Today’s Top News & Analysis

Saudi Arabia cutting oil production again

Ministry of Supply buys 3.112 tons of wheat since the beginning of the season

QIA and ETEL talks said to have resumed

Emirati investors are interested in EAST

A Saudi firm looking to acquire 70% of Heliopolis Housing

CICH Q1 2023: Above and beyond

Orascom Construction concludes its share buyback program

MACRO

Saudi Arabia cutting oil production again

Saudi Arabia announced that it would voluntarily cut crude oil production by an additional 1mn bpd. The production cut will start on 1 July 2023 and will be in effect for a month with the option to extend. Meanwhile, OPEC+ decided to extend the production cuts announced last April from December 2023 to the end of 2024. The total level of oil production for OPEC+ will be 40.46mn bpd from 1 January 2024 until the end of 2024. (Asharq Business)

Ministry of Supply buys 3.112mn tons of wheat since the beginning of the season

Ministry of Supply and Internal Trade announced buying 3.112mn tons of wheat from the beginning of the season (last April) until now, decreasing by 11.8% from 3.530mn tons for the same period last year. (Al-Borsa)

CORPORATE

QIA and ETEL talks said to have resumed

Qatar Investment Authority (QIA) is reportedly back in talks with Telecom Egypt [ETEL] to acquire a part of or its full stake in Vodafone Egypt [VODE], which is c.45%. However, ETEL wants to keep its stake in VODE as it largely contributes to its total earnings. (Al-Mal)

Emirati investors are interested in EAST

Emirati investors are reportedly back in talks to acquire 25-30% of Eastern Co. [EAST], however, still EAST denies receiving any official offers. In addition, EAST's management added that the discussions should be done with the Ministry of Public Enterprise and its subsidiary. News also reported that the ministry's subsidiary will likely sell a part of its stake in EAST, which is 50%, while the acquisition may be finalized this month. (Al-Mal)

A Saudi firm looking to acquire 70% of Heliopolis Housing

A Saudi firm is reportedly looking to acquire 70% of Heliopolis Company for Housing & Development [HELI] for USD400mn or the equivalent of EGP12.4bn, valuing HELI at EGP17.7bn or EGP13.26/share (+27% compared to market value). We note this offer implies a valuation of EGP2,565/sqm of unused land that HELI owns. (Cairo24)

CICH Q1 2023: Above and beyond

CI Capital Holding’s [CICH] Q1 2023 results showed a robust earnings growth to EGP320mn (+108% y/y), backed by strong top-line growth of EGP1.6bn (+114% y/y). The top-line performance was 80% derived from its NBFS platform with total revenues of EGP1.3bn, whereas its IB platform recorded revenues of EGP274mn.

• The NBFS platform was bolstered by strong leasing activities, as Corplease achieved a bottom line of EGP193mn (+76% y/y) and revenues of EGP946mn (+143% y/y) despite the decrease in new bookings volume due to the increased lending rates. Meanwhile, CICH’s microfinance arm Reefy achieved a 39% y/y growth in its bottom line to EGP106mn after expanding its footprint by adding 12 new branches, thus taking its total branch network to 144 branches. We note that total on-balance sheet lending portfolio reached a new record of EGP2.7bn.

• As for the IB platform, CICH’s brokerage came second in the EGX brokerage league with a market share of 7.5%, achieving a top line of EGP152mn (+135% y/y). Meanwhile, CI Capital Asset Management ended 2022 with AUMs reaching a record high of EGP56.9bn (+297% y/y) with revenues of EGP57mn (+243% y/y).

CICH has an annualized ROAE of 24% and a blended annualized net interest margin of 7.9%. (Company disclosure)

Orascom Construction concludes its share buyback program

Orascom Construction [ORAS] concludes its program to buy back 5.6% of Melinda Gates' stake in a share buyback program. ORAS bought 6.5mn shares for USD3/share, in a transaction worth USD19.5mn. (Company disclosure)

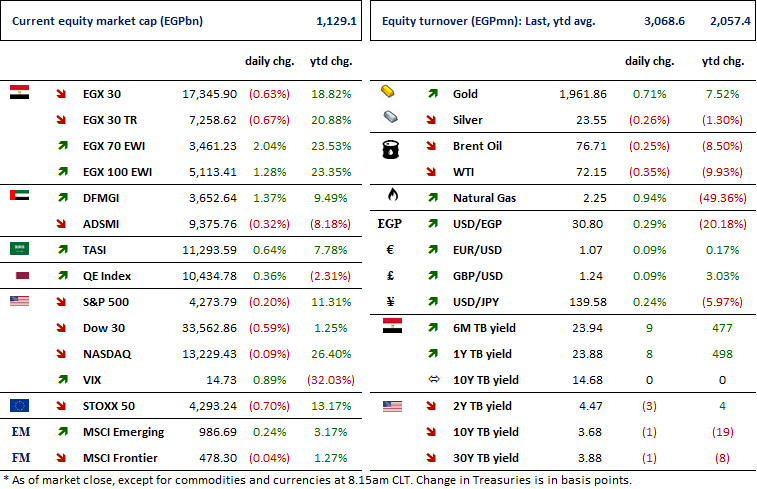

Markets Performance

Key Dates

6-Jun-23

BTFH: Capital increase / Capital increase subscription starting date.

JUFO: Cash dividend / Ex-dividend date for EGP0.15/Share.

CSAG: OGM / Approving the estimated budget of FY 2023/2024.

CSAG: EGM / Amending Article No. 3 of the company's bylaws.

7-Jun-23

ATQA: EGM / To renew the company's license for 25 years starting from the end of the previous license (30 May 2023).

8-Jun-23

JUFO: Cash dividend / Payment date for a dividend of EGP0.15/Share.

BTFH: OGM / Approving financial statements ending 31 Dec. 2022.

BTFH: EGM / Amending Article No. 29 of the company's bylaws.

15-Jun-23

ZMID: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

17-Jun-23

MICH: EGM / Amending Article No. 6 of the company's bylaws for increasing the authorized capital from EGP400mn to EGP1bn.

18-Jun-23

MOIL: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

MOIL: EGM / Discussing the continuation of the company.

19-Jun-23

SUGR: Cash dividend / Deadline for eligibility for a dividend of EGP2.550/Share.

20-Jun-23

SUGR: Cash dividend / Ex-dividend date for EGP2.550/Share.

22-Jun-23

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.