Fundamental Thoughts

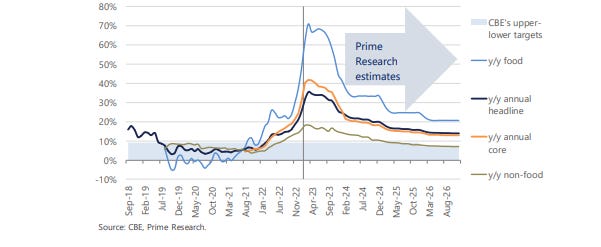

As we mentioned on Sunday, 12 March 2023, we believe inflation in Egypt is not transitory and will remain higher for longer, at least in 2023. The Central Bank of Egypt’s (CBE) Monetary Policy Committee (MPC) will meet today to decide on Egypt’s policy rates (corridor now at 16.25-17.25%) in its second meeting in 2023, out of a total of eight scheduled meetings. We are still sticking to our expectations of a 200bps move, and here is why:

(1) Prevailing inflation came higher than expected: Inflation has shot higher than expected in February, with headline and core inflation rates hitting highs of 31.9% and 40.3%, respectively.

(2) Forecasted inflation to remain high: We expect “forecasted”, the CBE’s preferred benchmark as opposed to “prevailing”, inflation rates to remain at elevated levels. We now see inflation averaging 31.4% in 2023, peaking in March at 35.4% for headline and 41.7% for core readings.

(3) Next MPC meeting is in 49 days: We note that March inflation readings are not due until 10 April and the following MPC meeting is not scheduled until 18 May when the MPC will have had two inflation readings to go through (March and April), at which time it might be just a bit too late for monetary policy actions to kick in.

(4) Impact of the latest rate hikes should have been felt by now: It’s been more than three months since the MPC’s latest 300bps move in late December, which we think by now should have begun to filter through the economy.

—Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

Egypt's food industries exports hit USD665mn in 2M 2023

Egypt targets 4.1% growth in FY24 budget

Faisal Investments to establish an EGP1bn sukuk fund

Rimco EGT Investment raises its stake in MCRO

POUL’s OGM decided no dividends for 2022

Compass Capital getting ready to bid on PACHIN

Badya University establishment approved

Macro

Egypt's food industries exports hit USD665mn in 2M 2023

Egypt’s food industries exports recorded USD665mn in 2M 2023 (+3% y/y). Arab countries topped the list of importing food from Egypt, representing 55% of total food exports. (Al-Mal)

Egypt targets 4.1% growth in FY24 budget

In a meeting held yesterday, the Cabinet approved FY24 budget with a target growth of 4.1%. While the primary surplus is expected to record 2.5% of GDP, it is the highest primary surplus targeted in the framework of efforts to reduce government debt as a percentage of GDP. The new budget projects inflation rate at 16%. (Cabinet statement)

Corporate

Faisal Investments to establish an EGP1bn sukuk fund

Faisal for Financial Investments, the investment arm of Faisal Islamic Bank [FAIT], is to establish an Islamic sukuk mutual fund for EGP1bn by the end of 2023. (Al-Mal)

Rimco EGT Investment raises its stake in MCRO

Rimco EGT Investment raised its stake in Macro Group Pharmaceuticals [MCRO] from 2.10% to 5.43% after buying 19,214,159 shares for EGP3.2/share or a total of EGP61.5mn. (Company disclosure)

POUL’s OGM decided no dividends for 2022

Cairo Poultry’s [POUL] OGM decided not to distribute any dividends of 2022 net profits. (Company disclosure)

Compass Capital getting ready to bid on PACHIN

Compass Capital finishes its due diligence process on Paints & Chemicals Industries (PACHIN) [PACH] and is reportedly going to offer a new bid soon. (Al-Mal)

Badya University establishment approved

The Cabinet approved the establishment of the privately-owned Badya University. The university should start within three years, only after fulfilling all the legal requirements. We note that Badya University is a joint venture between Taaleem Management Services [TALM] (60%) and Palm Hills Developments [PHDC] (40%). (Mubasher)