1. Today’s Trading Playbook

KEY THEMES

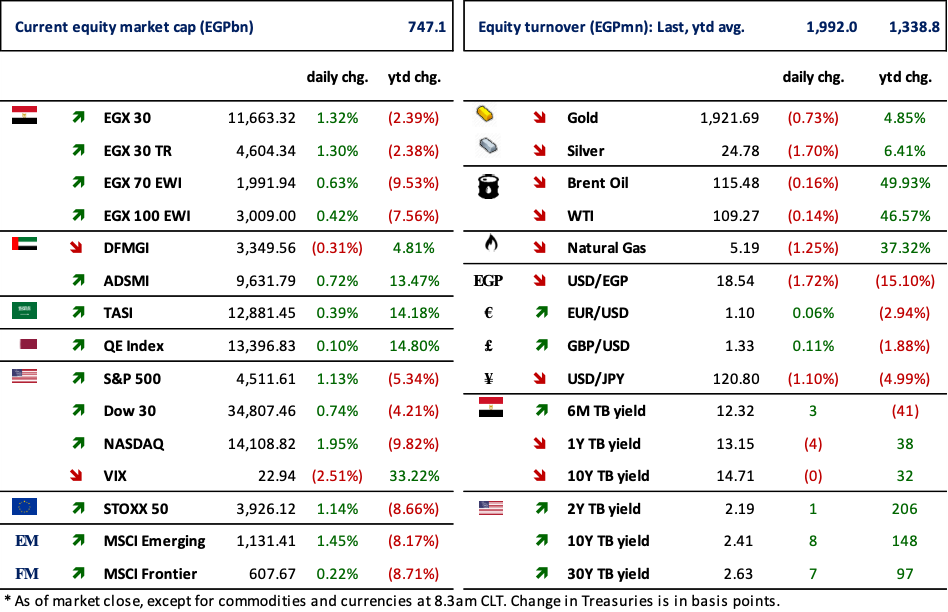

Yesterday, the market extended its gains for the sixth consecutive session, still boosted by the EGP depreciation. However, the EGX 30 closed off its intraday highs, impacted by obvious profit taking activities. In addition, foreigners were net sellers for the second straight day since the EGP depreciation.

Elsewhere, Orascom Construction’s [ORAS] 2021 net income after minorities surged by 25% y/y to USD113.4mn, in line with our estimates of USD113mn, on higher total revenues of USD3.5bn (+5% y/y). We note that annual earnings growth was sparked by a notable recovery in BESIX which turned into profitability. Net income contribution from BESIX stood at USD10.7mn in Q4 2021, contributing to 2021 total net income by USD15.7mn vs. an USD6.2mn loss in 2020. ORAS continues to boast a net cash position of USD442mn, representing a whopping 95% of ORAS’s market cap at yesterday is close on the EGX (88% based on close in the UAE). Meanwhile, ORAS is trading at a TTM P/E of only 4x. We see that ORAS is a clean winner from the EGP devaluation, simply by way of currency conversion. We remind you that ORAS is one of the 15 stocks we picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. We have an Overweight recommendation for ORAS, with our 12MPT of EGP146/share (ETR +99%).

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Egypt has revised downwards its GDP forecast for FY23, according to figures in the draft budget that was approved by Cabinet yesterday. The government sees the economy growing at a 5.5% clip in the coming fiscal year down from the 5.7% figure that was forecast before the Ukraine conflict impacted global commodity markets and hit state finances. (Cabinet statement)

The Finance Ministry plans to sell USD500mn in JPY-denominated Samurai bonds in Japan on Thursday. (Enterprise)

The Suez Canal Authority will raise fees for ships transiting the waterway from the beginning of May. (Suez Canal Authority)

Charter flights landing in Egypt will continue to receive cash subsidies from the government until the end of October after the cabinet yesterday agreed to extend incentives designed to boost tourism. (Enterprise)

There are growing indications that Egypt and the International Monetary Fund are close to reaching a new agreement. The EGP slid another 1% on Tuesday, after a 14% devaluation on Monday, and the government announced a budget restructuring. (Reuters)

