Fundamental Thoughts

Today, the Central Bank of Egypt’s Monetary Policy Committee (MPC) goes back to the drawing table to assess the result of its cumulative 10-percentage-point hikes so far in just a bit more than a year. Last time it met, the MPC kept interest rates unchanged at 18.25%/19.25% for overnight deposit/lending rates. This is the fourth of a total of eight meetings scheduled for 2023, where we think there is a higher likelihood that the MPC will stay put and maintain rates as is for several reasons, namely:

(1) When it met last week, the U.S. Federal Reserve decided to halt its rate hikes for the first time after 10 consecutive moves in just over a year. This should give emerging markets, Egypt included, a room to breathe without having to be concerned over their local currencies.

(2) The currently high inflation rate stems mainly from cost-push dynamics rather than demand-pull. Thus, hiking rates again will only mean higher cost of funding and eventually higher cost to consumers, further fueling inflation.

(3) By hiking interest rates, the cost of local debt will eventually rise, which would be detrimental to the state budget especially at a time when Treasury yields are cruising above 24%.

Thus, we think the MPC will opt to stay put for now, saving all its monetary muscles for H2 2023.

—Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

Another SCA-owned company to be listed

Record-breaking revenues for Suez Canal in FY23

Cabinet approves tax exemption draft law

Non-oil exports decline 6.4% y/y in Q1 2023

Moroccan Intelcia to invest EGP2bn in Egypt

ACGC to invest and restructure

Orascom Construction exits United Paints for EGP471mn

Abou Hashima to acquire 5% of Beltone

EFID to invest EGP1.2bn in 2023

Contact to issue EGP1.8bn of securitization bonds

MACRO

Another SCA-owned company to be listed

The Suez Canal Authority (SCA) will sell a 20% stake of Canal Company for Mooring & Lights through the EGX. The company will be transferred to the newly-established holding company prior to being floated. (Enterprise)

Record-breaking revenues for Suez Canal in FY23

Suez Canal revenues increased in FY23 to a new record of USD9.4bn (+35% y/y) with the passing of 25,887 ships carrying around 1.5bn tons. (Al-Mal)

Cabinet approves tax exemption draft law

The Egyptian Cabinet approved a draft law to cancel tax exemptions granted to state-owned entities as part of plans to improve the investment climate and support private sector participation ensuring fair opportunities. However, this will not apply to projects that fall under international agreements, projects that fall under defense and national security, and basic infrastructure projects. (Cabinet)

Non-oil exports decline 6.4% y/y in Q1 2023

Egypt’s non-oil exports declined in Q1 2023 by 6.4% y/y to USD8.3bn after recording an all-time high in 2022 on the back of supply chain disruptions caused by the Russian-Ukraine war. (Economy Plus)

Moroccan Intelcia to invest EGP2bn in Egypt

Intelcia, the Moroccan outsourcing company, is to invest a total of EGP2bn in Egypt, EGP500mn of which will be during 2023. This investment is planned to be the starting point to expanding into bigger markets like USA, Europe and GCC area, and is expected to hire around 5,000 Egyptians over the coming five years. (Al-Mal)

CORPORATE

ACGC to invest and restructure

Arab Cotton Ginning Co. [ACGC] will invest EGP18mn in Egyptian Spinning & Weaving, one of its subsidiaries. In addition, ACGC is studying a restructuring plan to integrate all the different activities conducted by its subsidiaries. Meanwhile, El-Nasr for Clothing & Textiles [KABO], one of ACGC’s group companies, paid off its debt of a total of EGP27.5mn. (Company disclosure)

Orascom Construction exits United Paints for EGP471mn

France-based Saint Gobain acquired 100% of United for Paints & Chemicals - Dry Mix for a total of EGP785mn. Orascom Construction [ORAS] sold its 60% stake in Dry Mix for EGP471mn. (Al-Mal)

Abou Hashima to acquire 5% of Beltone

It has been reported that the Egyptian business man Ahmed Abou Hashima will acquire a 5% stake in Beltone Financial Holding [BTFH] through its ongoing EGP10bn capital increase. (Asharq Business)

EFID to invest EGP1.2bn in 2023

Edita Food Industries [EFID] will invest EGP1.2bn in 2023, including the capital increase earmarked for Fancy Foods, EFID's latest acquisition. In addition, EFID will invest c.EGP800mn in working capital. (Al-Mal)

Contact to issue EGP1.8bn of securitization bonds

Contact Financial Holding [CNFN] is to issue securitization bonds of EGP1.8bn within days in three tranches over different maturities. (Al-Mal)

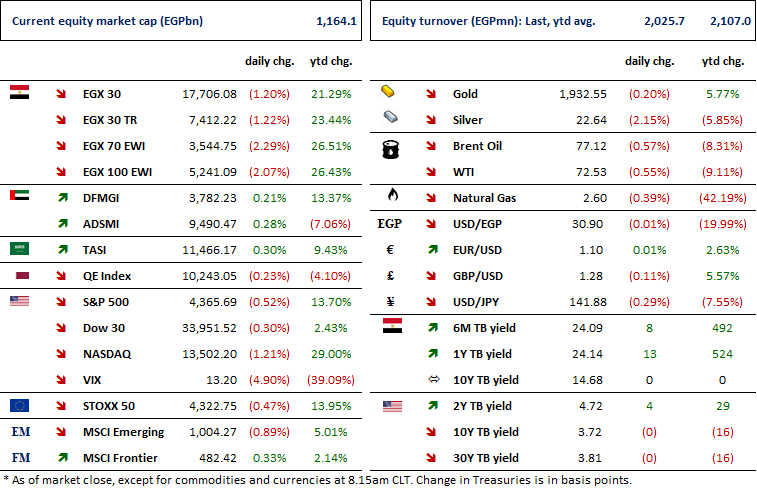

Markets Performance

Key Dates

22-Jun-23

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.

4-Jul-23

ISPH: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

ISPH: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

5-Jul-23

Egypt PMI: June 2023 reading.

6-Jul-23

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

BTFH: Capital increase / Capital increase subscription closing date.

9-Jul-23

EGCH: EGM / Approving the final cost of the nitric acid and ammonium nitrate project.

ETRS: EGM / Approving increasing the issued capital & amending Articles No. 7, 8 & 47 of the company's bylaws.

MPRC: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

10-Jul-23

MPRC: Cash dividend / Ex-dividend date for EGP0.50/Share.

MCRO: EGM / Amending Article No. 3 of the company's bylaws.

12-Jul-23

OCDI: OGM / Discussing netting contracts.

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

31-Jul-23

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).