Today’s Top News & Analysis

Slight improvement in NFAs in July

Egypt to collect foreigners' residence fees in foreign currency

IDHC Q2 2023: Lower net profits despite higher revenues

AT Lease closes EGP1.74bn bond issuance

OIH Q2 2023: Back to net losses again

MACRO

Slight improvement in NFAs in July

Net Foreign Assets (NFAs) for the Egyptian banking system improved slightly by USD800mn to negative USD26.3bn in July after falling sharply to USD27.1bn in June 2023. The improvement is driven by a slight easing in FX liquidity in the banking sector. (CBE)

Egypt to collect foreigners' residence fees in foreign currency

The Cabinet approved to collect foreigners’ residence permit fees in foreign currency starting 13 September 2023. (Cabinet)

CORPORATE

IDHC Q2 2023: Lower net profits despite higher revenues

Integrated Diagnostics Holding [IDHC] posted a 60% y/y lower Q2 2023 net profits of EGP51mn despite a 24% y/y increase in revenues to EGP957mn. The net profits drop is attributable to:

· A lower gross profit margin of 35% (-4pp y/y).

· SG&A-to-revenues ratio increased by 2pp y/y to 19%.

· Other expenses of EGP7mn vs. other revenues of EGP5mn last year.

· Net finance expense of EGP25mn vs. net finance income of EGP12mn last year.

In H1 2023, IDHC reported a 47% y/y lower net profit of EGP224mn with a 4% y/y decrease in revenues to EGP1.9bn along with an 8pp y/y decline in gross profit margin to 35%. (Company disclosure)

AT Lease closes EGP1.74bn bond issuance

Al Tawfeek for Financial Lease [ATLC] closed its fourth securitized bond issuance for the third consecutive year worth EGP1.74bn with CI Capital Holding [CICH] acting the financial advisor for the transaction. (Company disclosure)

OIH Q2 2023: Back to net losses again

Orascom Investment Holding [OIH] recorded a net loss after minority of EGP23mn in Q2 2023, thus pulling net income after minority to EGP86mn for H1 2023 (-9% y/y), absent gains from discontinued operations this year. Meanwhile, OIH recorded operating losses of EGP28mn in H1 2023 vs. operating losses of EGP55mn a year before on higher operating revenues and reversal of impairment charges. (Company disclosure)

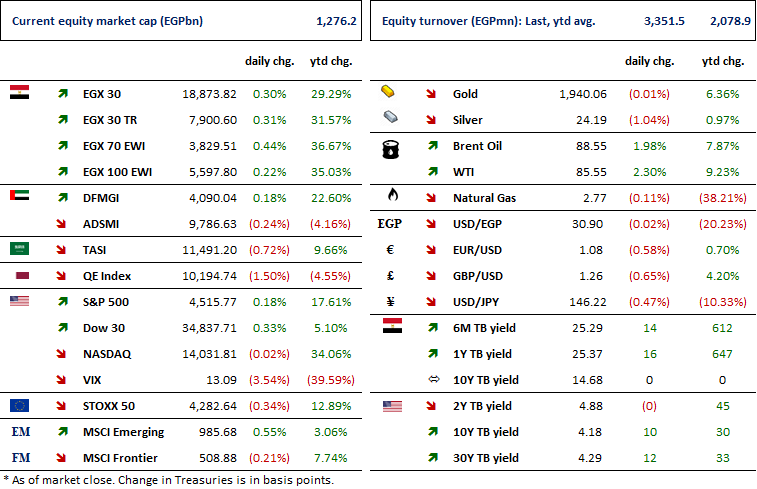

Markets Performance

Key Dates

5-Sep-23

Egypt PMI / August 2023 reading.

6-Sep-23

ELSH: OGM / Approving the decisions of the company’s board of directors in its meeting held on 15/6/2023.

ELSH: EGM / Amending some articles of the Company's bylaws.

15-Sep-23

IMF Review / Second IMF review with Egypt (end-June 2023 quantitative targets).

19-Sep-23

EXPA: EGM / Amending Article No. 5 of the bank's bylaws.

21-Sep-23

MPC Meeting / Determining the CBE's policy rate.

26-Sep-23

MICH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

30-Sep-23

ABUK: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ABUK: EGM / Amending Articles No. 8, 16, 21 & 39 of the company's bylaws.