation will be higher as well by c.EGP0.5:

· EGP4.5 for packs lower than EGP31.

· EGP7.0 for packs between EGP31 and EGP45.

EGP7.5 for packs higher than EGP45. (Economy Plus)

CORPORATE

KABO FY 2022/23 prelim.: Turning into net profits

El Nasr Clothing & Textiles Co.'s [KABO] reported its preliminary consolidated net profits attributable to majority of EGP53mn vs. a net loss of EGP25mn last year, this is due to:

· A 58% y/y growth in revenues to EGP573mn.

· A 2pp y/y improvement in the gross profit margin to 34%. (Company disclosure)

EKHO increases its share in BKH to 94%

Egypt Kuwait Holding Company [EKHO] announced signing a binding agreement with a Kuwaiti company and one of its affiliated funds to purchase their share of 9.45% in Bawabet Al Kuwait Holding Company "BKH" with a total of USD47.5mn. This increases EKHO's share in BKH to 94.34%. We note that BKH owns 59.82% of Alexandria Fertilizers Company (AlexFert), which raises EKHO's direct and indirect stake in AlexFert after executing this transaction up to 75%. (Company disclosure)

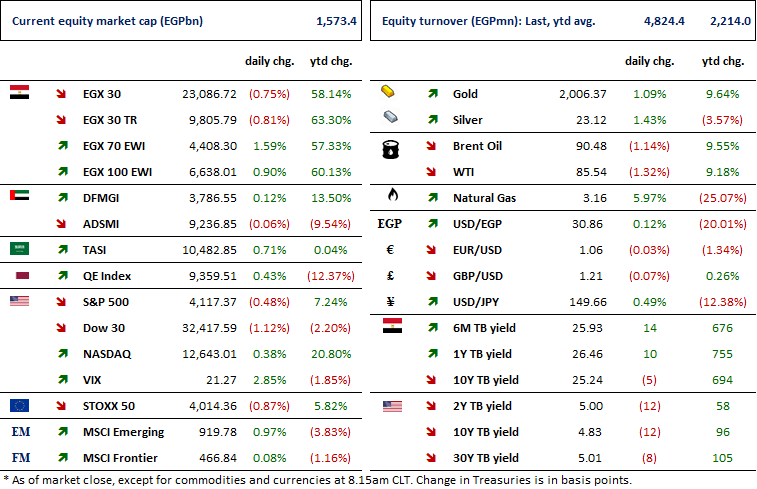

MARKETS PERFORMANCE

Key Dates

31-Oct-23

ORAS: Cash dividend / Payment date for a dividend of EGP8.51/share.

MCRO: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

2-Nov-23

MPC Meeting / Determining the CBE's policy rate.

4-Nov-23

MFPC: EGM / Approving the merger contract & amending some articles of the Company's bylaws.

5-Nov-23

Egypt PMI / October 2023 reading.

EFID: OGM / Approving proposed dividends for 31 Dec. 2022.

AMOC: Cash dividend / Deadline for eligibility for a dividend of EGP0.65/Share.

6-Nov-23

EFIH: Cash dividend / Deadline for eligibility for a dividend of EGP0.177/Share.

7-Nov-23

EFIH: Cash dividend / Ex-dividend date for EGP0.177/Share.

8-Nov-23

AMOC: Cash dividend / Payment date for a dividend of EGP0.45/share (1st installment).

9-Nov-23

EFIH: Cash dividend / Payment date for a dividend of EGP0.177/share

DOMT: OGM / Approving the proposed dividends.