Today’s Top News & Analysis

Second ease in Annual CPI

New listings and Islamic Index to be launched

RACC: Raises its stake in GCE to 100%

ALCN: BoD raising paid-in capital

BTFH: Strategic partnership between BTFH & CFH

Egypt studies raising subsidized fertilizers prices

MACRO

Second ease in Annual CPI

The annual headline urban CPI eased for the second consecutive month to 32.5% in April 2024 vs. 33.3% in March. (Bloomberg)

New listings and Islamic Index to be launched

The EGX studies the listing of six new companies, three of which will be in the main market in the food, energy, and real estate sectors. Additionally, the EGX is planning the launch of the Islamic Index through Q2 2024 which will include 30-50 companies that are compatible with the Islamic Shariaa. (Asharq Business)

CORPORATE

RACC: Raises its stake in GCE to 100%

Raya Contact Center’s [RACC] BoD approved the acquisition of 15% of Gulf Customer Experience (Bahraini Company) to reach 100%. (Company Disclosure)

ALCN: BoD raising paid-in capital

Alexandria Containers & Cargo Handling’s [ALCN] BoD approved to double the company’s paid-in capital from EGP744.9mn to EGP1.5bn to be distributed over a total number of shares of 3bn shares at a par value of EGP0.5/share. (Company Disclosure)

BTFH: Strategic partnership between BTFH & CFH

Beltone Holding [BTFH] signed a strategic partnership agreement with Comera Financial Holding (CFH) to foster digital transformation and customer experience in Egypt through knowledge transfer and the launch of new digital solutions related to Payments, Consumer Finance, SME Finance, and Supply Chain Financing to a new level. (Company Disclosure)

Egypt studies raising subsidized fertilizers prices

The Egyptian government is looking to raise subsidized fertilizers prices in response to calls from producers bearing high production costs following the recent EGP devaluation. The decision aims to close the gap between subsidized nitrogen fertilizer prices and the market, noting that the latest price increase was in November 2021 when subsidized urea prices reached EGP4,500/tonne. The news is positive for nitrogen fertilizers names (ABUK, EGCH, MFPC), as they have a production quota supplied to the Ministry of Agriculture at the current subsidized price of EGP4,500/tonne for urea and EGP4,400/tonne for ammonium nitrates. (Al-Mal)

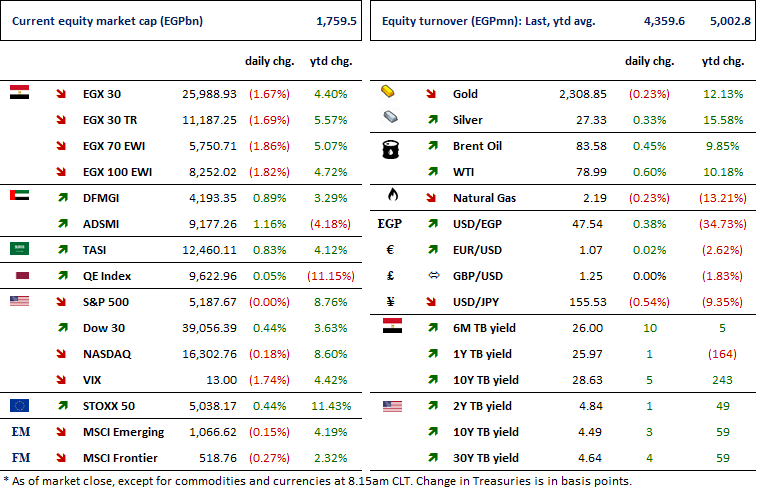

Markets Performance

Key Dates

9-May-24

JUFO: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

OLFI: Cash dividend / Payment date for a dividend of EGP0.950/share.

12-May-24

RAYA: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

RAYA: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

13-May-24

EFIH: OGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

DOMT: Cash dividend / Payment date for a dividend of EGP0.50/Share.

14-May-24

MSCI / MSCI's May 2024 Semi-Annual Index Review Announcement.

18-May-24

HRHO: OGM / Approving financial statements ending 31 Dec. 2023.

20-May-24

ORAS: OGM / Approvig financial statements ending 31 Dec. 2023 and the proposed dividends.

23-May-24

HELI: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

MPC Meeting / Determining the CBE's policy rate.

26-May-24

OIH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

SKPC: Cash dividend / Deadline for eligibility for a dividend of EGP1.25/Share.

OFH: OGM / Approving financial statements ending 31 Dec. 2023.

MCRO: OGM / Approving financial statements ending 31 Dec. 2023.

29-May-24

SKPC: Cash dividend / Payment date for a dividend of EGP0.75/Share (1st installment)

30-May-24

CCAP: OGM / Discussing agenda items.