Today’s Top News & Analysis

Seven industries to get tax exemptions

Oil cuts extended, again

NUCA to sell eight new land plots for USD

SDX Energy sells its Egyptian assets

EAST Q4 2022/23 prelim.: An exceptionally-strong year despite weak growth in Q4

CIRA Education issues its second securitization tranche

Beltone Leasing received FRA approval on adding factoring activity

MACRO

Seven industries to get tax exemptions

The Egyptian government has identified seven industries to benefit off the incentive package for strategic industrial projects that was announced by the President at the end of August. The package includes exempting strategic projects from all types of taxes except value-added taxes for five years. The seven industries are:

(1) Petrochemicals.

(2) Green hydrogen.

(3) Solar power.

(4) Electric vehicles.

(5) Mining.

(6) Textiles.

(7) Electronic devices. (Asharq Business)

Oil cuts extended, again

Saudi Arabia and Russia extended their voluntary oil cuts until the end of December 2023. Saudi Arabia will keep its 1mn bpd production cut, while Russia will continue its 300,000 bpd export reduction. (Reuters)

NUCA to sell eight new land plots for USD

The New Urban Communities Authority (NUCA) is selling eight plots of land for industrial projects in Badr City and Borg Al-Arab. The lands will be sold under the dollar-for-land initiative to secure foreign currency. (Enterprise)

SDX Energy sells its Egyptian assets

SDX Energy plc. [LSE: SDX] signed a non-binding agreement for the sale of its Egyptian assets to an undisclosed large multinational operator that already has existing Egyptian interests. The sale is expected to be completed by the end of Q4 2023. SDX achieved a net operating income of USD8.7mn from its Egyptian operations, while its Egyptian reserves and assets amounted to 4.75mn bbl and USD38mn, respectively, as of 31 December 2022. The decision to exit Egypt came after SDX incurred losses worth USD4.6mn in 9M 2022 due to the EGP devaluation which negatively impacted its financial statements when translated. Meanwhile, SDX plans to use the proceeds from the sale to focus on expanding its energy transition projects in Morocco. We note that SDX's concession interests in Egypt were previously reported in PRIMETime on 19 June 2023. (Company disclosure, Al-Borsa)

CORPORATE

EAST Q4 2022/23 prelim.: An exceptionally-strong year despite weak growth in Q4

Eastern Co. [EAST] reported its preliminary 2022/23 results, posting a 90% y/y growth in net profits to EGP7.7bn, marking the company's highest net profits ever. However, net revenues only grew by 5% y/y to EGP18bn with a flat gross profit margin of 46%. Regarding Q4 2022/23, EAST turned into profitability reporting EGP2.4bn net profits vs. EGP222mn net losses last year despite:

· Lower revenues of EGP1.4bn (-23% y/y, -28% q/q).

· A lower gross profit margin of 41% (-8pp y/y, +0.2pp q/q).

EASTs' BoD proposed a cash dividend of EGP3.75/share implying a dividend yield of 16%. Based on 2022/23 net profits, EAST is currently trading at a P/E of 6.8x. (Company disclosure)

CIRA Education issues its second securitization tranche

Sources said that CIRA Education [CIRA] will issue its second securitization tranche next month with a future flow of EGP800mn. We note that in November 2022, CIRA announced issuing an EGP2bn securitization program. (Al-Borsa)

Beltone Leasing received FRA approval on adding factoring activity

Beltone Leasing, a subsidiary of Beltone Financial Holding [BTFH], received the FRA approval to add factoring activity to its lines of business. This makes the company a full-scale alternative financial services provider. (Company disclosure)

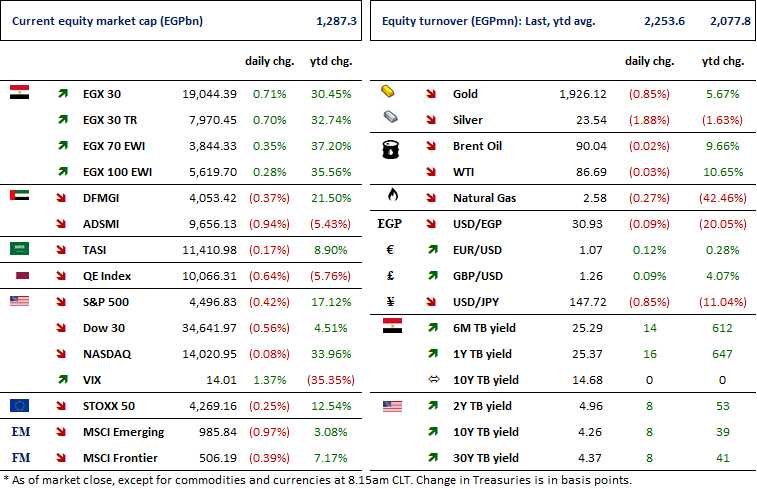

MARKET PERFORMANCE

Key Dates

6-Sep-23

ELSH: OGM / Approving the decisions of the company’s board of directors in its meeting held on 15/6/2023.

ELSH: EGM / Amending some articles of the Company's bylaws.

15-Sep-23

IMF Review / Second IMF review with Egypt (end-June 2023 quantitative targets).

17-Sep-23

MCQE: Cash dividend / Deadline for eligibility for a dividend of EGP0.750/Share.

19-Sep-23

EXPA: EGM / Amending Article No. 5 of the bank's bylaws.

20-Sep-23

MCQE: Cash dividend / Payment date for a dividend of EGP0.25/share (1st installment).

RMDA: Stock dividend / Last date for eligibility for a 0.52-for-1 stock dividend.

21-Sep-23

RMDA: Stock dividend / Date for distributing a 0.52 for-1 stock dividend.

MPC Meeting / Determining the CBE's policy rate.

26-Sep-23

MICH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ODIN: OGM / Approving financial statements ending 30 June 2023.

ODIN: EGM / Amending Article No. 7 of the company's bylaws.

TAQA: OGM / A board reshuffle.

TAQA: EGM / Amending Article No. 24 of the company's bylaws.

27-Sep-23

BTFH: OGM / Discussing netting contracts.

30-Sep-23

ABUK: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ABUK: EGM / Amending Articles No. 8, 16, 21 & 39 of the company's bylaws.

AMOC: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

IFAP: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.