TAKEStock: Delta Sugar [SUGR] - Sweet and Sour

Higher sugar prices and thin inventory to drive profitability

Delta Sugar [SUGR]

Egypt / Consumer Staples

Impact: POSITIVE | Degree: STRONG

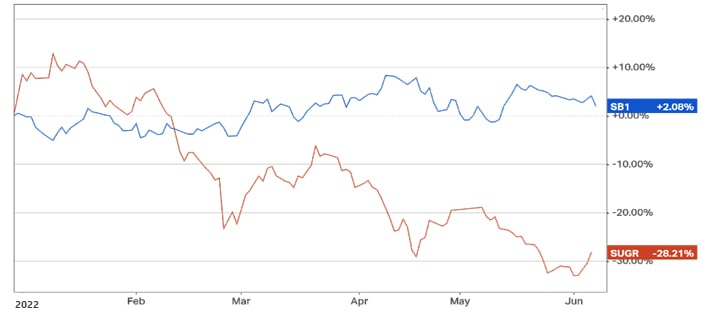

Stock performance lagging global sugar prices ytd

So far in 2022, Delta Sugar [SUGR] has been lagging global sugar prices by a 30% spread (ytd: SUGR -28%, sugar: +2%). We think this divergence in performance is unjustified in view of soaring global commodity prices, warranting a re-rating of SUGR. We set SUGR’s 12MPT at EGP22.2/share (+101%).

Figure 1: SUGR has underperformed global sugar prices ytd

More sweet profits to come

The year 2020 was a one-off for SUGR when it recorded huge losses of EGP254mn before turning this around in 2021 with net earnings of EGP385mn. SUGR had record sales in 2020, selling as much as 428,000 tons, nearly depleting its entire inventory. Starting 2021 with a thin inventory, SUGR managed to sell all sugar produced during the year at 17% higher selling prices. With sales volume falling 24% off its 2020 peak, SUGR’s revenues were flat in 2021 with gross margin improving from -3.6% in 2020 to +15.3% in 2021.

Higher prices and thin inventory to drive 2022 performance

Throughout 2021, sugar prices soared globally as supply shortages hit hardest. Sugar prices usually correlate with oil prices, as the majority of global sugar capacity is sugarcane-based. This makes both sugar and ethanol production compete for the same main input. When oil prices surge, sugar cane gets more directed towards ethanol production, thus limiting sugar global supply. In 2022, global sugar prices continued to trend upward, reaching their best levels since 2017. Prices are expected to remain in a bullish mode this year supported by both input costs and supply levels. On one hand, higher natural gas prices in Europe intensify supply shortages and support selling prices. On the other hand, higher oil prices kept adding fuel to the rally in other energy-related products, including ethanol. As a result, Brazil, the world's largest sugar producer, is using more sugar cane as feedstock for ethanol production, putting a lid on global sugar supply levels. Indeed, higher global sugar prices are a good omen for SUGR, supporting its average selling prices. To maintain its profitability levels, SUGR needs to see both selling prices increase and inventories remain relatively thin.

Recent government action further supports profitability

In December 2021, the Egyptian government raised subsidized sugar prices by 24% to EGP10,500/ton. The decision was attributed to higher global prices in general, as raw sugar prices jumped c.70% since H1 2020. We believe SUGR is set to benefit from this decision, given its strong contribution to the local market in general and the subsidized sugar segment in particular. So far, the hike proved to be persistent, further supporting SUGR’s selling prices. We note that SUGR sells a huge chunk of its output to the Holding Co. for Food Industries through contracts.

Our 2022 forecasts

We conservatively project SUGR’s sales volumes to reach 230,000 tons in 2022, a 29% drop y/y, having hit above-average levels in 2020 and 2021. Also, we expect white sugar selling prices to average EGP9,000/ton in 2022 in light of the government’s latest decision to hike subsidized sugar prices up to EGP10,500/ton. Meanwhile, we expect the average price per ton for beet to reach EGP777/ton (including an EGP75 premium to 2021 prices). Hence, we conservatively expect revenues to weaken by 16% to EGP2.7bn but GPM to improve to 18% vs. 15% in 2021. We expect pretax income to grow by 9% to EGP418mn on lower borrowing costs, yet we expect net earnings to drop 16% y/y to EGP324mn on the back of tax expenses.

Valuation

We valued SUGR using two valuation methods: multiples and replacement cost.

(1) Multiples: We applied a 5x EV/EBITDA multiple to a long-term median USD-denominated EBITDA (2014a-2022e), adjusted for FX impact, which came out to be USD26mn (incidentally our estimated EBITDA for 2022). Valuing SUGR’s investments at c.EGP300mn, we reached an equity value of EGP2.9bn (EGP20.5/share).

(2) Replacement cost: We conservatively applied USD480/ton to an estimated sales volume of 230,000 tons for 2022. This is a 20% discount to an EV/ton of USD600 derived from Canal Sugar’s inauguration costs of USD450mn for its 0.75mtpa sugar facility. SUGR’s investments included, we reached an equity value of EGP2.5bn (EGP17.7/share).

On average, both valuation methods yielded a fair value of EGP19.1/share, which implies a 12MPT of EGP22.2/share, offering an upside of 101%. We note that more recently SUGR’s shareholders approved a cash dividend distribution of EGP0.5/share, a 4.5% yield, with eligibility/payment dates of 20/23 June 2022.

Amr Hussein Elalfy, MBA, CFA

Head of Research

T +202 3300 5724

Mohamed Saad

Vice President, Research

T +202 3300 5719