CORPORATE NEWS

Orascom Construction’s [ORAS] 2021 net income after minorities surged by 25% y/y to USD113.4mn, in line with our estimates of USD113.0mn, on higher total revenues of USD3.5bn (+5% y/y). Also, GPM improved slightly to 9.8% in 2021 vs. 9.6% a year earlier. While EBITDA grew 3% y/y to USD204.4mn, EBITDA margin fell slightly to 5.8% vs. 5.9% in 2020 due to lower other revenues of USD2.3mn (-83% y/y). We note that annual earnings growth was sparked by a notable recovery in BESIX which turned into profitability. (Company disclosure)

CI Capital Holding [CICH] has posted its results for 2021. CICH achieved net earnings growth of 44% y/y to EGP681mn. Bottom line growth came derived by 56% y/y higher group revenues of EGP3.7bn. CICH is currently traded at 2021 P/E and P/B of 6.1x and 1.2x respectively, with 2021 ROAE at 20.6%. (Company disclosure)

Abu Qir Fertilizers’ [ABUK] inked an agreement with global SAP in order to execute a digitalization transformation project for ABUK’s operations. (Mubasher)

Palm Hills Developments [PHDC] and Taaleem Management Services [TALM] signed an agreement with JBI to supervise Badya International University projects. PHDC and TALM intend to inject EGP2.1bn for the construction activities. (Arab finance)

Macro Group Pharmaceuticals’ [MCRO] BoD proposed a dividend distribution of EGP40mn or 0.069/share (i.e. dividend yield of 2%). The proposal is pending the OGM approval. (Company disclosure)

The FRA greenlighted the completion of Madint Nasr Housing’s [MNHD] capital increase,where the remaining shares subject to capital increase subscription are amounted to 9.35mn shares. (Mubasher)

Maridive and Oil Services [MOIL] announced its 2021 consolidated results, reporting a decrease in bottom line losses of 45.5% y/y, coming in at USD78mn in 2021 compared to USD143mn in 2020. (Mubasher)

Arab dairy [ADPC] announced its 2021 consolidated results, reporting a widening in bottom line losses to EGP53mn compared to EGP47mn in 2020.. (Mubasher)

GLOBAL NEWS

Federal Reserve officials are helping shape market expectations for sharper interest-rate hikes to curb the surge in inflation, but have not managed to dispel fears the tightening cycle could blow a hole in the economy and labor market. (Reuters)

U.S. national security adviser said on Tuesday that U.S. President Joe Biden will announce joint action on enhancing European energy security and reducing its dependence on Russian oil and natural gas. (Reuters)

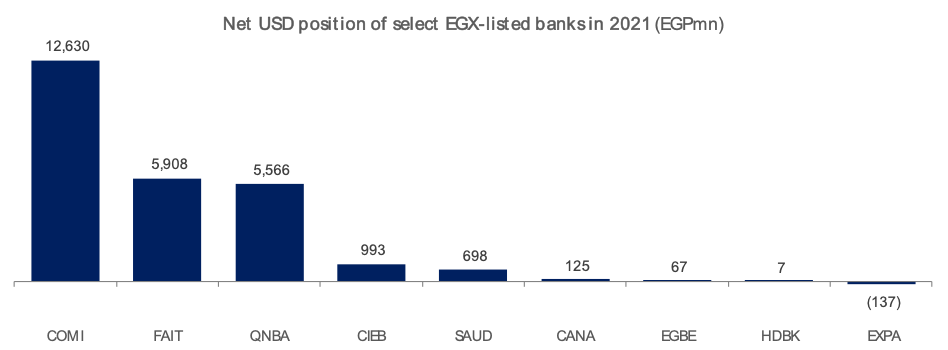

3. Chart of the Day

Amany Shaaban

Source: Companies' financials, Prime Research.

Banks with positive net USD positions will benefit the most from the EGP recent depreciation. CIB [COMI] is on top of the beneficiaries list followed by Faisal Islamic Bank of Egypt [FAIT]. On the other hand, Export Development Bank of Egypt's [EXPA] net USD position was negative in 2021, indicated a potential negative impact from the EGP depreciation.