Today’s Top News & Analysis

Eni to invest USD7.7bn within four years

EAST’s 30% stake sold to Global Investments Ltd., EAST to increase cigarette volumes

AMOC 2022/23: Net loss in Q4 driven by FX losses; BoD proposes dividend EGP0.6/share

CLHO Q2 2023: Earnings on strong y/y revenue growth despite higher finance expense

Orascom Construction wins a new EUR340mn contract

EGAL and ALUM deny being sued by the ECA

A fund raises its stake in GBCO

A company raises its stake in DSCW

MACRO

Eni to invest USD7.7bn within four years

Eni intends to invest USD7.7bn in Egypt within the next four years. The company will focus on R&D, exploration, and enhancing production. (Al-Borsa)

CORPORATE

EAST’s 30% stake sold to Global Investments Ltd., EAST to increase cigarette volumes

UAE-based Global Investments Limited will acquire a 30% of Eastern Co. [EAST] for USD625mn, implying an average price of EGP29/share, and will inject USD150mn to finance needed raw materials. The stake was sold out of the Egyptian government’s stake, leaving it with only a 20.9% stake in EAST. We note that the offer's value is equivalent to EGP19.4bn, implying a TTM P/E of 12.7x. Meanwhile, EAST said it will increase its cigarette production by 15%. (Company disclosure, Asharq Business)

AMOC 2022/23: Net loss in Q4 driven by FX losses; BoD proposes dividend EGP0.6/share

Alexandria Mineral Oils Co. [AMOC] reported its consolidated results for 2022/23, recording net profits of EGP1.33bn (+11% y/y) on higher revenues of EGP24bn (+31% y/y) and also driven by:

· Recording an FX gain of EGP139mn (+77% y/y).

· Interest income of EGP105mn (+132% y/y).

· Other revenues of EGP147mn (+72% y/y).

We note that AMOC's GPM in 2022/23 declined by 4pp y/y to 10% as a result of:

· Selling lower total volumes (-6% y/y).

· Blended COGS/ton increased 47% y/y which offset the increased blended average prices (+40% y/y).

Meanwhile, AMOC reported net losses of EGP60.7mn in Q4 2022/23 (vs. net profits of EGP408mn in Q3 2022/23 and EGP449mn in Q4 2021/22) with revenues of EGP6.5bn (-8% q/q, +5% y/y) and a GPM of 9% (same as in Q3 2022/23, -11pp y/y), driven by recording an FX loss of EGP420mn vs. an FX gain of EGP290mn in Q3 2022/23.

Lastly, AMOC's BoD proposed distributing a cash dividend of EGP0.6/share, implying a payout ratio of 58% and a dividend yield of 7% based on yesterday’s closing price. AMOC is currently trading at an LTM P/E ratio of 8.1x based on yesterday’s closing price. (Company disclosure: 1, 2)

CLHO Q2 2023: Earnings on strong y/y revenue growth despite higher finance expense

Cleopatra Hospitals Group [CLHO] reported a 41% y/y higher net profit in Q2 2023 of EGP97mn on higher revenues of EGP808mn (+34% y/y). Meanwhile, gross profit margin came in flat at 31.8% (-0.6pp y/y). CLHO reported a net finance expense of EGP11mn vs. a net finance income of EGP2mn last year, which was offset by a lower effective tax rate and lower losses from discontinued operations. In H1 2023, CLHO posted a 16% y/y higher net profit of EGP191mn on higher revenues of EGP1.6bn (+31% y/y), with gross profit margin also flat at 32.9% (-0.3pp y/y). (Company disclosure)

Orascom Construction wins a new EUR340mn contract

Orascom Construction [ORAS] announced a consortium with Thales to modernize Cairo-Beni Suef railway corridor in Egypt. The contract amounts to EUR340mn and is funded by The World Bank. (Company disclosure)

EGAL and ALUM deny being sued by the ECA

Egypt Aluminum [EGAL] and Arab Aluminum [ALUM] said they are not among the 14 companies being sued by the Egyptian Competition Authority (ECA) for price collision. (Enterprise)

A fund raises its stake in GBCO

The Miri Strategic Emerging Markets Fund LP raised its stake in GB Corp [GBCO] from 4.99% to 5.05%, buying 715,000 shares for EGP6.25/share. (Company disclosure)

A company raises its stake in DSCW

United Motors & Heavy Equipment Co. raised its stake in Dice Sport & Casual Wear [DSCW] from 6.79% to 7.24, buying 8.1mn shares for EGP0.55/share. (Company disclosure)

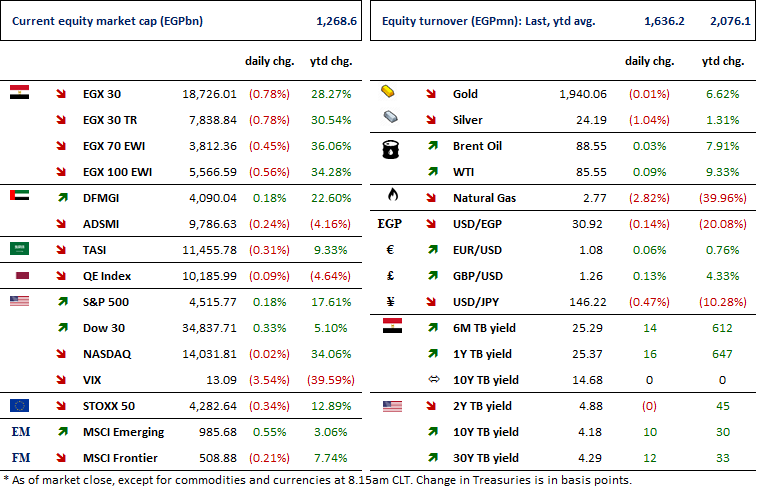

Markets Performance

Key Dates

5-Sep-23

Egypt PMI / August 2023 reading.

6-Sep-23

ELSH: OGM / Approving the decisions of the company’s board of directors in its meeting held on 15/6/2023.

ELSH: EGM / Amending some articles of the Company's bylaws.

15-Sep-23

IMF Review / Second IMF review with Egypt (end-June 2023 quantitative targets).

17-Sep-23

MCQE: Cash dividend / Deadline for eligibility for a dividend of EGP0.750/Share.

19-Sep-23

EXPA: EGM / Amending Article No. 5 of the bank's bylaws.

20-Sep-23

MCQE: Cash dividend / Payment date for a dividend of EGP0.25/share (1st installment).

21-Sep-23

MPC Meeting / Determining the CBE's policy rate.

26-Sep-23

MICH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ODIN: OGM / Approving financial statements ending 30 June 2023.

ODIN: EGM / Amending Article No. 7 of the company's bylaws.

30-Sep-23

ABUK: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ABUK: EGM / Amending Articles No. 8, 16, 21 & 39 of the company's bylaws.