Today’s Top News & Analysis

Egypt starts its 3 year sukuk program

EFIH' 2022: Growing top and bottom lines

MPRC’s prelim. 2022: A higher net profit and a wider GPM

New investment for the private equity arm of HRHO

The NPPA may cooperate with Elsewedy Electric and Orascom Construction

Helwan Fertilizers to produce Melamine with EUR200mn investment

Kafr El Zayat Pesticides’ 2022: A 76% growth in bottom line

SEMADCO to increase capital by EGP380mn

FRA approves Misr Beni Suef Cement’s capital decrease

FRA approves Macro Group's capital decrease

MACRO

Egypt starts its 3 year sukuk program

Egypt issued its first USD1.5bn sukuk yesterday, through The Egyptian Financial Co. for Taskeek. The high-yield program coverage reached USD6.2bn; it was offered at an initial yield of 11.625%. However, after the coverage exceeded the USD4.5bn mark, the yield decreased. The sukuk program is reportedly backed by a real estate 50-year right of use. We note that Moody's has assigned a (p) B3 rating to the USD5bn proposed sukuk program. Egypt has chosen Citigroup, Credit Agricole, Abu Dhabi Islamic Bank, Emirates NBD Capital, HSBC, and First Abu Dhabi Bank for the sale. (Al-Borsa)

CORPORATE

EFIH' 2022: Growing top and bottom lines

e-finance [EFIH] reported its consolidated 2022 net profit of EGP804mn (+56% y/y), and revenues of EGP2.6bn (+35% y/y), with the EFDO segment driving the majority of the growth (+56% y/y) to EGP2.4bn. Meanwhile, the sharp rise in EFIH’s revenues was supported by:

· Higher cloud hosting revenues of EGP779.1mn (+194% y/y), in light of higher cloud hosting contracts.

· Variable fee transactions revenues doubled to EGP495mn vs. EGP226mn in 2021, driven by an increased throughput value of EGP936bn (+29% y/y) and a higher take rate of 0.05%.

· eAswaaq revenues recorded EGP141mn (vs. EGP23mn in 2021), partially due to the VSLA project worth EGP52mn.

While GPM expanded by 5pp y/y to 52%, EBITDA margin declined by 2pp y/y to 36% due to an ESOP expense of EGP145mn. Excluding the ESOP expense, EBITDA margin would have been 42%. With an ROE of 19%, EFIH is currently trading at a P/E and P/BV of 41.8x and 7.3x, respectively. (Company disclosure)

MPRC’s prelim. 2022: A higher net profit and a wider GPM

Egyptian Media Production City [MPRC] reported its consolidated 2022 net profit of EGP272mn (+98% y/y) on revenues of EGP667mn (+27% y/y). Meanwhile, GPM expanded by 7pp y/y to 61%. (Company disclosure)

New investment for the private equity arm of HRHO

The private equity arm of EFG Hermes Holding [HRHO] and Zouk Capital, London-based private equity firm, will invest USD80mn in British EV charging company EO Charging. (Company disclosure)

The NPPA may cooperate with Elsewedy Electric and Orascom Construction

The Nuclear Power Plants Authority (NPPA) is reportedly looking to cooperate with Elsewedy Electric [SWDY] and Orascom Construction [ORAS] in the construction of El Dabaa Nuclear Power Plant. NPPA appointed Al Ezz Dekheila Steel Co. (EZDK) [IRAX] as its main supplier of steel for El Dabaa Nuclear Power Plant earlier this month. (Al-Mal)

SWDY — Rating: OW / M, 12MPT: EGP21/share (29-Jan-2023)

ORAS — Rating: OW / M, 12MPT: EGP146/share (29-Jan-2023)

Helwan Fertilizers to produce Melamine with EUR200mn investment

Helwan Fertilizers will invest EUR200mn in a new Melamine producing plant after finalizing the feasibility study. This comes as part of the company's expansion plans alongside the new methanol and ammonia plant that has a total production capacity of 1mtpa of methanol and 400ktpa of ammonia for an investment of USD1.3bn. (Economy Plus)

Kafr El Zayat Pesticides’ 2022: A 76% growth in bottom line

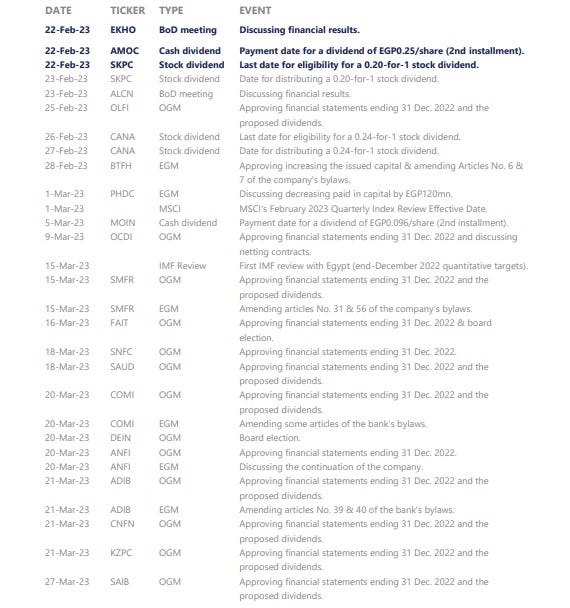

Kafr El Zayat Pesticides’ [KZPC] 2022 net income came in at EGP128.4mn (+75.5% y/y) on revenues of EGP1.56bn (+91% y/y). The increase in revenues is mainly attributable to an increase in revenues from reselling activities (+547% y/y), powered by higher USD-linked selling prices of pesticides. GPM came in at 17.7% (-2.8pp y/y) on higher pesticides prices. (Company disclosure)

SEMADCO to increase capital by EGP380mn

El-Nasr for Fertilizers & Chemical Industries Co. (SEMADCO) is currently going through an EGP380mn capital increase process to take place by Q2 2023 to fund its expansion plans and maintain its production capacity. We note that it was reported before that foreign and GCC investors are interested in acquiring a stake in SEMADCO, a fully-owned subsidiary of The Chemical Industries Holding Co. under the Ministry of Public Enterprise. (Economy Plus)

FRA approves Misr Beni Suef Cement’s capital decrease

The Financial Regulatory Authority (FRA) approved Misr Beni Suef Cement’s [MBSC] capital decrease from EGP750mn to EGP679.3mn by cancelling 7.07mn treasury shares with a par value of EGP10/share. (Company disclosure)

FRA approves Macro Group's capital decrease

The Financial Regulatory Authority (FRA) approved a capital decrease for Macro Group Pharmaceuticals [MCRO] from EGP115mn to EGP114mn through terminating 7,152,044 treasury shares worth EGP1.4mn. (FRA)