Fundamental Thoughts

STANDPoint Portfolio Update: Adding ALCN, ECAP, HRHO, and RACC

So far, the year 2023 has proven to be more than just a year of adjustment, not only locally but globally. The onset of what seems to be a re-run of the Global Financial Crisis (GFC) has taken many market participants by surprise. But depending on whom you ask, the picture is not all gloomy. For us, we like to stick to our rules, picking stocks for the long term at relatively cheap multiples with potential catalysts in sight. In this note, we are taking stock of our STANDPoint Portfolio (SPP) performance so far, updating its constituents, and recalibrating our outlook for the coming period.

Where do we stand and how are we doing so far?

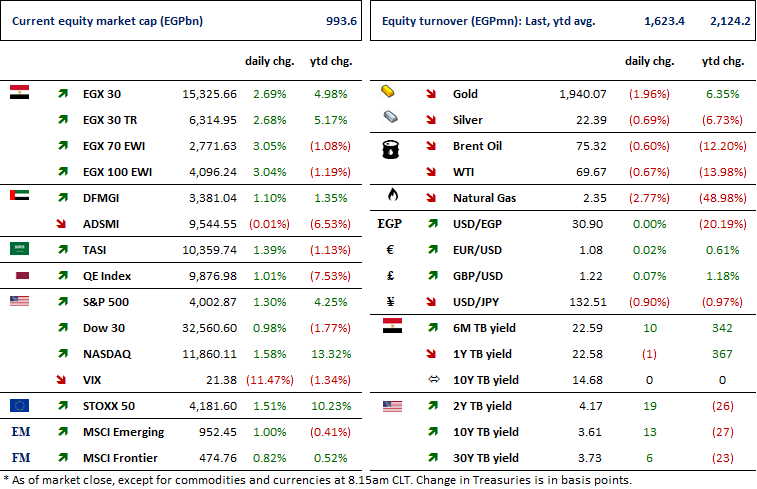

As we illustrated in our 2023 annual strategy outlook, SPP has outperformed all main market indices since inception back in 2021. However, the market has been on a downward spiral as EGX 30 (-14.3%), EGX 70 EWI (-12.1%), and EGX 100 EWI (-13.6%) all fell in the period from 29 January through 20 March 2023. Similarly, SPP fell 16.2% over the same period, yet maintaining its long-term outperformance nonetheless. We are adding four new stocks to SPP within our three key themes: (1) beneficiaries of a high interest rate environment, (2) export-oriented businesses, and (3) companies with long USD (i.e. non-EGP) positions. We note that today, Mother’s Day, marks the first anniversary of the first major EGP devaluation seen in 2022.

What to do next?

We continue to retain the same 10 stocks we had in our SPP, namely ADIB, COMI, TALM, EKHO/A, SWDY, ORAS, OFH, ACAMD, TMGH, and ETEL. Today, we are adding four new stocks, so in total we now have 14 stocks in SPP. The new additions are Alexandria Containers Handling [ALCN], Al Ezz Ceramics & Porcelain (GEMMA) [ECAP], EFG Hermes Holding [HRHO], and Raya Customer Experience [RACC].

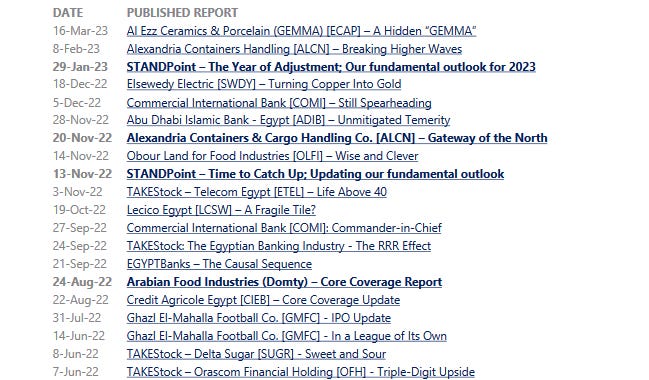

For the investment rationale for the four new additions, please the full report.

—Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

The Egyptian Parliament approves an additional budget allocation of EGP165bn

GB Auto Iraq becomes the official distributor for Shell Middle East

Eagles Chemicals offer to buy PACHIN at EGP35/share; National Paints to bid higher

Qalaa Holdings plans for an ERC expansion

TSFE includes El Salhiya for Development & Agricultural Investments to its pre-IPO

AD Ports interested in Damietta and Port Said terminals

EFG Hermes concludes another securitization for ValU

Macro

The Egyptian Parliament approves an additional budget allocation of EGP165bn

The Egyptian Parliament approved allocating an additional EGP165bn to the country’s FY23 budget. The appropriated funds will be allocated for:

· Interest payments with a value of EGP85bn.

· Subsidies, grants, and social welfare with a value of EGP70bn.

· Wages and salaries with a value of EGP10bn. (Economy Plus)

Corporate

GB Auto Iraq becomes the official distributor for Shell Middle East

GB Auto Iraq, a subsidiary of GB Corp [AUTO], signed an agreement with Shell Middle East to distribute Shell’s automotive lubricants in central and southern Iraq. (Arab Finance)

Eagles Chemicals offer to buy PACHIN at EGP35/share; National Paints to bid higher

The Financial Regulatory Authority (FRA) has approved Eagles Chemicals' offer to buy up to 100% of Paints & Chemical Industries (PACHIN) [PACH] at EGP35/share. According to sources, National Paints Holding is currently looking to raise its acquisition price again to compete with Eagle Chemicals’ offer. Currently, PACH has two active offers from National Paints Holding and Eagles Chemicals for EGP34/share and EGP35/share, respectively. (Company disclosure)

Qalaa Holdings plans for an ERC expansion

Qalaa Holdings [CCAP] is studying to expand its 13.1%-owned subsidiary the Egyptian Refining Company’s (ERC) by 800,000 tons. The expansion is scheduled to be completed within three years upon approval from the BoD. ERC produces 20% of Egypt’s total gasoline and diesel production, with a production capacity of 4.7mn tons/year. We note that Egypt consumes c.12mn tons/year of diesel and c.6.7mn tons/year of gasoline. (Asharq Business)

TSFE includes El Salhiya for Development & Agricultural Investments to its pre-IPO fund

The Sovereign Fund of Egypt (TSFE) included El Salhiya for Development & Agricultural Investments in its pre-IPO fund. El Salhiya's most important line of business is land cultivation, followed by poultry, livestock, feed manufacturing, and organic fertilizer production through its 18,100-feddan land portfolio. Ownership is split between National Investment Bank (44%), Banque Misr (30%), and Arab Contractors (26%). (Al-Borsa)

AD Ports interested in Damietta and Port Said terminals

AD Ports, a subsidiary of ADQ Holding, is currently in negotiations with the Egyptian government to acquire a majority stake in Damietta Container Handling Co. [DCCC] and Port Said Container Handling Co. [POCO], according to sources. We note that Maha Capital, a subsidiary of Qatar Investment Authority, is also currently in negotiations with the government to acquire a majority stake in both DCCC and POCO. (Al-Mal)

EFG Hermes concludes another securitization for ValU

EFG Hermes Holding [HRHO] concluded the fourth issuance of securitization bonds for its consumer finance arm ValU. The issuance, worth EGP856.5mn in one 12-month tranche, is part of an EGP4bn securitization program. (Al-Mal)